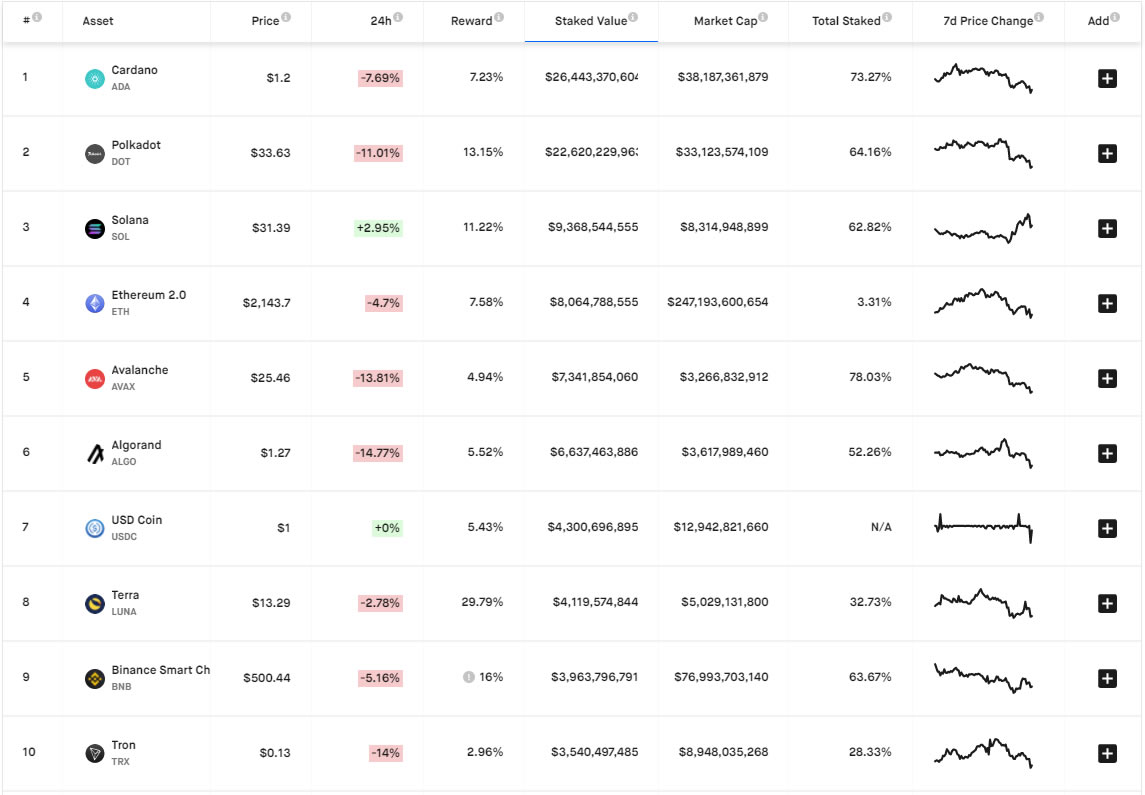

Cardano and Polkadot extend staked capitalization dominance

The stakes have been upped for Cardano and Polkadot, with the two networks continuing to dominate the staked capitalization rankings.

According to data from StakingRewards, Cardano is currently the top blockchain in terms of staked value, with roughly $26.4 billion worth of ADA allocated to securing the network. With Cardano’s entire capitalization tagging $36.6 billion, 73% of circulating ADA are being staked.

StakingRewards estimates Cardano stakers are earning an annual reward of 7.22%.

The second-largest crypto asset by staked value is Polkadot with $22.7 billion worth of DOT locked — representing 64% of its circulating supply. Average annual staking rewards for DOT are estimated at more than 13%.

Cardano and Polkadot currently represent 7.9% of the $620.6 billion in crypto assets currently designated for staking across the crypto asset sector combined.

While Polkadot and Cardano have long-dominated the staking sector by locked value, other leading assets have experienced notable disruptions to their rankings recently.

Solana has now surpassed Eth2 to take the third spot for staked capitalization, with $9.4 billion with in capital staked. SOL staking and validation require the asset to be time-locked up and taken out of circulation which may explain the discrepancy, explaining why its staked capitalization exceeds its roughly $8 billion market cap. SOL stakers are generating 11% annually.

The once king of staking, Tezos, has dropped way down to the eleventh spot with a staked capitalization of $3.5 billion yielding 5.5% per annum. In mid-December 2020, Tezos was ranked fourth according to a Cointelegraph report at the time.

In terms of overall capitalization, XTZ has slumped from the top ten to rank 35th according to Coingecko.

Eth2 currently ranks as the fourth-largest staked asset with $8.2 billion. According to the ETH 2.0 launchpad, there are 3.9 million ETH locked into the Beacon Chain deposit contract. However, just 3.4% of circulating Ether has been allocated to staking, suggesting there is still significant room of Eth2’s staking cap to grow.

While ETH stakers are currently earning more than 7% annually, Ethereum’s forthcoming chain merge is expected to significantly boost rewards as stakers begin collecting fees from the Ethereum Virtual Machine, or EVM.

Eth2 researcher, Justin Drake, predicts staking rewards will at least double with the chain merge, estimating rewards could jump to 25% per year.

staking rewards likely to at least 2x with EVM gas fees

I expect ~25% staking APR immediately after the merge

more rewards → more staking → more economic securityhttps://t.co/6YTnaGGNyA

— Justin Ðrake (@drakefjustin) April 19, 2021

The remaining networks inhabiting the top ten rankings for staked capitalization are Avalanche, Algorand, USDC, Terra, Binance Smart Chain, and Tron.