Deribit begins rollout of its USDC priced suite of perpetuals with BTC-USDC

Deribit, the popular crypto derivatives exchange, has announced the commencement and first instrument launch date of its USDC-based set of margined products.

Coming up this Wednesday, March 9th at 1 PM UTC, a BTC-USDC-perpetual will be listed.

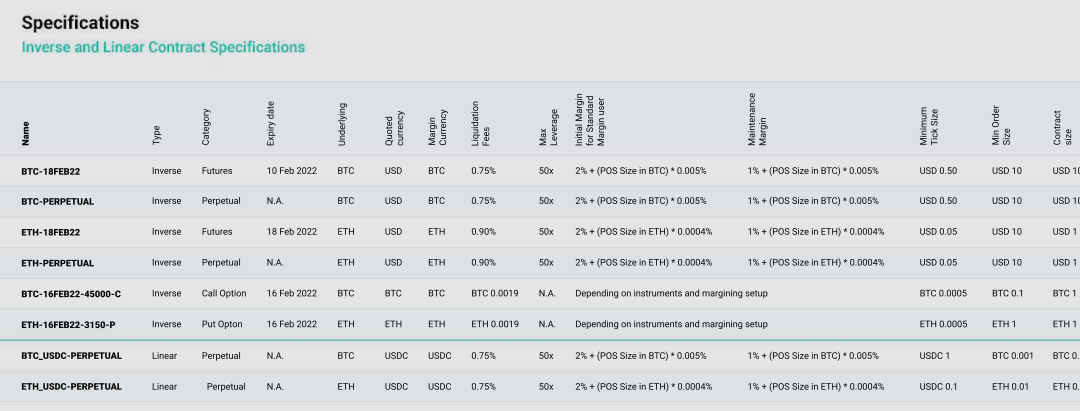

A shortlist of USDC products Deribit plans to launch can be found below:

Note, the exchange’s USDC wallet was opened on February, 23th 2022 when all clients received a free trading fee balance of USDC 100.

Some launch notices:

- USDC linear will enable users to trade one collateral for multiple different assets; clients can use USDC to trade multiple instruments without depositing each instrument (e.g. BTC or ETH as collateral).

- Trading and particularly the P&L for linear products is considered simpler and more intuitive compared to inverse products.

- The USDC address on Deribit is based on the ERC20 USDC (Ethereum network).

- Deribit’s Swap functionality will launch when the first instrument is tradable.

- Perpetual Funding Rate methodology is identical to Deribit’s inverse perpetuals, however, the cap is higher and set at +/- 5% for all linear USDC perpetuals.

- A USDC insurance fund will start with a value of USDC 10 million.

The post Deribit begins rollout of its USDC priced suite of perpetuals with BTC-USDC appeared first on CryptoNinjas.