BTC hash ribbon upcoming convergence signals miner capitulation

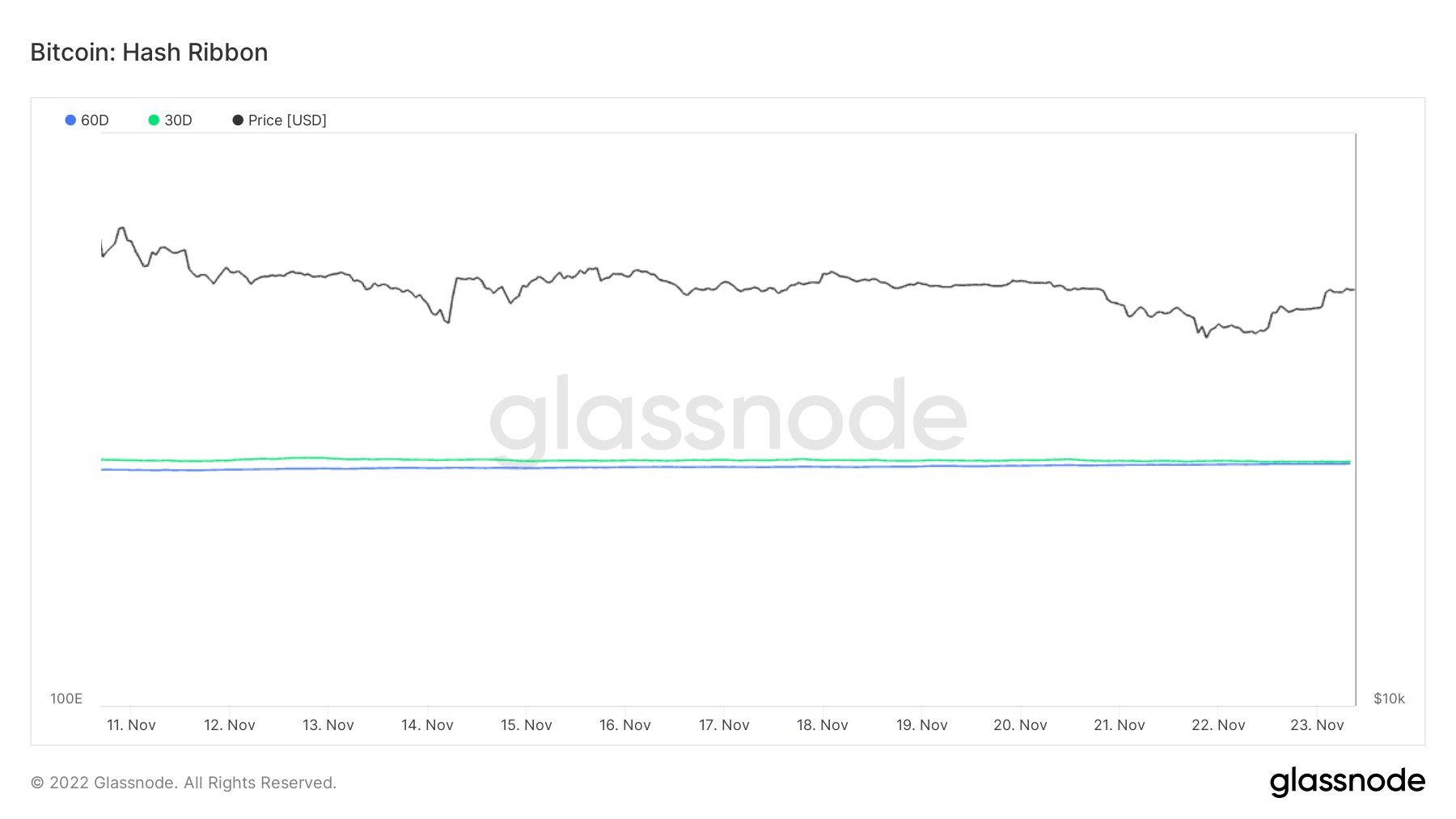

Bitcoin (BTC) hash ribbon indicators are often used to identify and catch BTC bottoms as the convergence of the BTC hash ribbon signals further miner capitulation as mining costs increase, and BTC price falls.

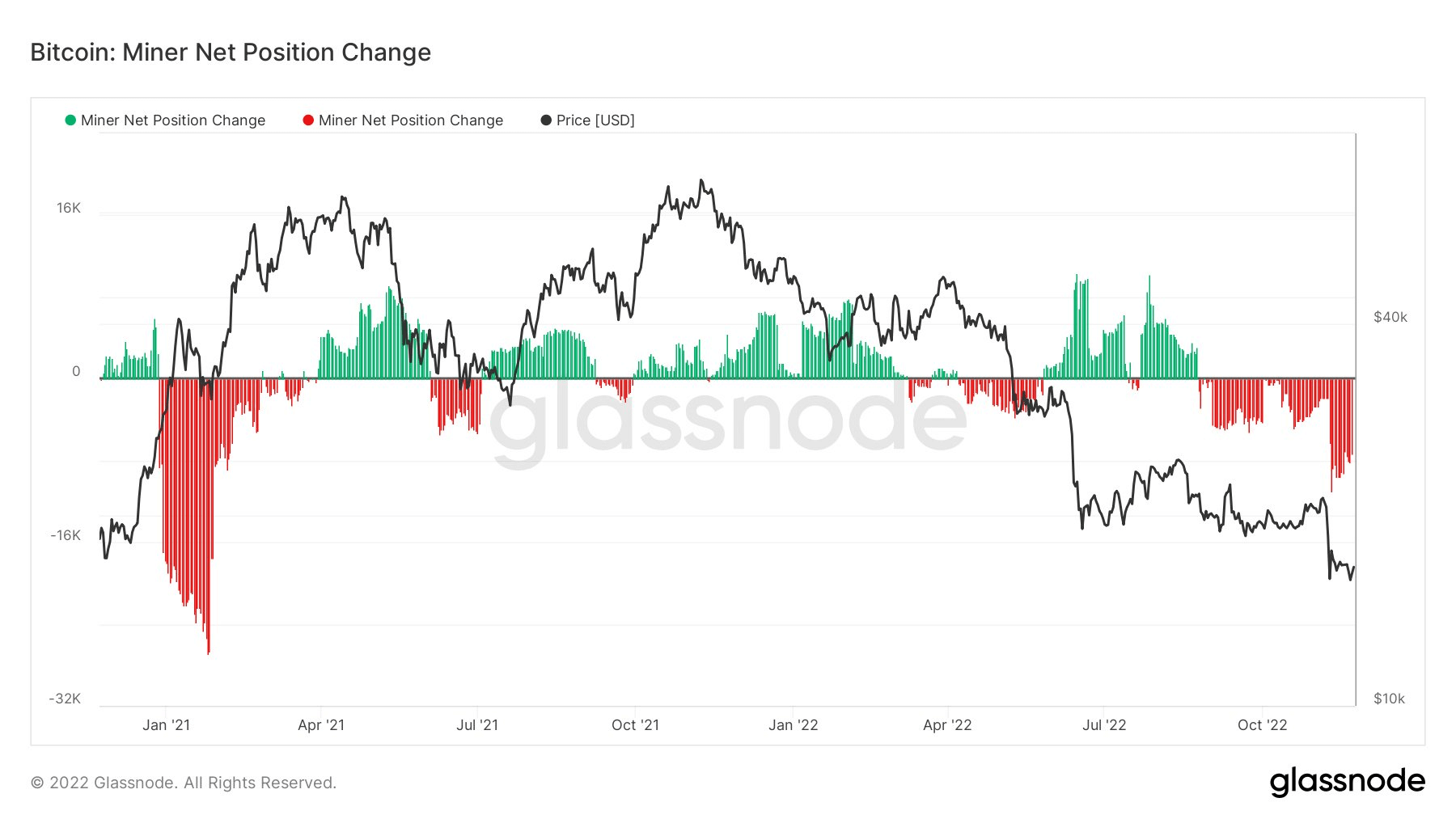

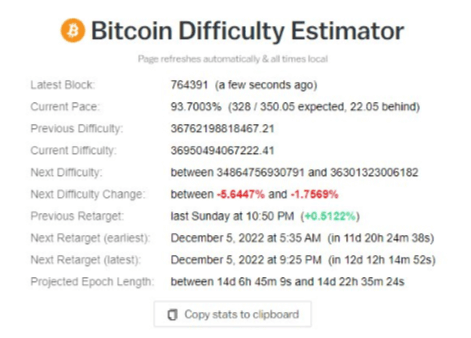

As miners are seen to be selling at the most aggressive rate over the last two years, the Bitcoin network is set to adjust difficulty negatively for the next epoch.

Though miner capitulation has been ongoing for some time now, this hash ribbon convergence signals that the end of this capitulation period is almost over, and historically, a change to the upside is likely near.

After the 30-day moving average crosses the 60-day moving average (MA), history shows us that the next indicator to watch for convergence are the 10-day and 20-day MAs. Once they do cross over, the miner capitulation period is usually over.

As highlighted Nov. 21st by Bitsbetrippin on Twitter, noticeable Bitcoin network delays have already been experience as BTC hash rate across the network began falling by up to 25%.

Who has shut off #bitcoin #btc mining. Last bitcoin block found over 30min ago, this is a 15-25% drop in total bitcoin hashrate across the network. Someone large or several just powered down. pic.twitter.com/8OWLX7cRa0

— Bitsbetrippin (@BitsBeTrippin) November 21, 2022

The post BTC hash ribbon upcoming convergence signals miner capitulation appeared first on CryptoSlate.