Bitcoin and Gold Correlation Spikes to Yearly Highs

Investors are currently fleeing bitcoin and gold amidst a strengthening US Dollar and rising interest rates. This has negatively impacted both – the world’s largest crypto and the precious metal.

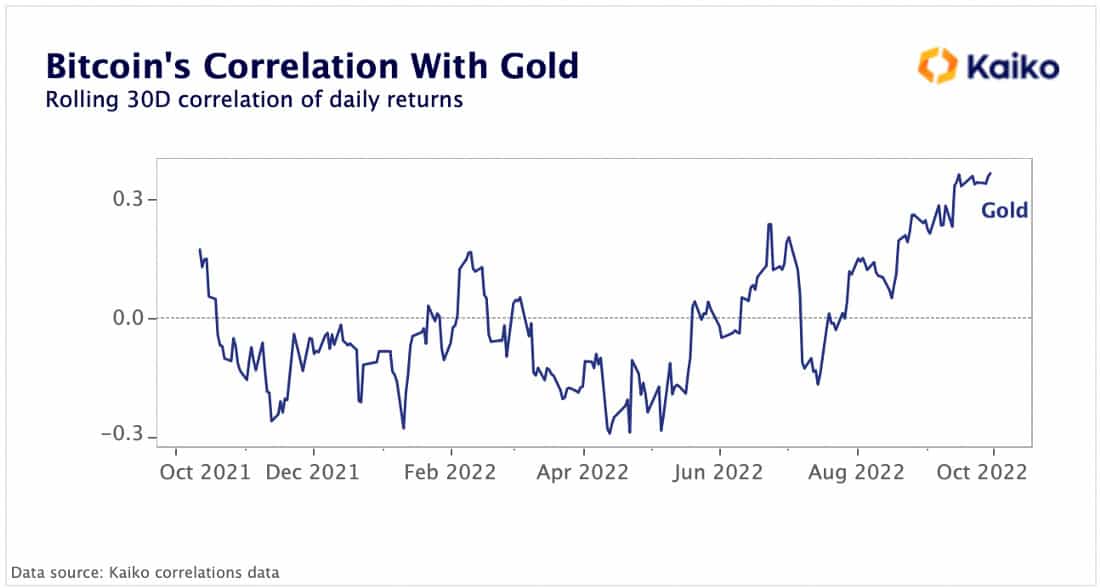

As a result, the correlation between the two has shifted and has hit its highest level in more than a year.

Bitcoin and Gold Correlation

Over the past year, bitcoin has been mostly uncorrelated with gold. Its correlation hovered between negative 0.2 and positive 0.2. But this year has been particularly unraveling for both cryptocurrencies as well as traditional markets.

Several narratives have been broken, including bitcoin being hailed as a “digital gold” and a hedge against inflation similar to the yellow metal. As a matter of fact, both BTC and gold have seen significant drops in value as inflation broke record highs.

While global monetary policy tightening dragged bitcoin down by over 70% since its all-time high last November, gold lost 10% of its YTD gains. A series of aggressive US rate hikes this year are to blame, which have dented the non-yielding metal’s appeal.

Gold failed to act as a safe-haven asset even as core inflation remained persistently high. This resulted in a year-high correlation of +0.4, depicting a shift in the market structure, according to Kaiko Research.

2022 Jolted Investor Confidence

Bitcoin appears to have largely lost its inflation hedge and store-of-value narratives in the market despite a fixed supply and hardened monetary policy. Investors are currently lured by low-risk assets, and according to market experts, the cryptocurrency is still seen as a newer, volatile asset to be a hedge even as it is considered to be a highly profitable one for middle- and long-term investors.

On the bright side, a high hash rate, accumulating sentiment dominating among long-term holders, low exchange supply, and expanding institutional interest may prove beneficial for a potential BTC rally.

For gold to recover, on the other hand, the market should reach peak hawkishness. Ole Hansen, head of the commodity strategy at Saxo Bank, in a recent note, stated,

“Gold and the other semi-investment metals like silver and platinum will likely to continue to remain under pressure until the market reach peak hawkishness, potentially not before 4% is reached in 10-year yields and the dollar squeezes out any remaining short positions. Whether the turning point will be reached before year-end remains to be seen.”

The post Bitcoin and Gold Correlation Spikes to Yearly Highs appeared first on CryptoPotato.