Bitcoin And Crypto Face Turbulence As 10-Year US Treasury Yield Hits 15-Year High

In an environment of soaring interest rates and economic unpredictability, Bitcoin and the broader crypto market face increased headwinds. The shift in the financial landscape was recently underscored by the Benchmark 10-year US Treasury yield, which hit a 16-year high this Thursday.

Longest Yield Curve Inversion Ever

Historically, an inverted yield curve, where short-term yields are higher than long-term ones, has been a harbinger of economic downturns. Notably, the 10-Year minus the 3-Month Treasury Yield curve has been inverted for a record 217 trading days. Past data indicates that the longer the delay between the inversion and the start of a recession, the more severe the recession is likely to be.

Joe Consorti, Market Analyst at The Bitcoin Layer, underscored this concern, remarking on Twitter: “The yield curve is re-steepening at breakneck speed. Up by 10 bps or more today across the curve. Do you know what happens when the yield curve steepens, every single time? Hint: not economic expansion.”

The Fed’s recent signals and policy stance have taken the financial world by storm. Charlie Bilello, Chief Market Strategist at Creative Planning, noted, “The 10-Year Treasury Yield moved up to 4.49% today, highest since October 2007. The Real 10-Year Yield (adjusted for expected inflation) of 2.11% is now at the highest level since March 2009.” Bilello also pointed out the significant reduction in the Fed’s balance sheet, which is currently “over 10% below its April 2022 peak.”

The two largest drawdowns over the last 20 years were between December 2008 and February 2009 with 18.2% (balance sheet hit a new high in Jan 2010), and from January 2015 to August 2019 with -16.7% (balance sheet hit a new high in March 2020).

The rise in the 10-Year Treasury Yield was reiterated by the analysts from “The Kobeissi Letter,” who stated: “BREAKING: 10-Year Note Yield officially hits our 4.50% target… The 10-Year Note Yield is up an incredible 20 basis points in less than 24 hours… With supply side inflation out of control and oil prices back to $90+, the Fed has no choice. Higher for longer is back.”

The Federal Reserve’s Stand

During Wednesday’s FOMC meeting, the US central bank and chairman Jerome Powell have made clear its intentions, signaling the potential for an additional rate hike this year and forecasting fewer cuts next year. It now forecasts half a percentage point of rate cuts in 2024. Prior, the dot plot showed cut rates by a full percentage point next year.

This “higher for longer” strategy seems to diverge from the market’s prior expectations, despite three months of seemingly positive inflation data. Moreover, Powell conveyed confidence in the US. economy, emphasizing the need to ensure interest rates are adjusted correctly to achieve the central bank’s 2% inflation target.

However, the market remains uncertain, with the CME Group’s FedWatch Tool indicating only a 32% chance of another rate hike in November and a 45% likelihood by December.

Implications For Bitcoin And Crypto

Risk assets, including Bitcoin and other cryptocurrencies, have historically been sensitive to increases in the 10-Year Treasury Yield. Charles Edwards, founder of Capriole Investments, highlighted the challenges for the Bitcoin and crypto sector:

The Fed wants more unemployment. The job market is still too strong. They’ve raised the expected 2024 rates as a result and the 10YR has broken out to new decade highs. As long as the 10YR is breaking upwards like this, risk assets are going to see further headwinds.

Historically, rising yields are indicative of an expectation of higher interest rates, which increase the cost of borrowing. This scenario often leads to a reduction in speculative investments, with investors favoring more stable, yield-bearing assets over riskier options such as Bitcoin and crypto.

Another problem for the market is the “higher for longer” approach and the massive reduction of the Fed’s balance sheet. Risk assets like Bitcoin are traditionally a “sponge” for high liquidity, but when this dries up in the financial market, they usually suffer the most.

In addition, concerns about a possible recession will continue to rise due to the inverted yield curve. Remarkably, Bitcoin and crypto have never traded in a recession, the reaction is uncertain.

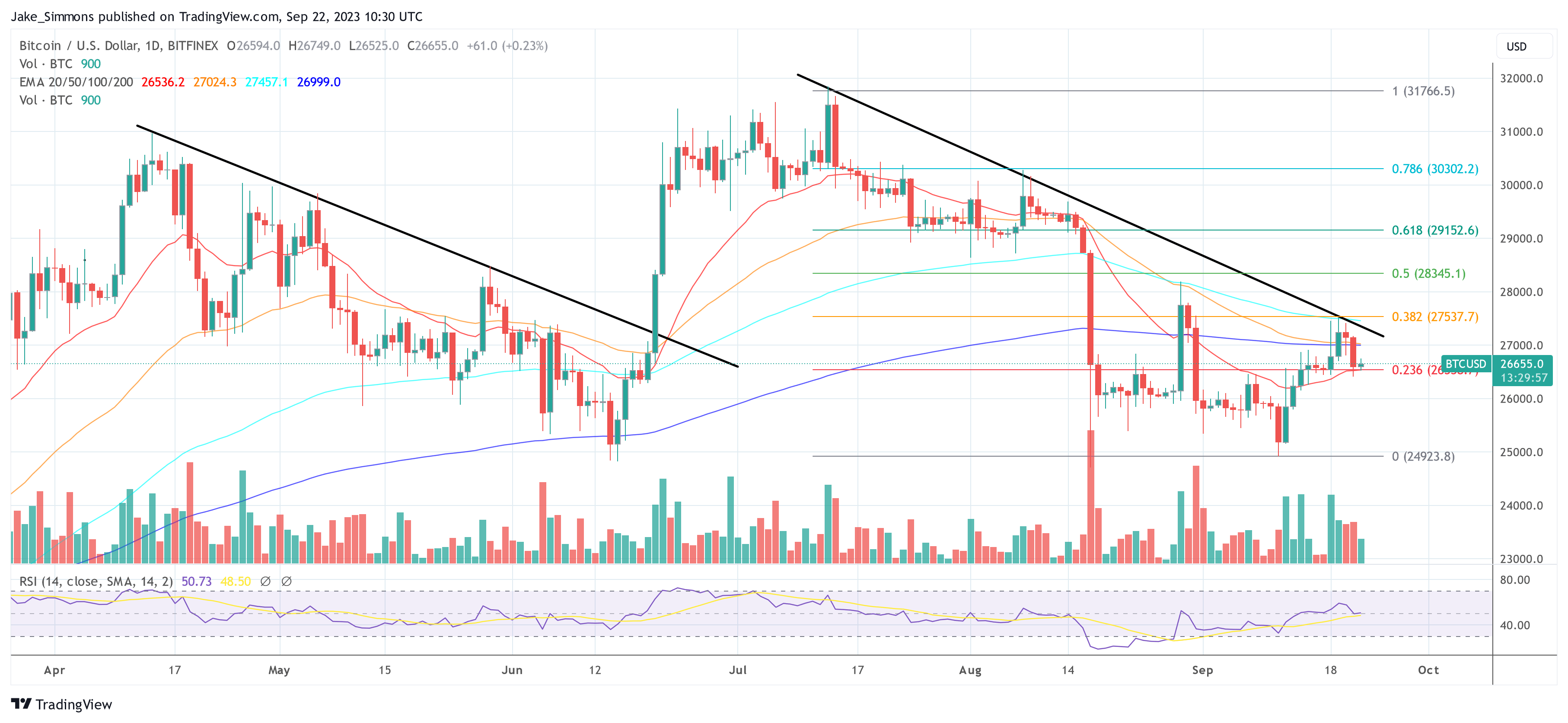

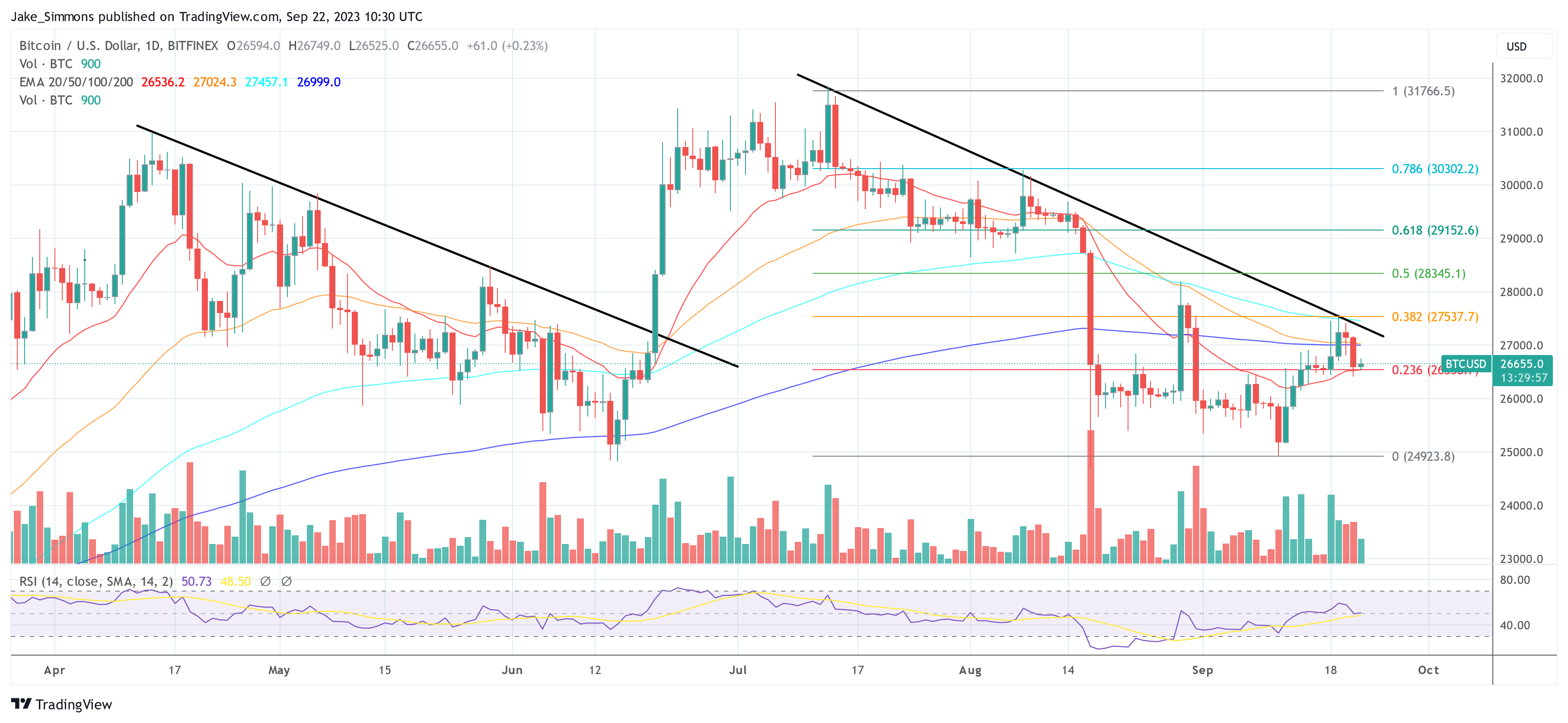

At press time, Bitcoin traded at $26,655.