Terra Luna Classic Votes to Cut Validators Despite Criticisms, What Next for LUNC & USTC?

The post Terra Luna Classic Votes to Cut Validators Despite Criticisms, What Next for LUNC & USTC? appeared first on Coinpedia Fintech News

The tumbling network has no major update Terra land is having its winter fall. In a pivotal moment for the Terra Luna Classic network, a contentious proposal sought to decrease the number of validators, sparking a heated debate within the community. Despite concerns raised over potential threats to security and fears of centralization risks, the proposal managed to secure passage, triggering a significant impact on the network’s assets—LUNC and USTC.

Proposal Success Despite Backlash

The curtain raiser Proposal 11888, titled “Decrease the validator set of Terra Classic to 100 from 135,” aimed to reduce the number of validators on the Terra Classic chain. Proponents of the idea stated that reducing the number of validators would make the network safer from smaller entities that could pose a threat by impersonating others.

However, not everyone in the Terra Luna Classic community was on board with the idea. Some people are worried that reducing the number of validators would lead to more centralization, which goes against the whole idea of decentralization that blockchain networks aim to achieve. Some were worried that this change would make the network less secure and hurt smaller validators who were trying to help the chain grow.

Next, Comes the Validator Standoff — A Decisive Move?

Despite the contentious debates, the proposal ultimately passed, albeit with a mixed reception. The voting outcome displayed a split within the community, with 31.69% voting “Yes,” 22.49% casting “No” votes, and 46 abstentions. Notably, significant validators refrained from taking a definitive stance; Allnodes, the largest validator, opted for an “Abstain” vote.

Implications of the Decision on Lunc & USTC

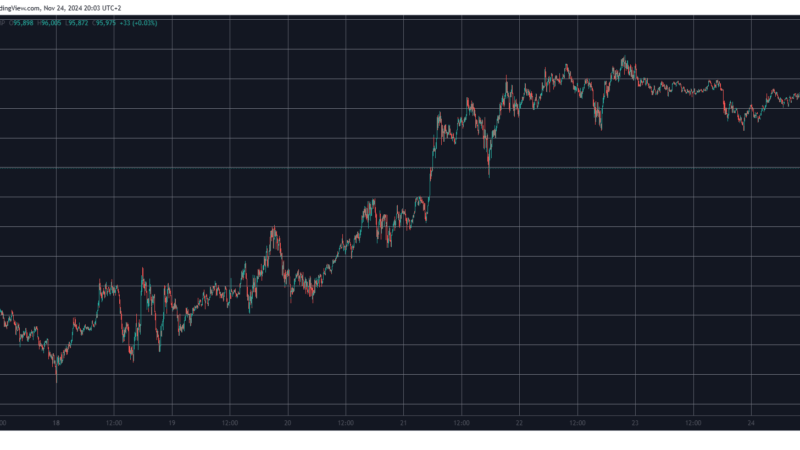

The aftermath of the decision made a substantial impact on the Terra Luna Classic assets—LUNC and USTC. After a spike in both assets, LUNC fell 10% to $0.000237. USTC fell 15% to $0.055. The price drop and trading volume drop indicate a drop in trader interest post-decision. LUNC’s all-time high is $119.18, but it would take $690 trillion to get it, surpassing the NYSE. At the highest market cap, LUNC traded at $0.007. 10,000% more than the current pricing. This pricing is much lower than its ATH of $119.18 owing to inflation.

The passage of the proposal unveiled a divided sentiment within the Terra Luna Classic community. It ignited a cautious response among investors, signaling a need for further discussions and evaluations regarding the implications of this decision on the network’s future, security, and decentralization objectives.