Uma’s Latest Innovation Ova Promises Fairer Profit Distribution in Defi

UMA has officially introduced Oval, a novel product designed to optimize the use of oracle data by defi protocols. This tool changes how protocols manage oracle-based MEV, enhancing efficiency and fairness in Ethereum’s blockchain profits.

Oval Launch by Uma Aims to Redistribute Profits Back to Defi Protocols

Ethereum-based oracle protocol Uma unveiled its latest product Oval today, which Uma claims “lets lending protocols capture Oracle Extractable Value by auctioning the right to liquidate positions.” The new tool is designed to enable defi protocols like lending protocols such as Aave and Compound, to more efficiently utilize oracle data.

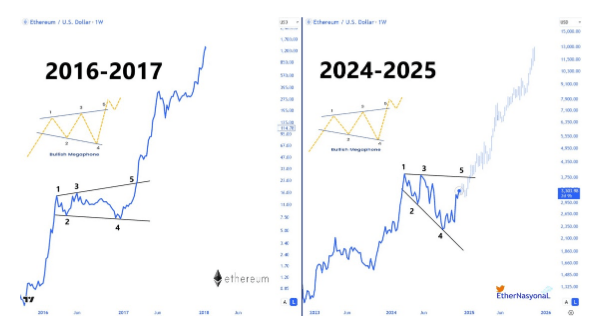

Oval’s introduction addresses a particular subset of Maximal Extractable Value (MEV), that Uma calls Oracle Extractable Value (OEV). MEV refers to the profit that miners, validators, or searchers can make through manipulating the order of transactions in a blockchain block. MEV arises because the sequence of transactions can significantly impact the outcome of trades. Miners or validators, who have the authority to decide the order of transactions in a block, and searchers, who can find opportunities in the mempool, can profit by reordering, inserting, or censoring transactions.

For instance, they can “front-run” a large trade by placing their own transaction first to profit from the expected price movement. This manipulation can lead to higher transaction fees and potential network congestion, as users bid higher gas fees to prioritize their transactions.

This extracted value has been predominantly captured by external parties such as block builders, validators, and searchers. With Oval, Uma aims to reapportion much of this value back to the originating applications, thereby creating a more equitable distribution of profits within the blockchain ecosystem.

Major protocols like Aave have been overpaying to incentivize liquidators due to the current system, leading to a disproportionate accumulation of profits by validators. Oval seeks to rectify this imbalance by facilitating an auction mechanism where searchers can bid for the right to use Chainlink’s price data. The proceeds from these auctions will be shared among Aave, Uma, and Chainlink, with Aave receiving the majority share. On their website, Uma claims that Oval allows a protocol to, “capture as much as 90% of all the OEV [a] protocol creates.”

“Aave and Compound are losing ~$50m/year in MEV (in a bear market). DEX perps are losing boatloads too,” said Uma co-founder Hart Lambur.

The transition to Oval will necessitate changes in the operational dynamics for block builders and validators, who stand to lose a portion of their current revenue streams. However, participation in this new system will be mandatory once major protocols like Aave integrate Oval.

Do you think Oval will be adopted by Ethereum ecosystem parties? Share your thoughts and opinions about this subject in the comments section below.