Bitcoin Price Will Skyrocket To $280,000 Next Year: Hedge Fund Manager

Renowned crypto asset hedge fund manager Charles Edwards has made a bold prediction regarding the future price of Bitcoin. Edwards, founder of Capriole Investments, shared his insights via X (formerly Twitter), outlining a compelling case for Bitcoin’s potential to reach $280,000 in the coming year.

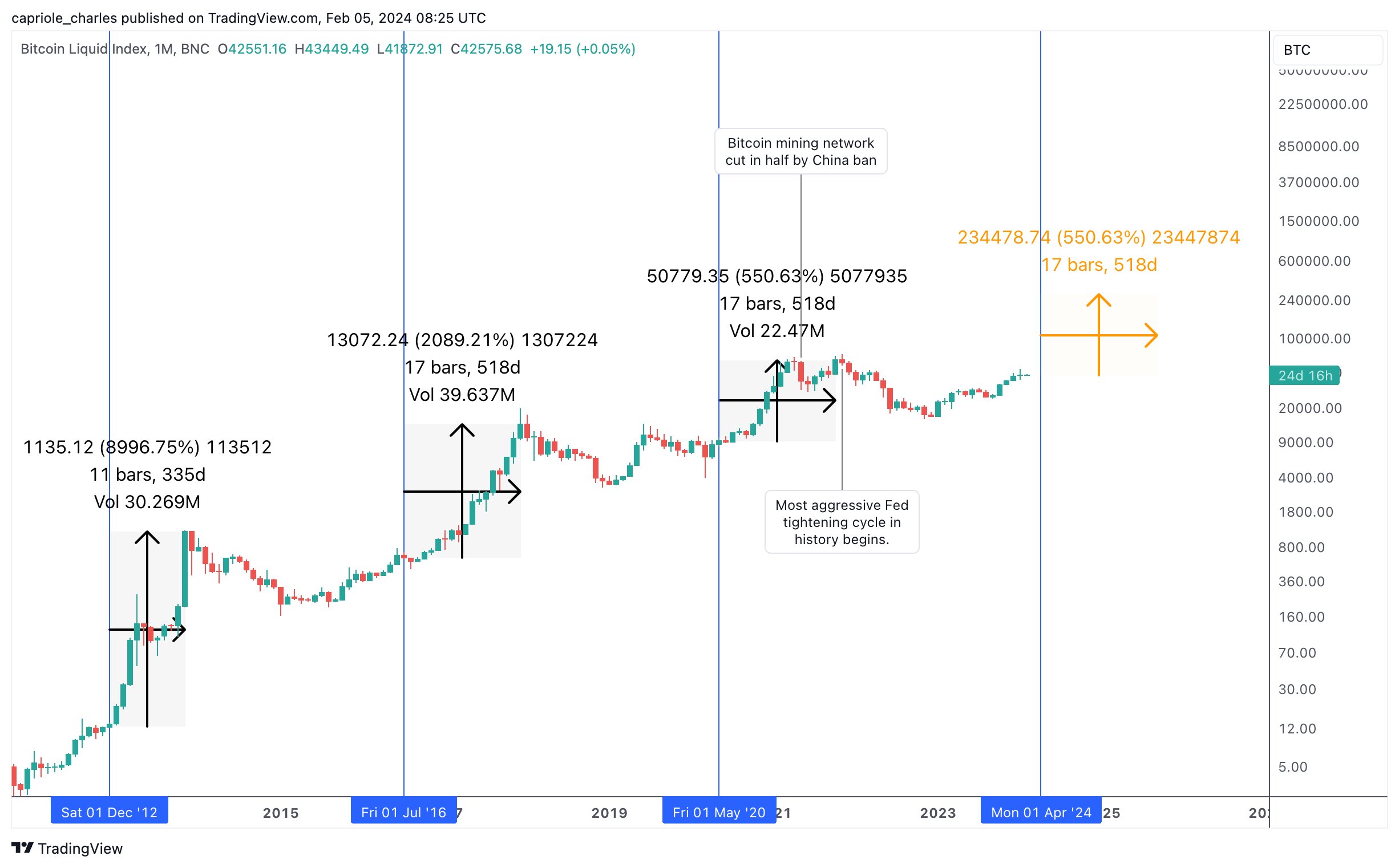

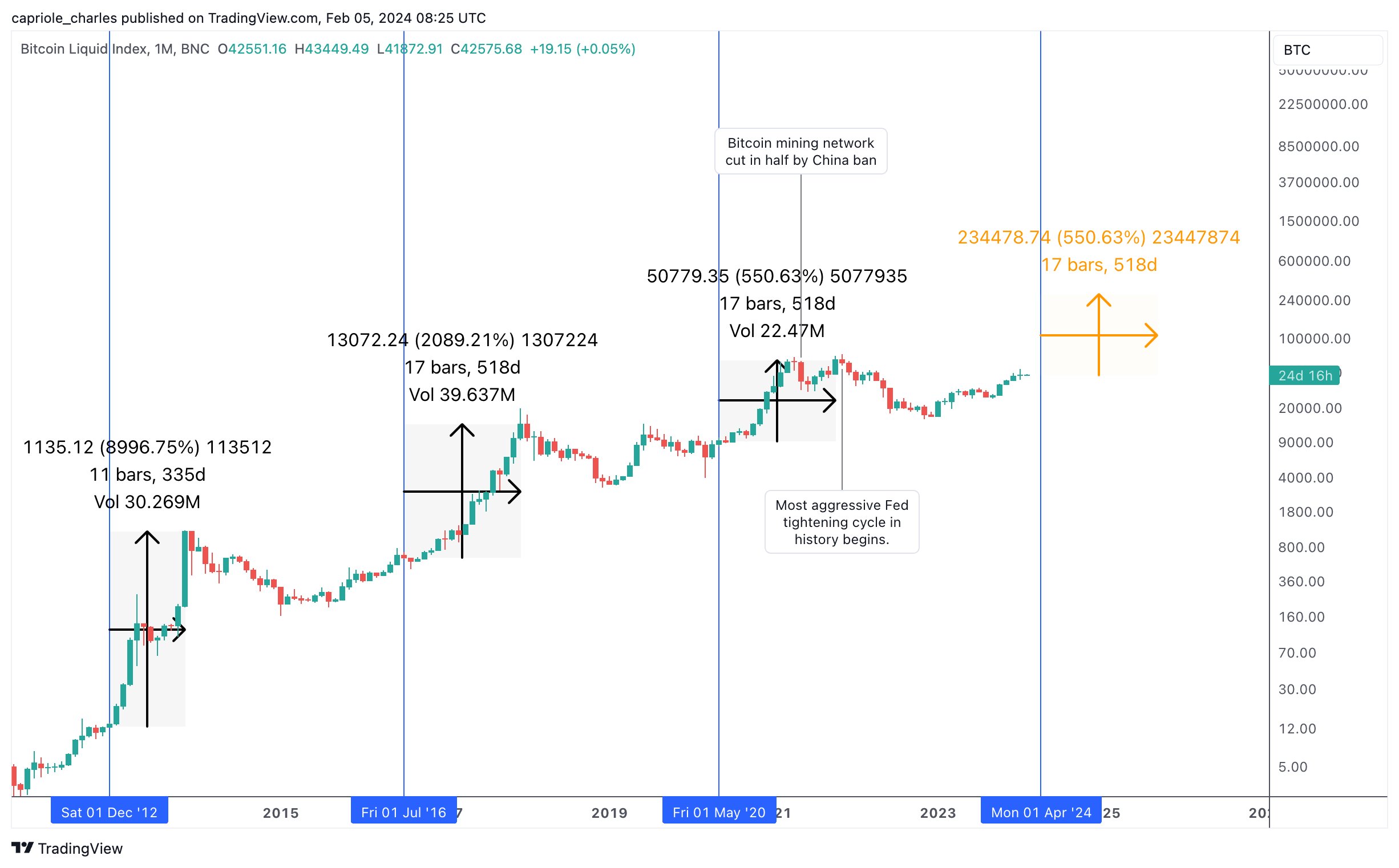

In his statement, Edwards referenced historical data and several key factors that could drive Bitcoin’s price to new heights. He began by comparing Bitcoin’s performance after the 2020 halving event, stating, “If Bitcoin’s post halving returns are the same as 2020, we are looking at $280K Bitcoin next year.”

Bitcoin Price Could Top $300,000 Next Year

As the chart by Edwards shows, the third bull run in 2020 was rather subdued in comparison to the previous ones. The first bull market (halving cycle) in 2012 saw Bitcoin price peak at $1132, marking a dramatic increase of 8,996% over 11 months (335 days). The second bull run in 2016 ended in December 2017 when the price reached approximately $20,000, marking a 2,089% increase over 17 months (518 days).

Edwards acknowledged that some might argue that profits diminish with each cycle. However, he made a counterpoint that 2020’s performance was pinned down due to main factors. First, Edwards attributed the lackluster performance of the 2020 bull market to China’s decision to ban Bitcoin mining, which led to a 50% reduction in hash rate and had a stifling effect on Bitcoin.

Second, he highlighted the aggressive tightening measures taken by the Federal Reserve, which negatively impacted Bitcoin’s performance during that period, stating, “2020 was the worst Bitcoin bull market in history. I believe overall performance was pinned down due to the -50% destruction of mining network by China and the most aggressive Fed tightening cycle in history.”

However, Edwards expressed optimism about the future, pointing to a contrasting economic landscape in 2024. He stated, “In fact, 2024 marks the polar opposite to 2021. QE has resumed and the Fed has started easing, with Fed chair Powell expecting 3 cuts this year. A weaker dollar = a stronger Bitcoin.”

He also compared the upcoming launch of Bitcoin ETFs in January to a “second halving,” highlighting the potential market impact, saying, “Further, I consider the January Bitcoin ETF launches as powerful as a ‘second halving’.”

Drawing parallels to the gold market, Edwards emphasized that Bitcoin’s current market cap of around $800 billion is significantly smaller than gold’s market cap when the GLD ETF launched in 2004.

He noted that gold experienced a parabolic rise of over 300% in just seven years following the launch of the ETF, stating, “With a market cap of around $3.3T, Gold commenced a parabolic rise of over 300% to $13T in under 7 years. Bitcoin’s market cap today is just over $800B. Smaller assets are generally capable of experiencing larger upside returns.”

Furthermore, Edwards underscored the rapid growth of Bitcoin, asserting that it is currently outpacing the adoption rate of the Internet, saying, “Bitcoin is currently growing faster than the Internet.”

The hedge fund manager concluded by summarizing his prediction, stating:

A 500% return over the 18 months following the halving would not be unusual for Bitcoin historically. An additional 300% return over the next 2-5 years from the ETFs alone would be a conservative assumption. When you drill it down to the two most important factors for Bitcoin this cycle, and add them together, it’s easy to arrive at a conservative Bitcoin price of $300K in the next couple of years.

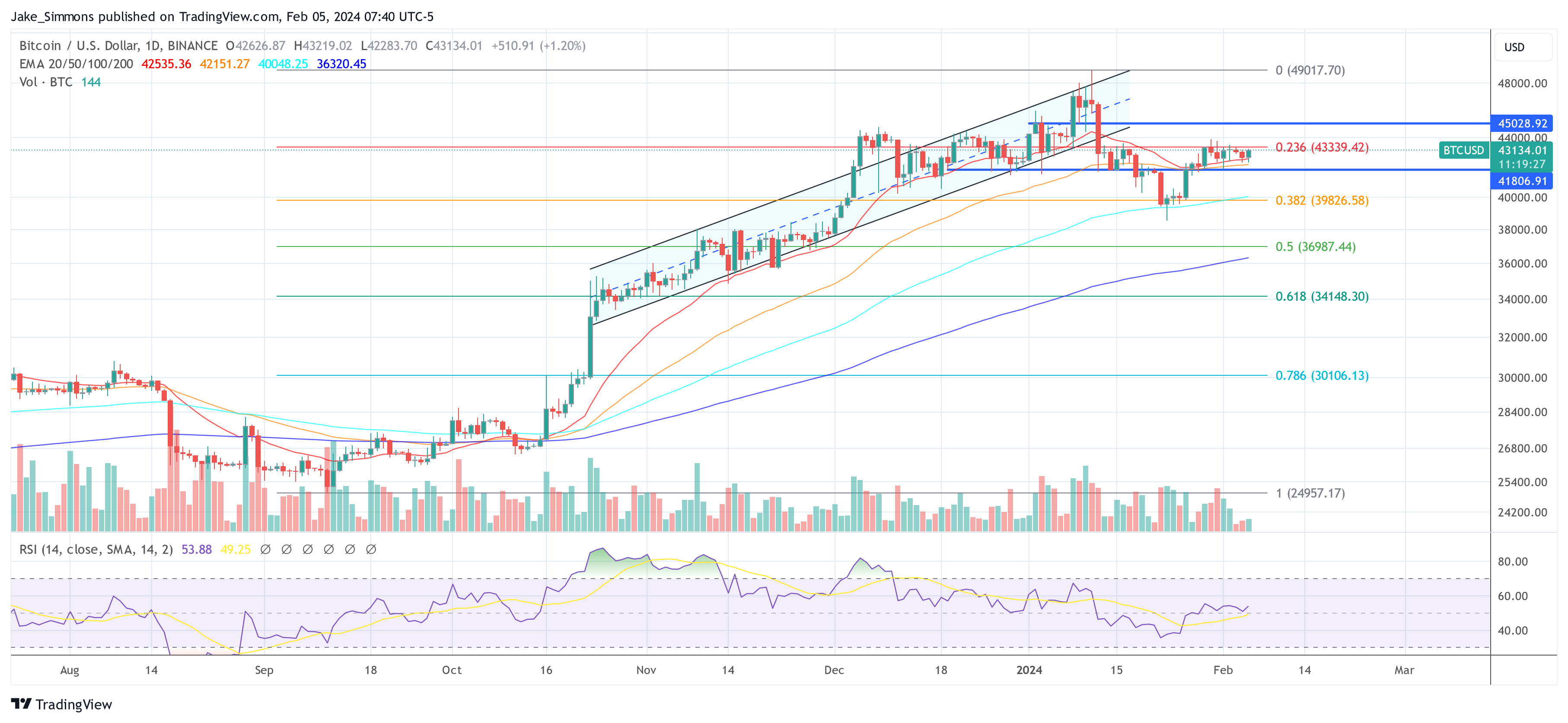

At press time, BTC traded at $43,134.