Gold’s recent performance draws parallels with major historical economic events

Quick Take

Gold has demonstrated its resilience and value as a safe-haven asset, surging over 16% year-to-date and outperforming the S&P 500. The precious metal recently hit the $2,400 threshold for the first time, marking a significant milestone.

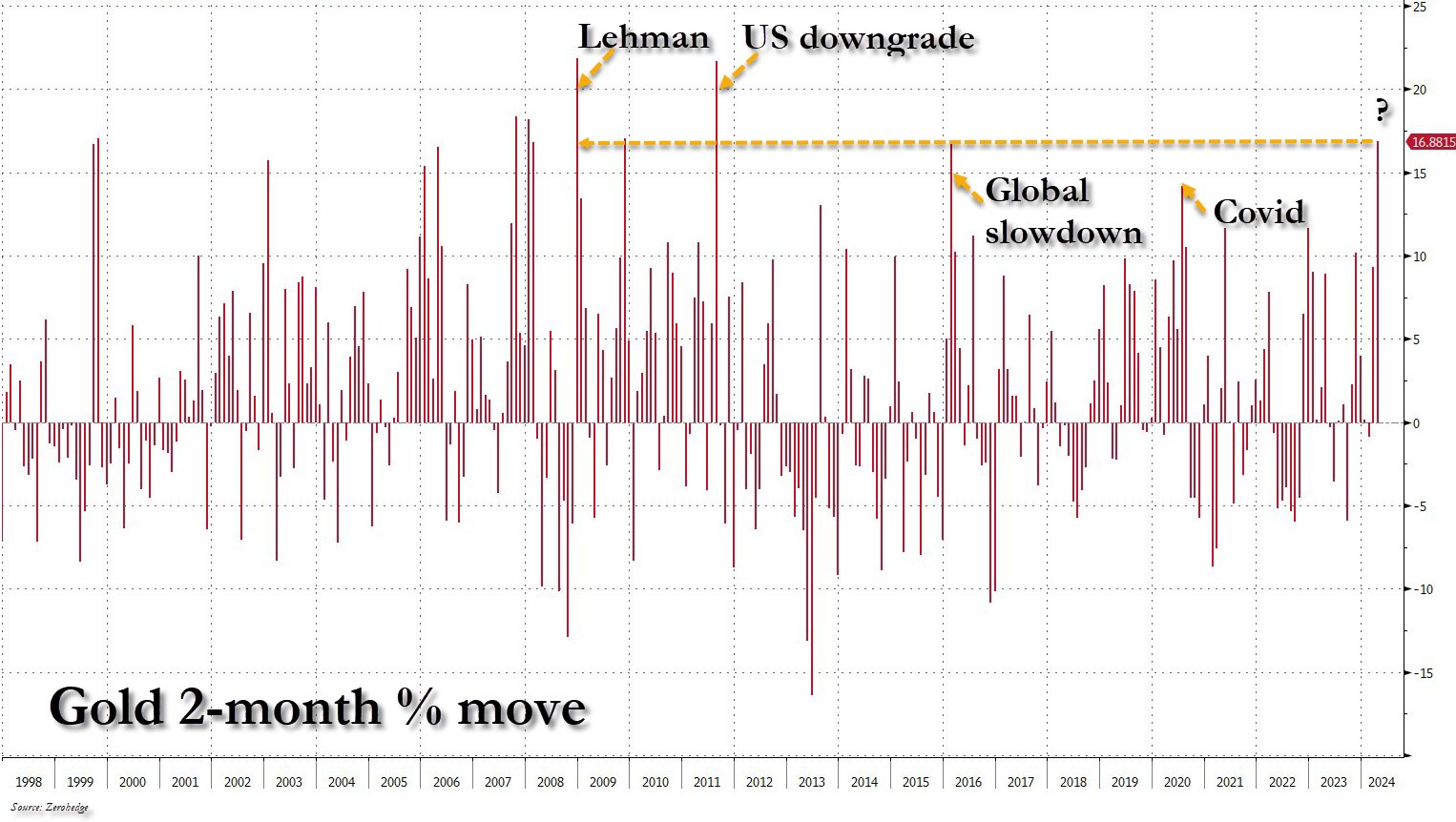

According to data shared by Zerohedge, gold has experienced a remarkable 17% increase over the past two months. Historically, similar short-term percentage moves in gold have coincided with major economic events, such as the 2008 Global Financial Crisis, the 2011 US downgrade, the 2016 global slowdown, and the 2020 COVID-19 pandemic.

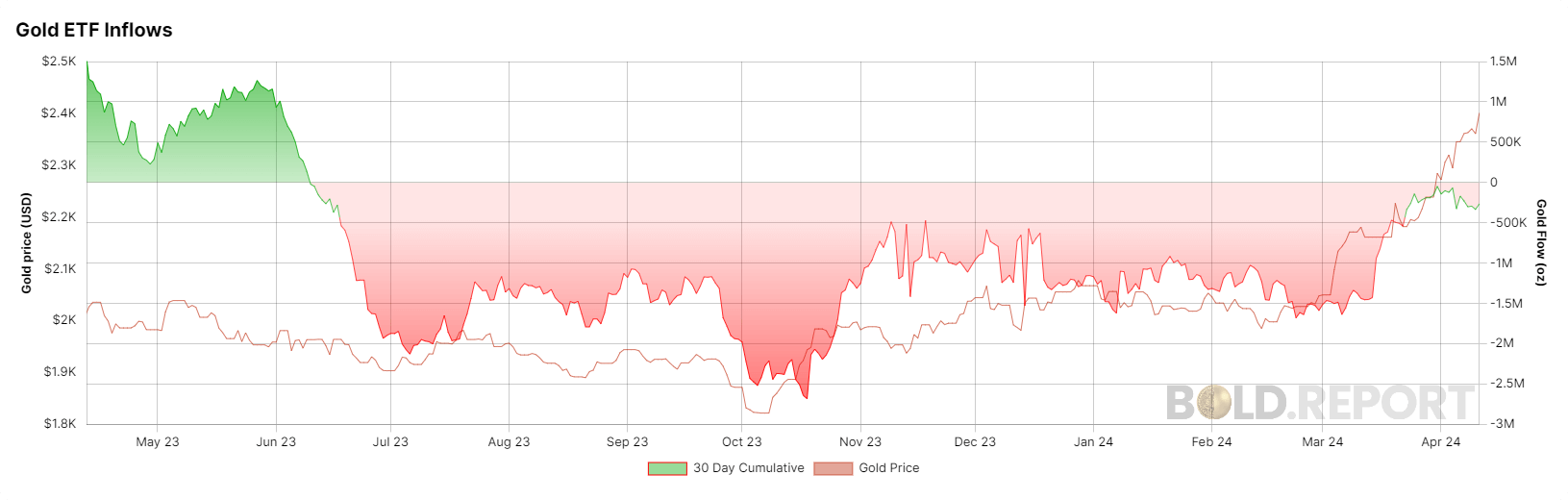

Despite the recent impressive performance, gold ETFs have witnessed outflows on a 30-day cumulative view since June 2023, according to the bold report. These outflows have significantly reduced since mid-March, raising the question of whether potential inflows could propel gold prices even further. As economic uncertainty persists, investors closely monitor gold’s performance and its potential as a hedge against market volatility.

The post Gold’s recent performance draws parallels with major historical economic events appeared first on CryptoSlate.