SEC Suspends its Investigation into Ethereum 2.0: Will This Be the Catalyst to Propell ETH Price to $4000?

The post SEC Suspends its Investigation into Ethereum 2.0: Will This Be the Catalyst to Propell ETH Price to $4000? appeared first on Coinpedia Fintech News

A major win for the Ethereum developers as the US SEC suspends all its investigation into Ethereum 2.0. The SEC has earlier approved an investigation to examine the buy-sell-trade of individuals and entities. However, in a recent update shared by Cosensys, the blockchain development company behind Metamask, the SEC notified the company of the withdrawal of the investigation.

In a detailed thread, the company said the notification was a reply to the letter that was sent to confirm whether the approval of the spot ETH ETF was after the agency decided to close the investigation or not. To this, the SEC notified its closure, however, the blockchain company is expected to continue its fight to bring justice to the developers, technology providers, and traders who have suffered under the SEC’s illicit crypto crackdown.

“Our fight continues,” says the post, which also seeks a declaration in their lawsuit that metamask swaps & staking do not violate the securities law.

Will ETH Price Reach $4000 This Week?

No sooner than the rounds of the SEC’s withdrawal of investigation circulated within the market, the ETH price gained momentum and overcame the previous bearish action. While Bitcoin continues to remain stuck around $65,500, the ETH price has already made it above $3,500. However, the second-largest token is required to clear certain levels, which may only send the price beyond $4000.

The recent bullish push has pushed the ETH price a step ahead towards the critical resistance zone between $3,663 and $3,703. As the token has failed to surpass these levels, it is now very important to enter and clear this zone. The technicals are bullish, with the MACD displaying a drop in selling pressure and the levels are closer to undergoing a bullish crossover. Secondly, the DMI is also displaying a similar trend but the plunging ADX may be a matter of concern.

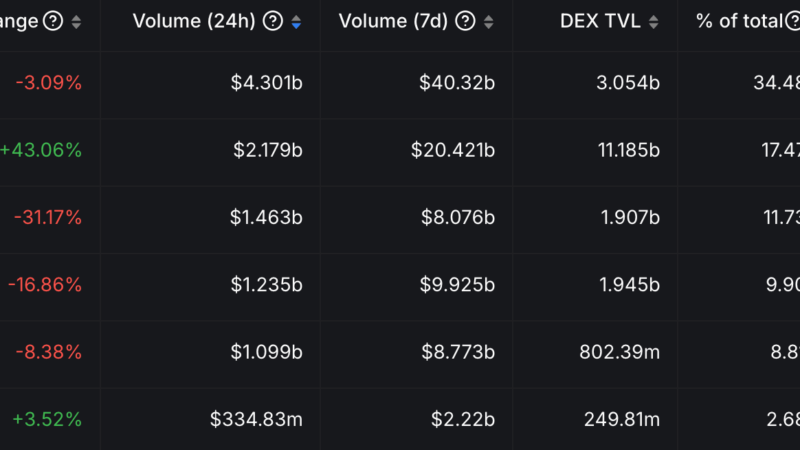

Therefore, the Ethereum (ETH) price may receive a decent bullish push but may not reach the milestone at $4000 as the strength of the rally is waning. Besides, the volume does not show any bullish figures, suggesting the market participants remain doubtful of the upcoming trend. Historically, network upgrades or any positive events have failed to have a sustained and extended impact on the price and hence, traders seem to expect a similar trend now.