STHs faced substantial losses as Bitcoin briefly fell below $60k

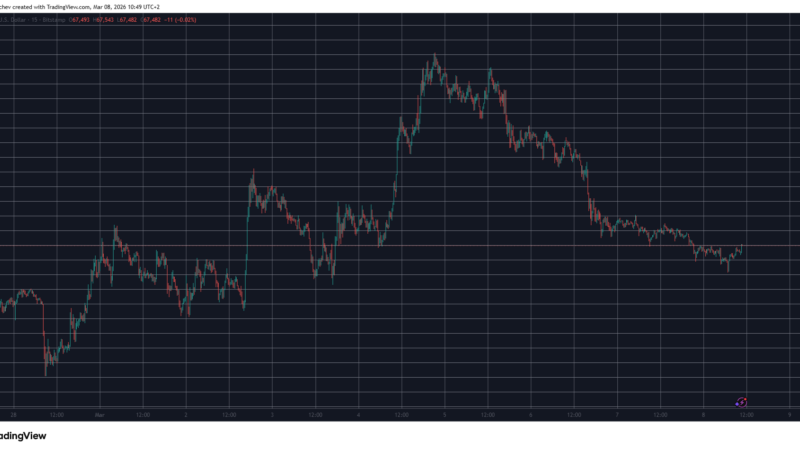

Bitcoin’s volatility over the weekend translated to a sharp drop to below $60,000 on June 24, leading to over $537 million in realized losses for the market.

As with most spikes in realized losses, this sell-off was predominantly driven by short-term holders, who accounted for almost the entire amount of realized losses. This pattern further confirms how susceptible STHs are to market volatility — $441 million of the losses came from holders who owned BTC for one month or less.

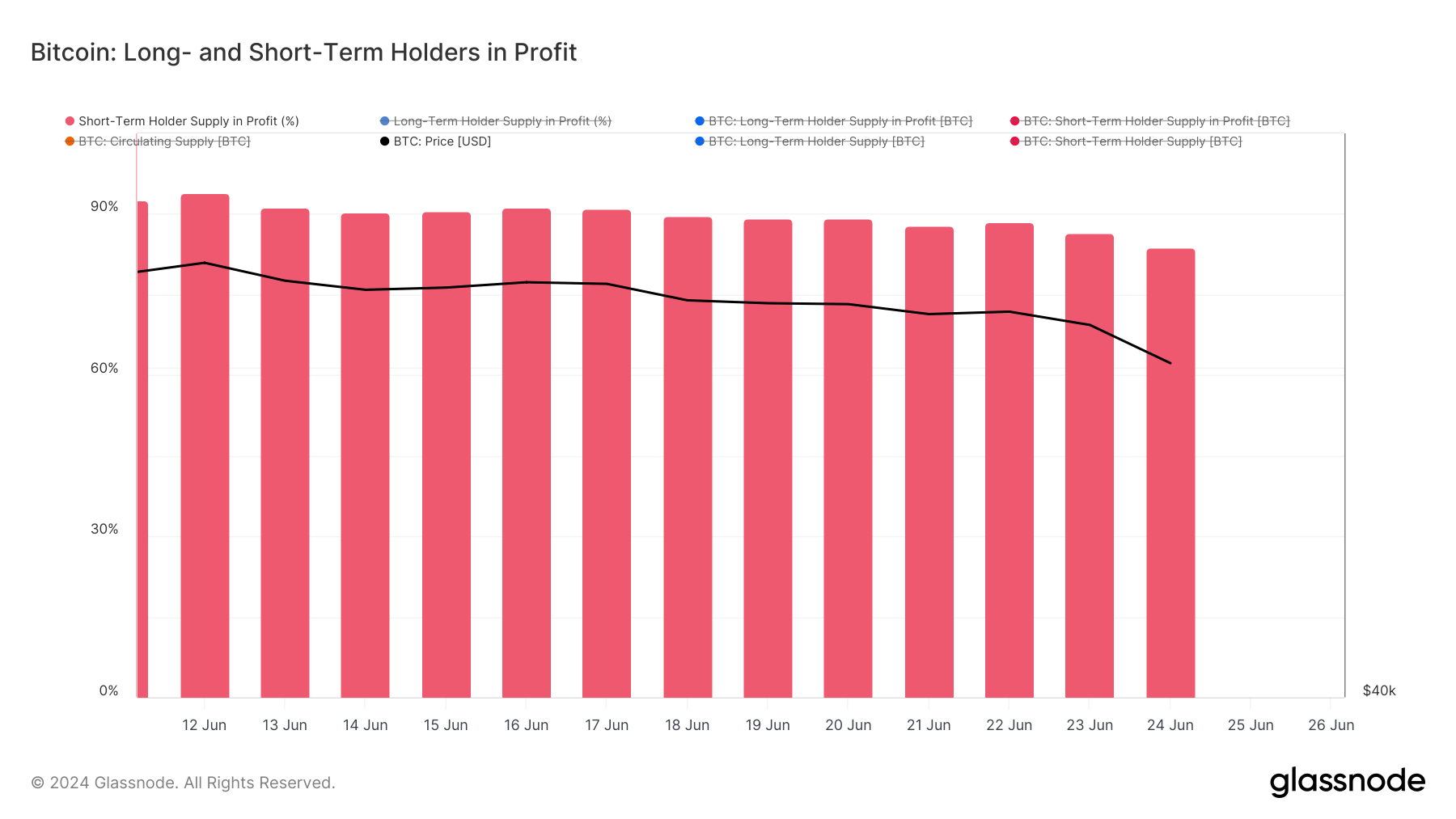

The scale of this sell-off is clearly visible in on-chain data. The percentage of the STH supply in profit shows the proportion of Bitcoin held by STHs currently valued higher than the purchase price.

On June 22, 88.422% of the STH was in profit, but this percentage decreased as Bitcoin’s price dropped. It dropped to 83.854% on June 24, showing that a growing portion of STHs are holding Bitcoin at a loss.

A drop of approximately 4% in the percentage of STH supply in profit over a short period is relatively substantial. This decrease signifies a substantial volume of Bitcoin moving from profit to loss, and the rapid rate of change shows the reactive nature of the cohort.

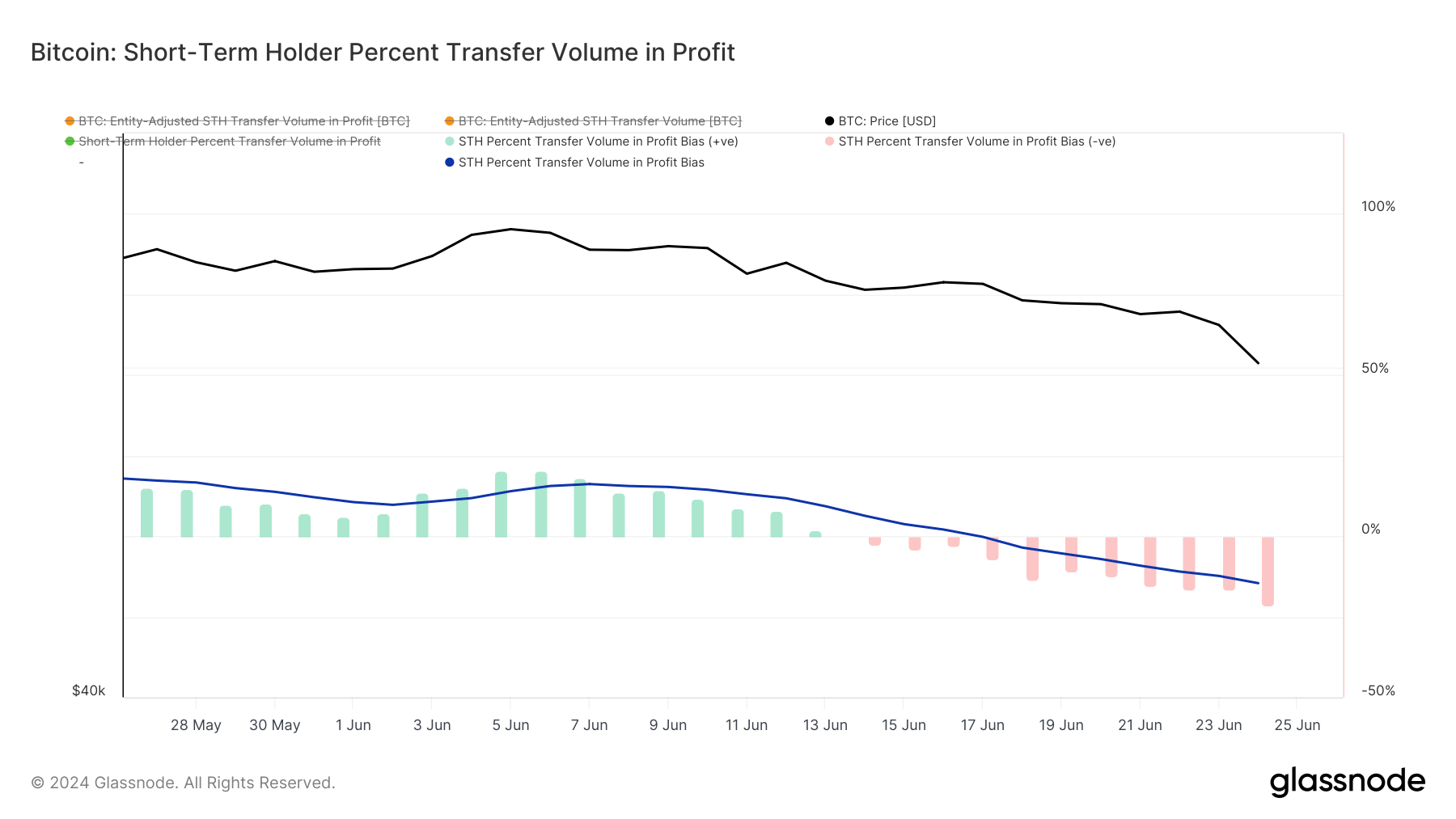

Most of the short-term holder transfer volume has been in loss since June 15. The negative trend worsened from -15.282% on June 21 to -21.309% on June 24, reaching its lowest level since September last year. This shows that the increased selling pressure among STHs persisted before the price drop and that the drop below $61,000 further exacerbated this trend.

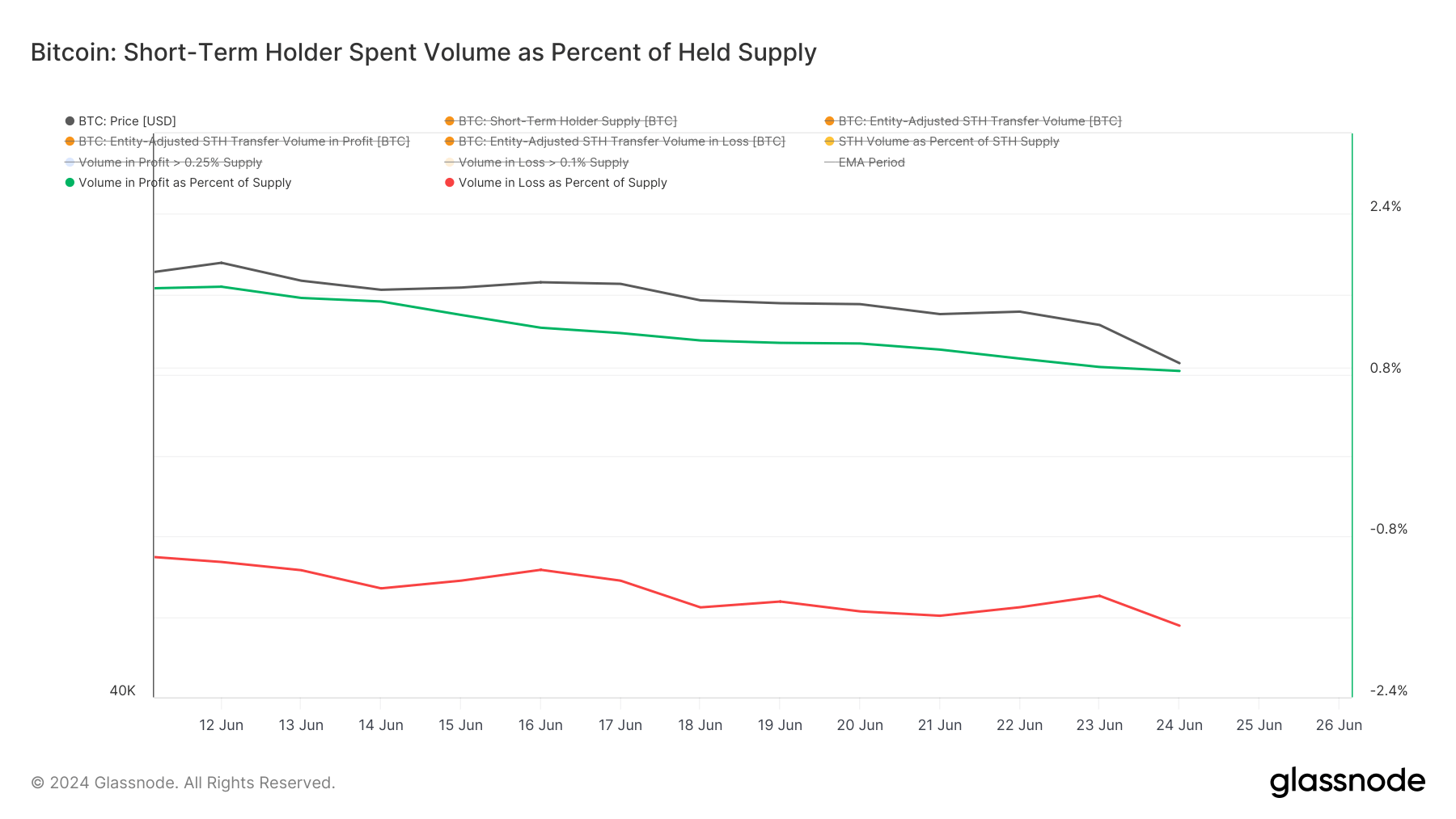

Another metric that illustrates the scale of the sell-off is the short-term holder spent volume in profit and loss as a percent of held supply. This metric from Glassnode helps demonstrate how much of the STH supply was spent, realizing gains and losses.

Between June 21 and June 24, there has been a consistent decrease in the STH volume spent in profit from 1.053% to 0.841%. Conversely, the STH volume spent in loss as a percent of held supply showed a slight uptick from -1.590% on June 21 to -1.688% on June 24.

The data aligns with the trend of STHs becoming more inclined to sell and realize their losses.

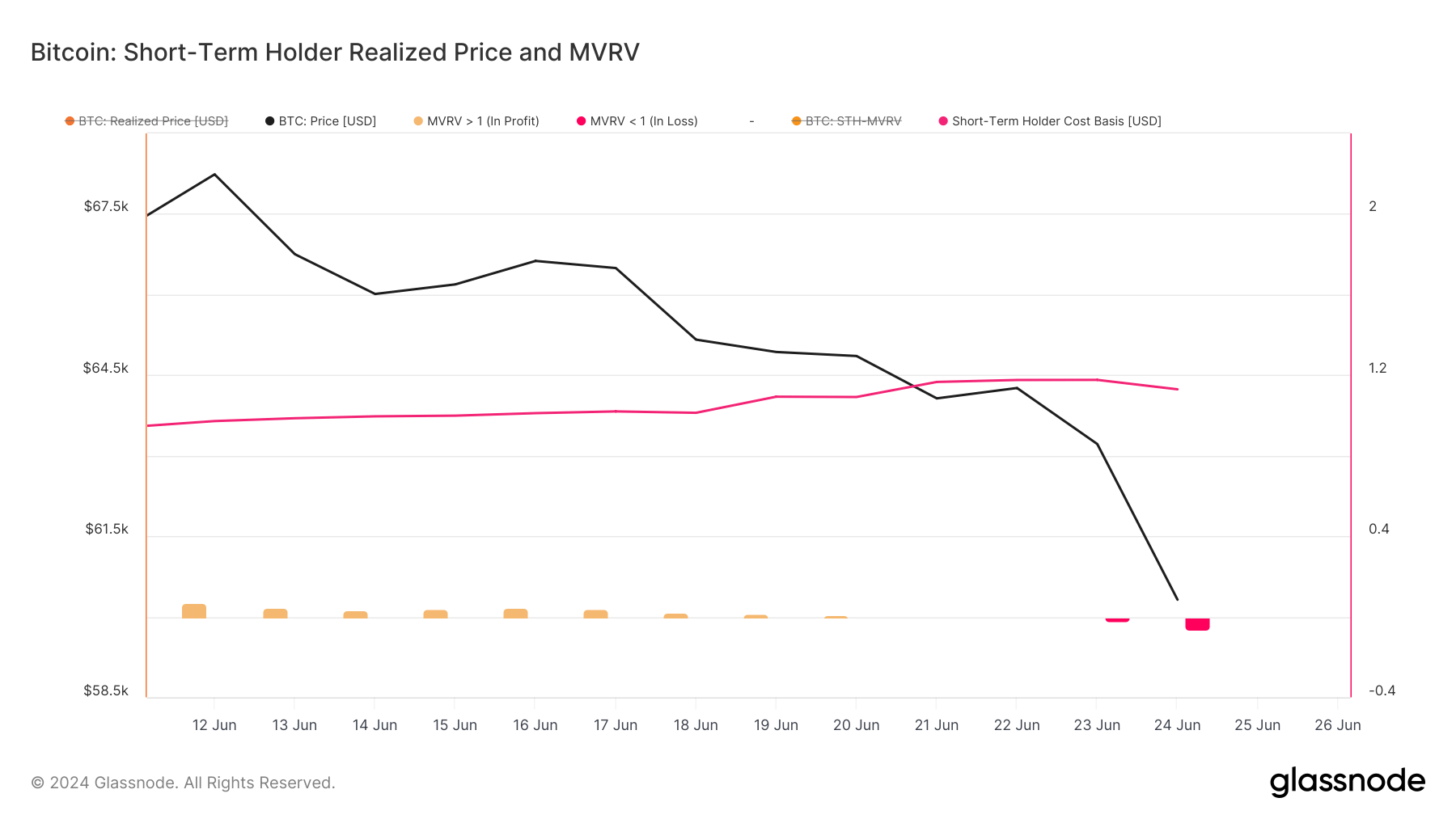

The realized price and MVRV ratio for short-term holders further confirm this. The realized price, the average price at which the current STH supply was acquired, remained relatively stable at around $64,000 throughout the weekend.

However, the MVRV ratio, which compares market value to realized value, turned negative. On June 21, the MVRV was -0.0047, dipping further to -0.0609 by June 24. A negative MVRV ratio suggests that the market value is lower than the realized value, indicating that the current market conditions are unfavorable for STHs — confirming that they are realizing losses upon selling.

The decreasing percentage of STH supply in profit, the negative trend in transfer volume in profit, and the rising spent volume in loss collectively indicate increased selling pressure and loss realization among STHs. The negative MVRV ratio shows unfavorable market conditions for STHs looking to profit. These metrics show a market driven by highly reactive behavior, particularly among new investors.

The post STHs faced substantial losses as Bitcoin briefly fell below $60k appeared first on CryptoSlate.