Should You Buy Ethereum Before the ETF Launch? Analyst Issues Warning

The post Should You Buy Ethereum Before the ETF Launch? Analyst Issues Warning appeared first on Coinpedia Fintech News

The overall market sentiment remains mixed. Bitcoin is consolidating at a crucial level, indicating stability before the next upward push. The focus remains on maintaining the $65,000 support level to pave the way for further gains. On Crypto Banter’s Rans Show, the analyst said that Bitcoin consolidating around the $65,000 level is positive because consolidations are necessary for a healthy market.

Despite the NASDAQ having its worst day in a long time, dropping 3%, and the Mt. Gox coins hitting the market, Bitcoin remained strong.

Ethereum ETF and Grayscale’s Fee Structure

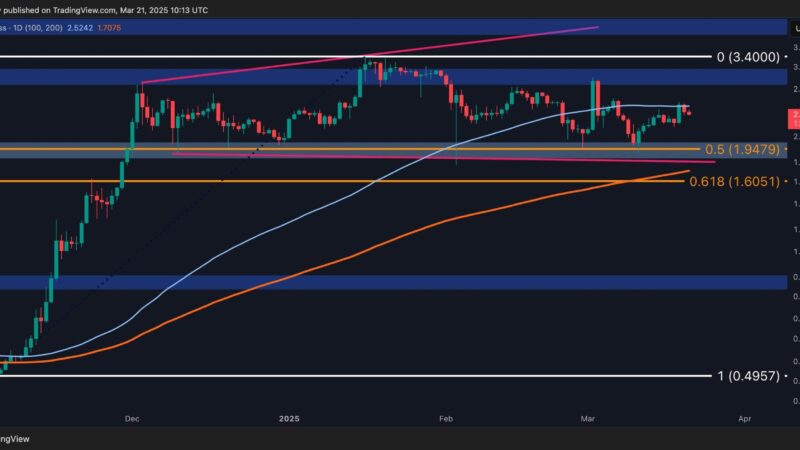

As for Ethereum (ETH), the launch of the ETH ETF is approaching, but the analyst warned against buying ETH before the ETF’s launch due to potential drawbacks revealed by recent fee publications for the Grayscale ETF.

Grayscale’s ETH ETF charges high fees of 2.5%, much higher than competitors who charge around 0.12% to 0.25%. Grayscale’s large ETH holdings, worth about $10 billion, generate revenue from these fees. This high fee structure might lead to outflows as investors switch to cheaper alternatives, similar to issues seen with Grayscale’s Bitcoin Trust. Analysts view this as a strategic mistake, though 60% of respondents in a Twitter poll believe Ethereum’s price will rise 14 days after the ETF launch. However, a brief price drop might still occur initially.

Analysis on ETH ETF Inflows

Eric Balchunas predicted that the ETH ETF would attract 10 to 15% of the Bitcoin assets. This is consistent with Hong Kong crypto ETFs, where ETH makes up 60% of the total assets under management (AUM). So, we’re talking about 15 to 16% of the total ETF inflows going into ETH. In the five months since the Bitcoin ETF launched, nine BTC issuers have attracted $37 billion in assets under management. Assuming ETH attracts 15% of that, it would amount to $5.6 billion.

Currently, Grayscale holds $11 billion in ETH. If we assume that 53% will be sold by Grayscale trust holders, this would amount to $5.88 billion, which is close to the predicted inflow of $5.6 billion. Therefore, according to this analysis, the outflow should roughly equal the inflow.