Why Ethereum Price is Down Today? A 22% Drop Triggers Massive Market Liquidation

The post Why Ethereum Price is Down Today? A 22% Drop Triggers Massive Market Liquidation appeared first on Coinpedia Fintech News

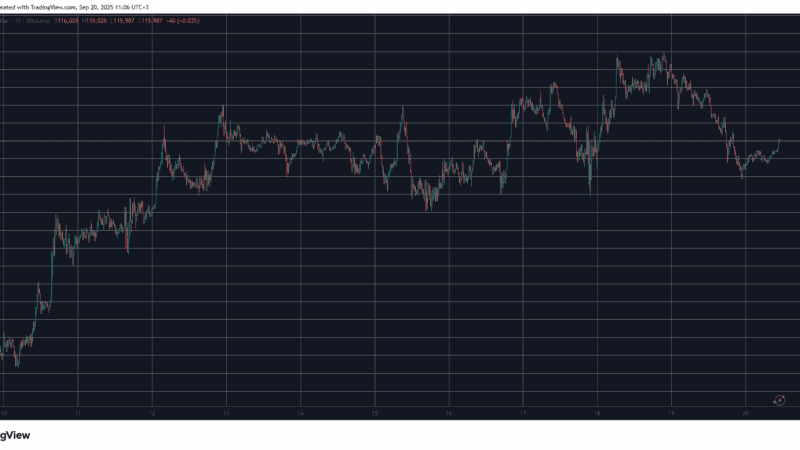

As Bitcoin (BTC) price teased below $50k for the first time since early February, Ethereum (ETH) price had its worst-performing day in more than 12 months. According to the latest crypto oracles, Ether’s price dropped more than 22 percent in the past 24 hours to trade around $2,294 on Monday during the London session.

Consequently, more than $344 million was liquidated from the Ethereum leveraged market.

Interestingly, Ethereum’s total market cap is lower than the cash pile held by billionaire Warren Buffet’s company, which currently holds about $277 billion.

What Caused the Ethereum Crash?

The notable crypto capitulation, which resulted in the liquidation of more than $1 billion, closely followed the losing streak in the global stock market. In Japan, the stock market registered its worst performance since 1987, signaling the onset of possible global economic recession ahead.

With the US markets yet to open, fear of further crypto capitulation has significantly escalated. Bitcoin’s fear and greed index slipped below 26 percent, denoting extreme fear.

Interestingly, Robinhood Markets has already halted its 24-hour trading in fear of a liquidity crisis.

Since the approval of US-based spot Ether ETFs, the issuers have reported a cumulative net cash outflow of about $510 million. With Grayscales ETHE holding over $5.97 billion worth of Ether, further bleeding is expected in the coming weeks.

Meanwhile, Jump Trading has been offloading its Ether holdings in the past two weeks and has already installed $500 million worth of Ether.

Amid the ongoing uncertainty in the Middle East, the crypto industry could continue with the choppy market.

Is the Macro Bull Cycle Over?

While there are some odds for the macro crypto bull cycle having topped out in the past few months, several indicators point to a possible rebound in the near term. Furthermore, the US Fed could initiate interest rate cuts soon amid the upcoming general elections.

Additionally, the crypto industry has performed poorly in the past August and September but registered impressive gains in October.