Bitcoin Price Prediction: Volatility Index Hits COVID-19 Levels, Rare Signal Predicts Drop to $50k

The post Bitcoin Price Prediction: Volatility Index Hits COVID-19 Levels, Rare Signal Predicts Drop to $50k appeared first on Coinpedia Fintech News

The world is currently experiencing the most significant global financial meltdown. The implications of this downturn are vast, with ripple effects seen across various markets, including cryptocurrencies like Bitcoin and Ethereum.

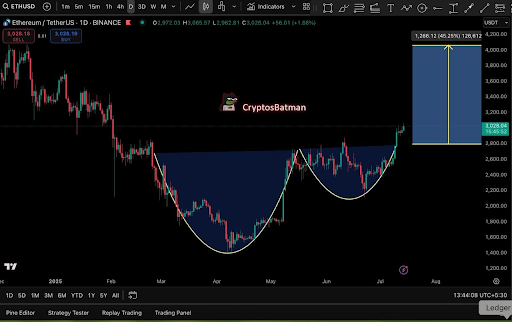

Analyst Josh of Crypto World’s concerns are based on several worrying signs. A key chart shows increasing instability in the global financial system. This situation is similar to past crises, indicating that what we’re seeing isn’t just a normal market correction but a potential major financial disaster.

One of the key indicators of market fear, the Volatility Index (VIX) for the S&P 500, has spiked to levels not seen since the COVID-19 crisis in March-April 2020. The VIX is now at its highest point since the 2008 financial crisis, underscoring the severity of the current market volatility.

Bitcoin has recently flashed a rare bear market signal, one that hasn’t been seen since the beginning of the 2022 bear market. This signal, if confirmed, could suggest that Bitcoin is about to enter a prolonged period of downward price action.

In the short term, Bitcoin’s daily chart shows that the cryptocurrency has recently broken below a crucial support level between $56,000 and $57,000, quickly dropping to the next support zone around $51,000 to $53,000. However, at the time of writing, BTC has hopped back above the $55k levels.

Despite this drop, there are signs that Bitcoin may have reached a local low, with the daily RSI entering oversold territory. This suggests that while the broader trend may be bearish, Bitcoin could see a temporary rebound or stabilization before any further declines.

A crucial technical indicator, the Super Trend Indicator, is flashing a bearish reversal signal on Bitcoin’s four-day timeframe. The last time this signal appeared was at the start of the 2022 bear market, which led to a sustained period of bearish price action. While the current signal is not yet confirmed, it’s a development that bears watching closely.

Should Bitcoin close a four-day candle below the $56,000 mark, this signal would be confirmed, potentially indicating the start of another significant bearish trend.