Traders’ leveraged bets on Bitcoin’s $60,000 level drive market volatility

Quick Take

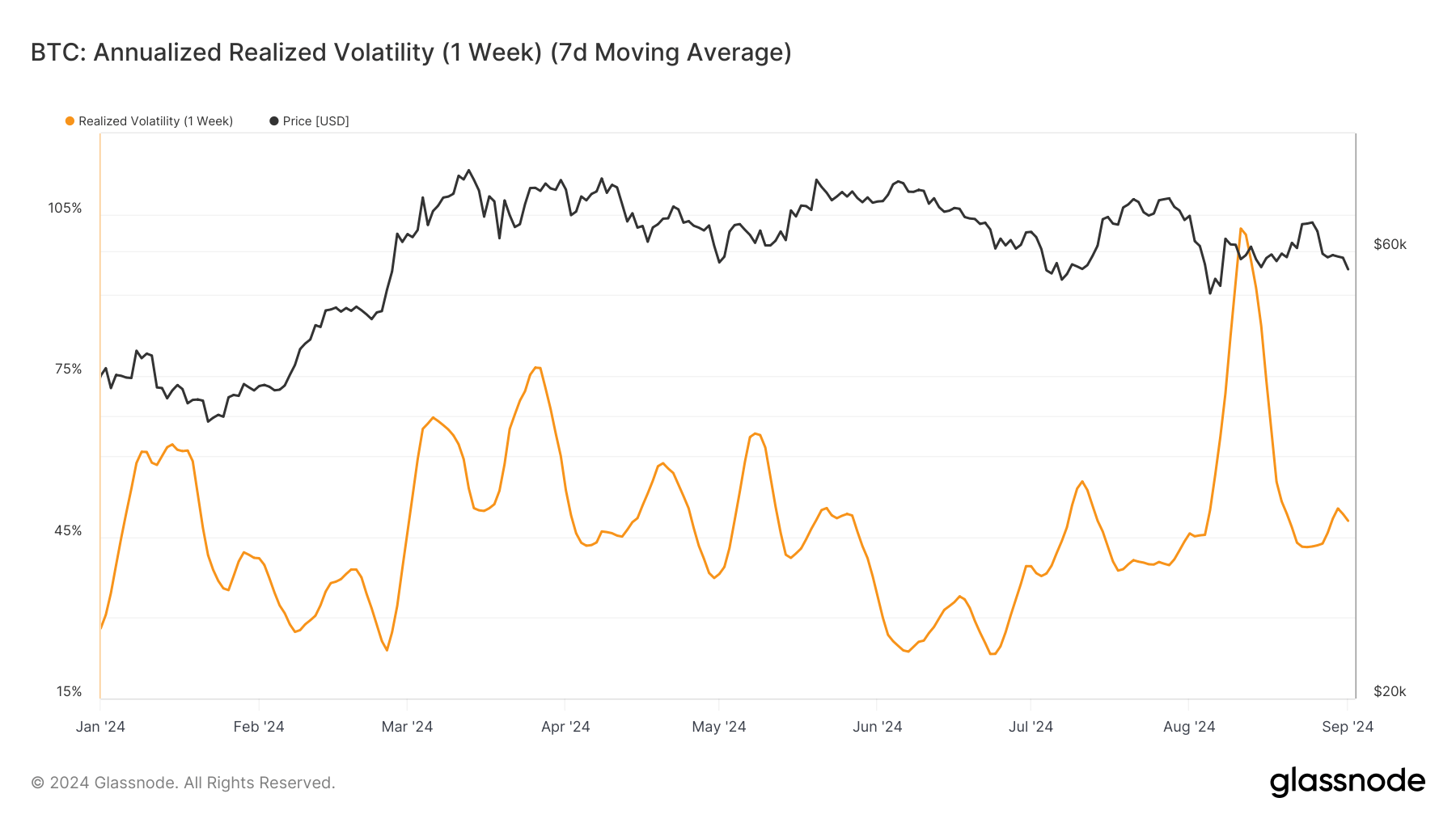

Bitcoin has been experiencing a prolonged period of consolidation since reaching its all-time high of over $70,000 in March. This downward chop phase has drawn comparisons to the price action of around $9,000 in 2019.

Analyst Checkmate has noted that these price swings are becoming “larger and more sustained,” suggesting that the current “price range is becoming increasingly unstable.” This instability indicates that a significant upward or downward move could be imminent.

The intraday price movements show greater deviations from the mean, which could be attributed to traders trying to catch any price breakouts from this prolonged range.

As Bitcoin approaches key levels, such as $60,000, traders tend to increase leverage, anticipating a breakout. However, these breakouts have failed to materialize recently, contributing to a rise in realized volatility.

ByBit has increased its popularity for spot and derivatives trading, with funding rates and open interest fluctuating rapidly in response to price changes. This volatility is partly driven by traders attempting to time the market with long and short positions. Additionally, uncertainty surrounding the upcoming US election adds another layer of unpredictability to Bitcoin’s future performance.

The post Traders’ leveraged bets on Bitcoin’s $60,000 level drive market volatility appeared first on CryptoSlate.