Bitcoin drives Morgan Stanley fund’s strategy with key positions in IBIT and MicroStrategy

Quick Take

According to a recent SEC filing, the Morgan Stanley Institutional Fund, Inc. – Counterpoint Global Portfolio reported total net assets of $10,042,729 as of June 30, 2024. The portfolio holds 216 different investments and has a portfolio turnover rate of 51% for the first half of the year.

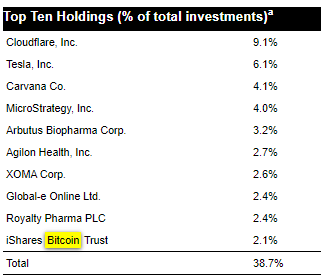

Among the portfolio’s top ten holdings, notable investments include the iShares Bitcoin Trust (BlackRock IBIT ETF), which represents 2.1% of total assets—roughly a $211,000 stake. MicroStrategy, known for its significant Bitcoin holdings, ranks fourth with a 4.0% portfolio weighting, or approximately a $402,000 investment. While not a dedicated digital assets company, Tesla is the second-largest holding, accounting for 6.1% of the portfolio, reflecting its notable Bitcoin exposure as part of its corporate strategy.

These positions highlight the portfolio’s significant exposure to digital assets and related companies, reflecting a broader interest in Bitcoin and its influence on the corporate sector.

The post Bitcoin drives Morgan Stanley fund’s strategy with key positions in IBIT and MicroStrategy appeared first on CryptoSlate.