Bitcoin Price Analysis: Why Long-Term Investors Aren’t Selling Despite Drop

The post Bitcoin Price Analysis: Why Long-Term Investors Aren’t Selling Despite Drop appeared first on Coinpedia Fintech News

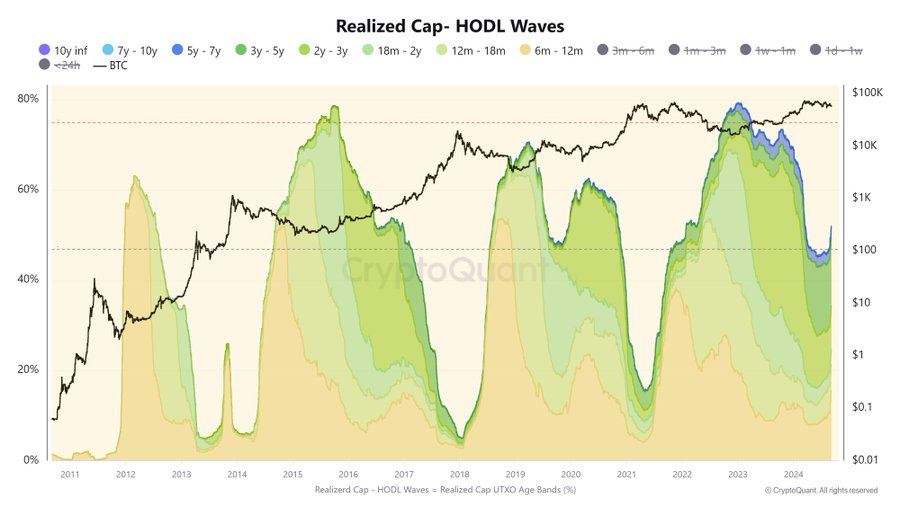

The price of Bitcoin has just touched a monthly low of $56,567.10. In the last 24 hours alone, the price has marked a drop of over 6.2%. If things progress this way, the price is likely to go further downwards. Recently, there were reports that short-term Bitcoin investors were aggressively leaving the market. Have Bitcoin investors lost hope in the market completely? Actually, not many experts think so. A Realised Cap-HODL waves chart of Bitcoin, shared in X by Binhdangg, explains the other side of the story very well. Let’s dive in!

Bitcoin Long-Term Holders’ Market Behavior: What the Chart Conveys

The chart, shared by the cryptocurrency expert in the X platform, reveals that Bitcoin long-term holders are no longer interested in selling their assets. What’s its implication? Long-term holders right now consider holding more beneficial than selling. Then, is Bitcoin presently in a holding phase? Maybe, it is! The chart definitely supports such an assumption for sure. It seems that long term traders have extreme confidence in Bitcoin and are expecting to see a bull run in the market soon. It is clear that experienced Bitcoin traders now hold a view about the market exactly opposite from what the general perception of the market is.

Bitcoin Current Pattern Analysis: What Expert Says

The expert is of the opinion that the pattern that we see now in Bitcoin reflects what was observed between mid-2019 and mid-2020. If the current scenario can be interpreted as a period of stability, then a price momentum is about to happen in the Bitcoin market. At least, that is what our past experience suggests.

What’s Next in the Bitcoin Market

The expert forecasts that the Bitcoin market will see major price momentum in the fourth quarter of this year, as well as in the first quarter of next year. He highlights the unpredictability of the market, pointing out the fact that real market action occurs when least expected.

In conclusion, long-term traders are the ones who are going to benefit hugely from the Bitcoin market if the situation evolves as suggested by the expert.

Also Read: Bitcoin Selloff: Why Major Institutions Are Selling Bitcoin?