Solana Records Highest DAA in History—Is This A Bullish Sign for SOL Price Rally?

The post Solana Records Highest DAA in History—Is This A Bullish Sign for SOL Price Rally? appeared first on Coinpedia Fintech News

Solana chain has been breaking records every new day! The inception of the new tokens over the platform has attracted the immense attention of traders. As a result, the trading activity over the chain has surged and reached the highest level in blockchain history. However, the price of its native token, SOL, remains stuck within a narrow range as the market dynamics suggest the presence of bearish dominance.

Daily active address, or DAA, is the number of active addresses that interact with the platform to perform a trade, regardless of whether it is a buy, sell, or swap trade. The rise in these levels suggests an increase in trading activity, which is expected to impact the value of the token. In a recent update, the DAA on the Solana chain has peaked at 5.4 million addresses, the highest ever in history.

Besides, the platform has also recorded the highest daily transactions of over 40.3 million, surpassing giants like Ethereum, BNB Chain, Cardano, etc. This suggests the rising interest of the market participants in the Solana chain, while the SOL-based tokens and SOL price remain consolidated within a range.

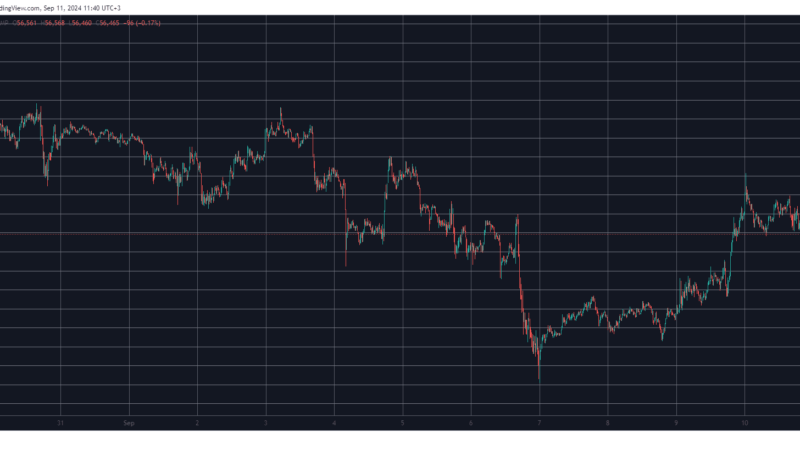

The weekly chart suggests the SOL price continues to remain within the bullish range but under the bearish influence. The MACD displays a rise in the selling pressure while the price trades above the pivotal support zone since the previous week. Although the volume remains restricted within a range, the bulls are believed to dominate the rally to a large extent. The price has never closed the weekly trade below the range, ever since it surpassed the support zone.

Therefore, the Solana (SOL) price is believed to accumulate above the range for a while followed by a breakout, aiming to reach $150 initially.