BONK Outperforms Bitcoin, Ethereum, and Solana, What’s Happening?

The post BONK Outperforms Bitcoin, Ethereum, and Solana, What’s Happening? appeared first on Coinpedia Fintech News

On October 1, 2024, the popular Solana-based meme coin Bonk (BONK) made a headline as it topped the cryptocurrency market with its impressive performance. In the ongoing struggling cryptocurrency market, BONK has outperformed major cryptocurrencies like Bitcoin (BTC), Solana (SOL), Ethereum (ETH), and many others with a significant price surge of over 9.5% in the past 24 hours.

At press time, it is trading near $0.0000253 and has experienced significant participation from traders and investors, resulting in a spike of 115% in trading volume during the same period.

BONK Technical Analysis and Upcoming Levels

According to expert technical analysis, BONK appears bullish and is poised for a significant upside rally in the coming days. Recently, it experienced a breakout from a strong resistance level of $0.000022 and consolidated for two days. With an impressive price surge today, it broke the consolidation zone, indicating a bullish signal.

Based on the historical price momentum, if BONK closes its daily candle above the $0.000025 level, there is a strong possibility it could soar by 30% to reach the $0.000035 level in the coming days.

Currently, BONK is trading above the 200 Exponential Moving Average (EMA) on a daily time frame, indicating an uptrend. The 200 EMA is a technical indicator that determines whether an asset is in an uptrend or downtrend.

BONK’s On-Chain Metrics

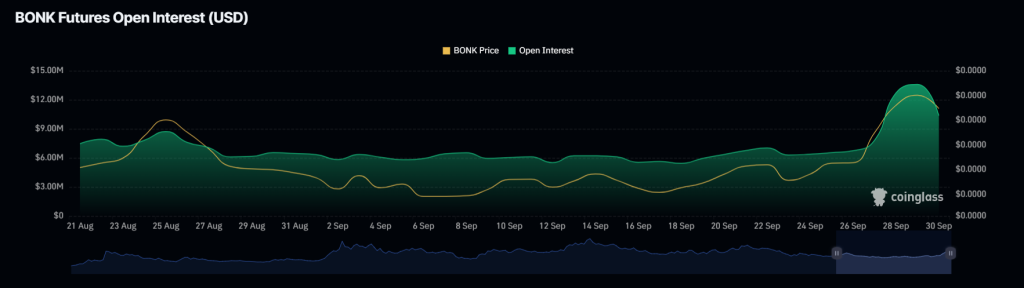

Despite a bullish outlook and impressive price surge over the past 24 hours, BONK’s on-chain metrics signal fragile market sentiment. According to the on-chain analytics firm Coinglass, BONK’s Long/Short ratio currently stands at 0.99, indicating a weak sentiment among traders. However, a value above 1 indicates bullish market sentiment.

Additionally, its future open interest has declined by 3.8% in the past 24 hours, indicating that traders have liquidated their positions, potentially due to the current market sentiment as major cryptocurrencies are experiencing significant price declines.