XRP Crashes 14% As Whales Send Deposits To Exchanges

The XRP price has registered a notable drop during the past day as on-chain data shows the whales have been making transactions to exchanges.

XRP Has Witnessed A Sharp Drop Over The Last 24 Hours

The cryptocurrency sector has been observing bearish winds recently, with the drawdown deepening across the market during the past day. Most of the top coins, though, have managed to limit their losses, except for XRP, which has notably underperformed.

The below chart shows how the coin’s recent trajectory has looked like.

Following the 14% drop in the last 24 hours, XRP has come down to the $0.52 level. This plunge has also put the asset more than 21% down compared to the $0.66 top that it had seen a few days back.

As for why the cryptocurrency has performed this poorly during the past day, perhaps on-chain data can provide some hints.

Whales Have Been Active On The Network Recently

According to data from the cryptocurrency transaction tracker service Whale Alert, several large transactions have been spotted on the XRP network in the last 24 hours.

All of these transactions happen to be of a scale that’s generally associated with the whales, who are large entities that can carry a degree of influence in the market.

Naturally, one whale can’t move the market on their own, but some number of them together can, which may be exactly what has happened today. Generally, it can be hard to say for certain what the whales’ intentions are when they make moves, but address details can sometimes carry a hint or two.

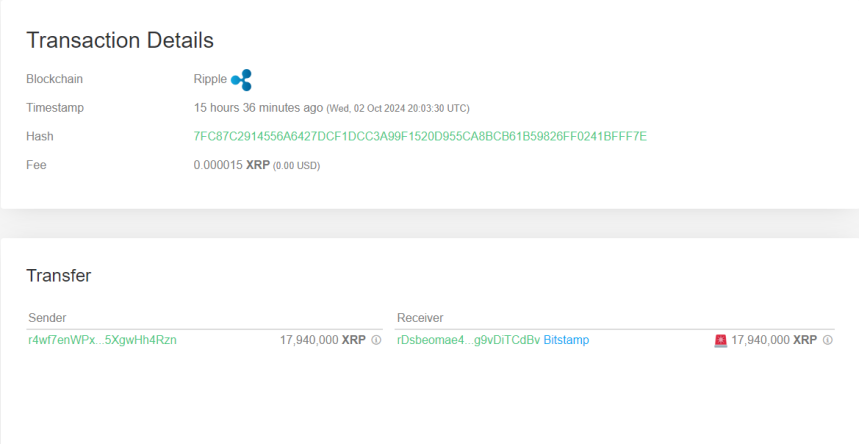

Here are the details of the first of the whale transfers from the past day:

As is visible above, the whale moved 17,940,000 XRP, worth around $10.3 million at the time the transfer was executed, from an unknown wallet to an address connected to the cryptocurrency exchange Bitstamp.

An “unknown wallet” is one that’s not affiliated to any known centralized platform and is likely to be an investor’s personal address. Thus, it would appear that the whale moved coins from their self-custodial wallet to an exchange with this transaction.

Transfers of this type are called exchange inflows. Since one of the main reasons why investors deposit their coins to these platforms is for selling-related purposes, large exchange inflows can lead to a bearish outcome.

The three other XRP whale transactions from the past day were also of the same type, with whales shifting a combined $37.9 million to different platforms. It’s possible that these transfers weren’t for selling at all, but for using a different service that exchanges typically provide. Given the corresponding price trend, though, it’s indeed likely that these moves provided a net selling pressure to the cryptocurrency.