Are You Still Holding XRP? Here’s What You Need to Know!

The post Are You Still Holding XRP? Here’s What You Need to Know! appeared first on Coinpedia Fintech News

In the latest update in the Ripple vs SEC lawsuit, the company is about to file a cross-appeal much before the SEC’s filing an appeal in the last week. The Ripple CLO ensure that with this move, nothing should be left on the table. This move is also intended to focus on essential rights and obligations without contesting the ruling that XRP isn’t a security. As the XRP price remains less impacted by the proceedings, is there any possibility of a strong rebound?

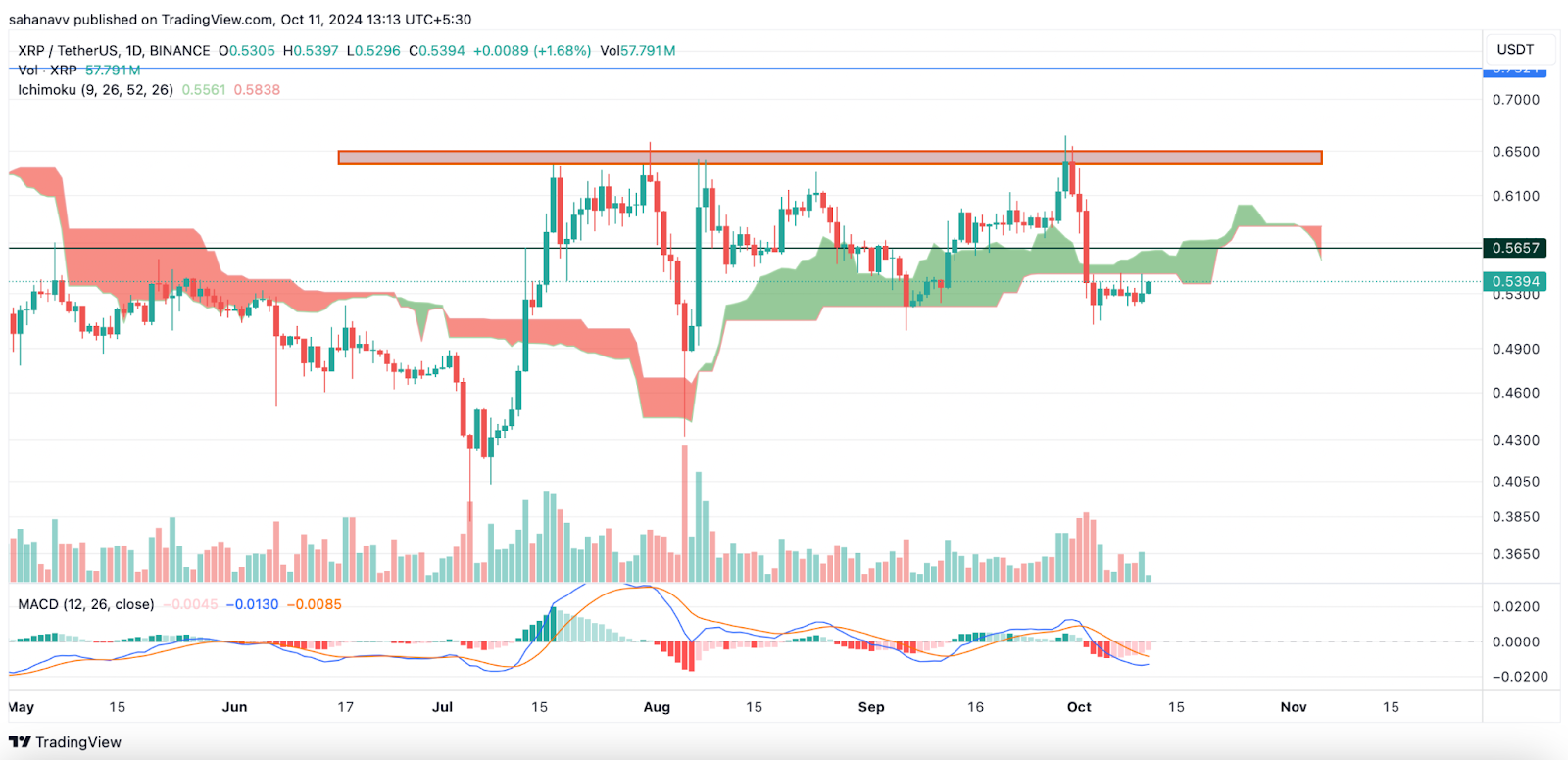

After the giant pullback, the XRP price has remained stuck within a predetermined range between $0.53 and $0.52. The latest upswing has helped the price rise above the consolidation and is about to reach $0.54. However, the technicians are flashing bullish signals, which suggests the XRP price is bound to rise above $0.55 in a short while, but there could be a twist.

The XRP price is restricted below the crucial resistance at the 200-day MA at $0.5427. The MACD shows a drop in the selling pressure from the past few days, which may further pave the way for a bullish crossover. Besides, the RSI has triggered a healthy rebound from the consolidation, suggesting the rally is gaining some strength. However, the Ichimoku cloud remains within the bearish range, with the average bands of Bollinger displaying a bearish divergence.

Hence, the technicals remain uncertain at the moment, with both the possibility of a bullish breakout and a bearish rebound. The dropped volume also has added fuel to the fire and hence the next few days could be pivotal as the rise above 200-day MA may result in a fine upswing.

Ripple’s XRP has seen renewed interest following the conclusion of its legal battle with the SEC. Despite a recent 7.6% weekly drop, many investors viewed it as a buying opportunity, with XRP expected to rebound in the coming days. Analysts suggest it could break past key resistance levels if market conditions remain favourable.