TRUMP Token Takedown—Did Insiders Plan The Crash?

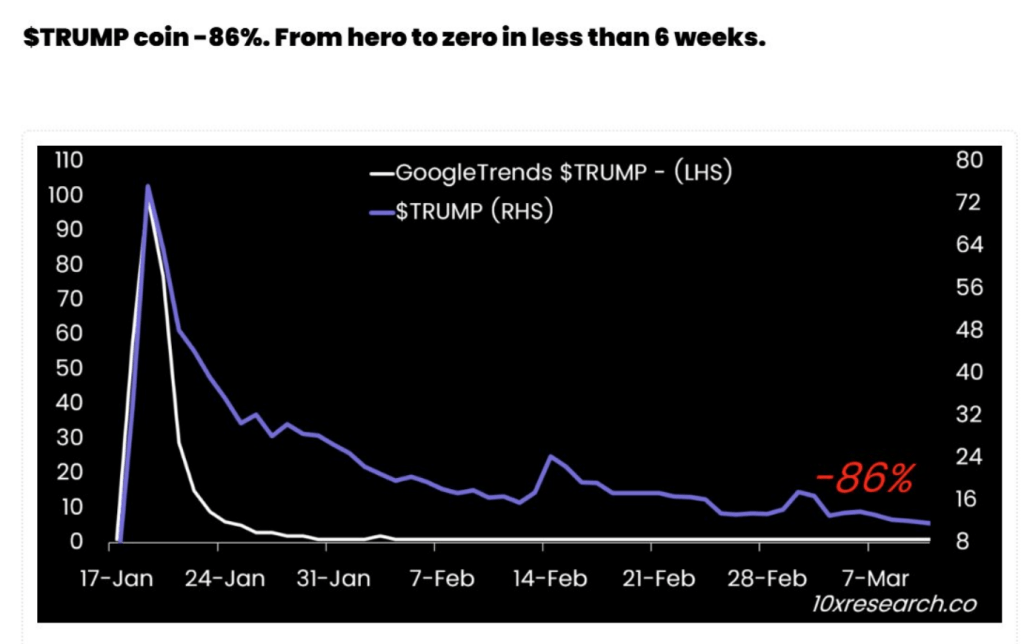

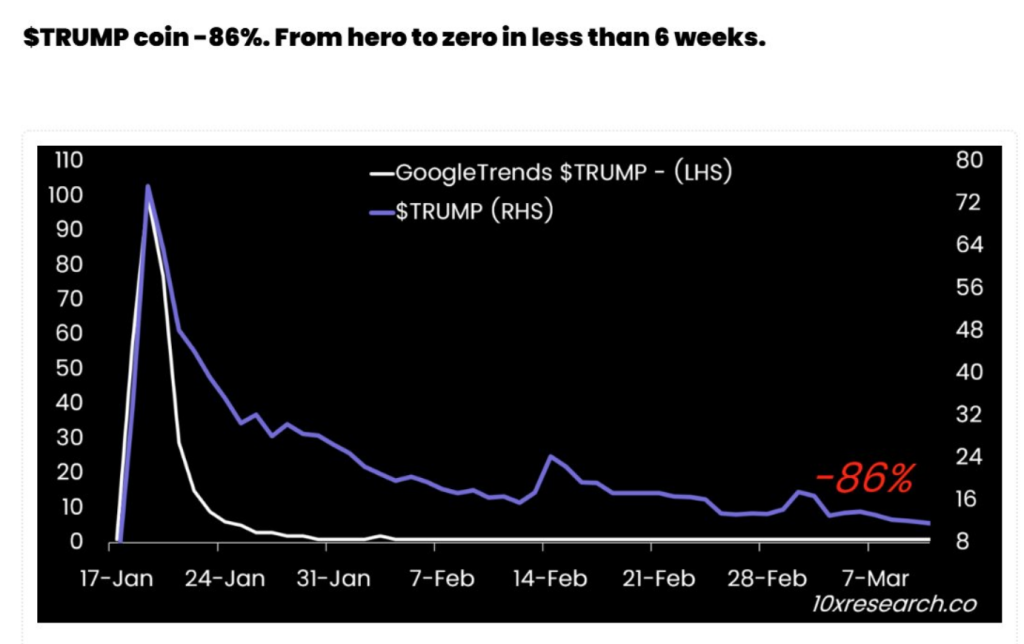

The official TRUMP token, designed to commemorate US President Donald Trump’s second presidency, was an instant hit upon launch. The token surged from less than $10 on January 18th to a high of $74.59 on January 20th before quickly surrendering some gains within hours.

Although the token remained competitive days after the president’s inauguration, by trading above $30, it quickly faded under pressure. TRUMP dipped below $20 on February 2nd, and it’s now trading at $10.

Observers say that the broader crypto market and TRUMP’s token are crashing. However, TRUMP’s crash is not without controversy—10x Research has disclosed that there was “insider play” before the coin’s massive drop. While most traders lost billions of dollars during its crash, a sizeable number of early investors cashed in for huge profits.

Early Investors Cash Out Before Listing In Major Exchanges

According to 10x Research, most early investors cashed in just before major exchanges listed the coin, as its value moved past $60 and briefly hit $70. The coin’s rapid surge in price was welcomed by everyone, with the early investors getting the best seats in the house. After its quick rise, TRUMP suffered a massive drop. From the low $20s, it’s now trading at $10, leaving retail and small traders with losses.

The $TRUMP Dump: When the Hype Fades, Reality Hits

1-4) A clear example is the $TRUMP coin, where insiders and those with early access at the Washington crypto ball could buy in before the public, while exchanges rushed to list the token as it soared past $60. After briefly… pic.twitter.com/PVzLcVbL0m

— 10x Research (@10x_Research) March 11, 2025

Losses related to the TRUMP price drop are reminiscent of previous bearish cycles, including the 2021 NFTs boom and bust. With the TRUMP token, the value significantly dropped within the week. By looking at the bigger picture, TRUMP token shed more than 80% since its peak last January. And on-chain data suggests that early investors quickly liquidated their positions, with retail and small traders used as pawns.

Solana Chain Takes A Hit

The Solana ecosystem is one of the biggest losers in the token’s crash. Aside from TRUMP, a few other Solana-based tokens faced selling pressure, including Raydium’s RAY token, which dropped by 60% in the last month.

Even Solana’s native token, SOL, dropped by over 40% over the same period. The drop in value for SOL-based tokens suggests that the interest in meme coins or speculative tokens is waning.

Pump.fun Also Sees Dramatic Shift

Pump.fun, another leading meme coin platform, has also witnessed a dramatic drop in network activity. Over the past year, this platform processed 8.4 million meme coin launches, peaking days ahead of Trump’s inauguration.

From Christmas season to early January, up to 1.7 million meme tokens were launched on Pump.fun. However, the daily launches on Pump.fun have dropped. Also, participation rates have fallen on this platform, reflecting declining interest on this asset class.

Feature image from Newsweek, chart from TradingView