$390M Liquidated Amid Iran-Israel-US Tensions: Will Bitcoin, XRP Survive a 24-Hour Crash Threat?

The post $390M Liquidated Amid Iran-Israel-US Tensions: Will Bitcoin, XRP Survive a 24-Hour Crash Threat? appeared first on Coinpedia Fintech News

The cryptocurrency market is on edge again as global tensions keep rising. US President Donald Trump has announced a last-ditch effort to prevent an all-out war between Israel and Iran, which could impact global markets, including crypto.

According to reports, Trump is pushing for an emergency meeting with Iranian officials this week. He believes the decision to use powerful “bunker buster” bombs on Iran’s nuclear sites would be a turning point. Trump also cut his trip to the G7 Summit short to head back to Washington and focus on the crisis. In a bold statement, he even called for “everyone” to evacuate Tehran, Iran’s capital, though it’s unclear whether he meant US citizens or the city’s 14 million residents.

The crypto market, which saw a brief rally a few hours ago, has already started reacting. XRP led the jump with a 7% gain, while Bitcoin soared to $108,950 before pulling back. Bitcoin is now hovering slightly above the $107,000 mark.

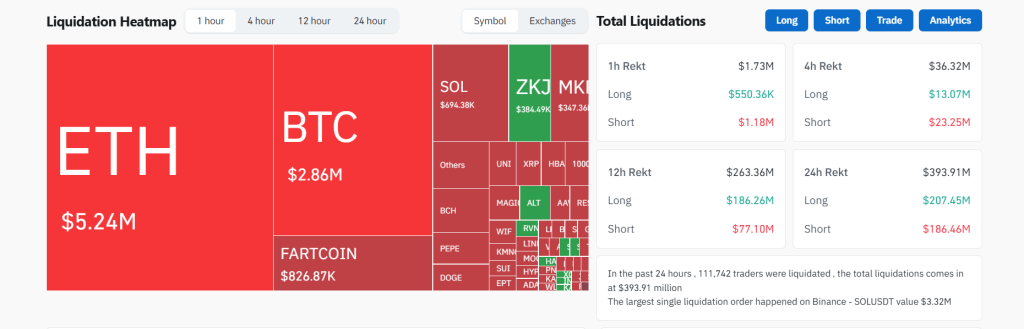

With the latest developments, it’s uncertain which way the market will move next. Experts are closely watching the news, as any escalation could trigger another major sell-off. Adding to the pressure, liquidations have begun across the market. In the past 24 hours alone, total liquidations reached a staggering $394.16 million, wiping out leveraged positions.

Last week, on Friday morning, crypto prices tumbled after Israel launched airstrikes against Iran, sending Bitcoin down to $103,000. For now, the crypto world waits to see if peace talks will ease tensions — or if another crash is coming in the next 24 hours.

The Kobeissi Letter wrote on X (formerly Twitter), “We continue to believe that a peace deal is on the horizon for this conflict. Markets are clearly pricing-in a short-lived conflict ahead. We are hopeful that an agreement can be reached as soon as this week.”