BNB Hits New High, Meme Stocks Soar, ETH ETFs See Inflows: Binance Report

This past week, a fresh wave of retail euphoria swept through U.S. equities and crypto markets, with meme stocks roaring back into vogue and altcoins teasing the arrival of a long-awaited altseason.

According to the latest Binance Research report, the risk-on sentiment was powered by strong economic data, AI-driven tech optimism, and institutional crypto flows, especially into Ethereum (ETH) ETFs.

Altcoins Whipsaw

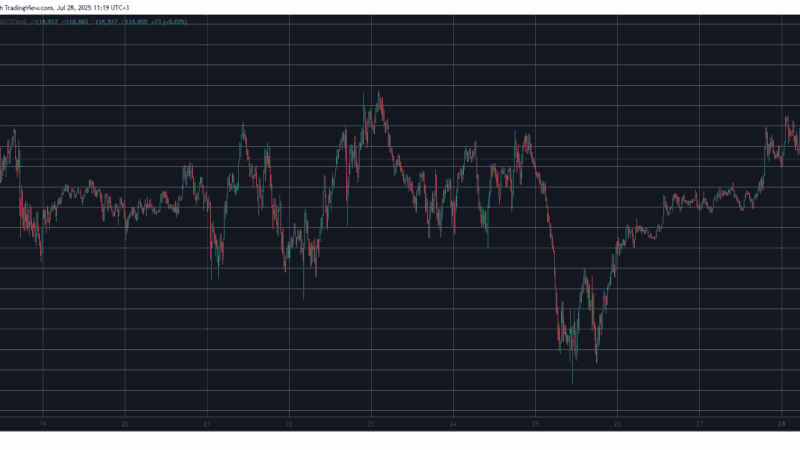

While Bitcoin (BTC) has cooled, hovering between $116,000 and $119,000, Binance Coin (BNB) stole the show, smashing through $800 to register a new all-time high on July 23.

The rally was sparked by news that Nano Labs, a Nasdaq-listed firm, had built a $90 million BNB treasury as part of a wider trend where companies are diversifying beyond BTC and ETH.

Binance Research highlighted BNB’s superior risk-adjusted returns, boasting a five-year Sharpe ratio of 2.5, meaning it has delivered $2.50 in returns for every $1 of risk taken. This performance has outpaced both traditional indices and other major cryptocurrencies, reinforcing BNB’s appeal to sophisticated investors.

Meanwhile, between July 21 and July 24, U.S. Ethereum ETFs saw nearly $1.4 billion in net inflows, eclipsing BTC’s nearly $59 million outflows in the same period. The latest weekly surge brings ETH exchange-traded funds’ inflows for July to $4.67 billion. Analysts now point to these flows as a sign that institutional investors are increasingly warming to altcoins, particularly the world’s second-largest crypto asset by market cap.

Despite the bullish momentum, the crypto market remains volatile. Just a day before the Binance Research report landed, altcoins suffered a sharp correction, wiping over $100 billion from the total market cap. Coins like XRP and Dogecoin (DOGE) plummeted by double digits, with some, like Aptos (APT), dropping as much as 16%.

This pullback has reignited debates over whether the altseason has truly begun or if we are merely in the middle of a speculative bubble.

Although buoyed by strong ETF inflows, Ethereum has seen its ETH/BTC ratio decline by 7.4% from its recent peak. At the same time, Bitcoin’s dominance, which had dipped below 60%, has rebounded slightly as the rest of the market retraced. Analysts are closely watching whether the flagship cryptocurrency can break past the $120,000 resistance level, a move some say could dictate the next phase of the market cycle.

Meme Stocks Soar

On the Wall Street front, Binance Research noted the surprise return of retail mania this week, with investors piling into meme stocks once again. Kohl’s, for example, skyrocketed nearly 90%, while GoPro jumped 49% in intraday activity.

This resurgence mirrors the 2021 GameStop frenzy, possibly pointing to a revival of speculative trading fueled by social media hype and FOMO.

Elsewhere, the S&P 500 hit a record 6,358.91 on July 23, driven by AI-led earnings beats and easing trade tensions after the U.S.–Japan tariff deal.

Looking ahead, Binance says key macroeconomic events, including Federal Reserve and Bank of Japan meetings, U.S. GDP data, and the looming August 1 tariff deadline, could sway market sentiment. Additionally, the report noted that regulatory developments, such as potential Solana ETF approvals, may further shape crypto’s trajectory in the coming weeks.

The post BNB Hits New High, Meme Stocks Soar, ETH ETFs See Inflows: Binance Report appeared first on CryptoPotato.