Spot ETH ETFs Records $455M Inflows, Ethereum Price Up 2% Today

The post Spot ETH ETFs Records $455M Inflows, Ethereum Price Up 2% Today appeared first on Coinpedia Fintech News

The United States spot Ethereum (ETH) exchange-traded funds (ETFs) recorded the highest cash net inflows of about $455 million since August 15, 2025. BlackRock’s ETHA led in net cash inflows on Tuesday of about $323 million, thus currently holding about $16.9 billion in net assets.

Fidelity’s FETH and Grayscale’s ETH registered a net cash inflow of about $85 million and $41 million respectively. As a result, the U.S. spot Ethereum ETFs have now recorded a cumulative total net inflow of about $13.33 billion and hold net assets of around $29.89 billion.

Spot Ethereum ETFs Outshine Bitcoins

The demand for spot Ether ETFs has outpaced that of spot Bitcoin ETFs in the recent past. On Tuesday, the U.S. spot BTC ETFs recorded a net cash inflow of about $88 million, down from $219 million registered on Monday.

BlackRock’s IBIT registered a net cash inflow of about $45 million on Tuesday while Fidelity’s FBTC recorded a net cash inflow of about $14.5 million. As Coinpedia previously pointed out, the rising cash rotation from Bitcoin to Ethereum has bolstered the 2025 altseason narrative.

Ether Price Gains on Rising Demand from Institutional Investors

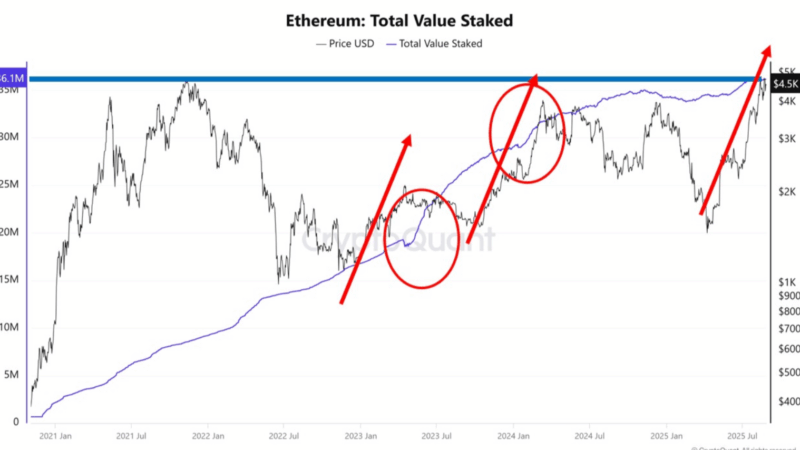

According to Coinpedia’s crypto oracles, the ETH price surged 2 percent during the past 24 hours to trade at about $4,640 on Wednesday during the mid New York session. The large-cap altcoin, with a fully diluted valuation of about $559 billion, is well-positioned to rally to a new all-time high soon.

According to popular Wall Street Ether investor, Tom Lee, the Ethereum price is well-poised to hit $5.5k fueled by renewed demand from institutional investors. From a technical analysis standpoint, the ETH price recently retested the breakout from a multi-year megaphone structure, thus signaling bullish continuation ahead.