Plasma (XPL) Price Soars 17%, Can Bulls Sustain Above $1?

The post Plasma (XPL) Price Soars 17%, Can Bulls Sustain Above $1? appeared first on Coinpedia Fintech News

Plasma’s native token XPL has stunned the crypto market with a strong 17% rally in the last 24 hours, to $1.09. This is despite it still being down 9% for the week. The market cap is at $1.86 billion, and 24-hour trading volume has shot up nearly 80% to $4.45 billion. As I’ve watched its recent climb from a $0.868 low to a daily high of $1.07, it’s clear that both retail and institutional traders are rushing to catch this rebound. But is this the start of a sustainable uptrend, or just a flash in the pan?

What’s Fueling Plasma?

Driving the surge are aggressive campaigns by major exchanges like Binance and Bitget. Plus, new staking pools offering sky-high APRs up to 200%, in addition to 9 million XPL in staking rewards, have supercharged spot volumes by 425% to $5.17B. Moreover, Binance’s HODLer airdrop, which distributed 75M XPL to users, further squeezed supply and intensified buying pressure. However, despite today’s excitement, derivatives open interest dipped slightly, suggesting some traders might soon lock in profits.

On the fundamentals, Plasma’s real-world momentum comes from zero-fee USDT transfers. This triggered a 5,200% jump in monthly transactions and boosted stablecoin TVL to $5.28B. But there’s a catch, TVL dropped $600M as yield chasers began to exit. Future stability will depend on whether Plasma can keep daily active addresses (now 878K) and TVL above $5B after the latest incentive wave.

XPL Price Analysis:

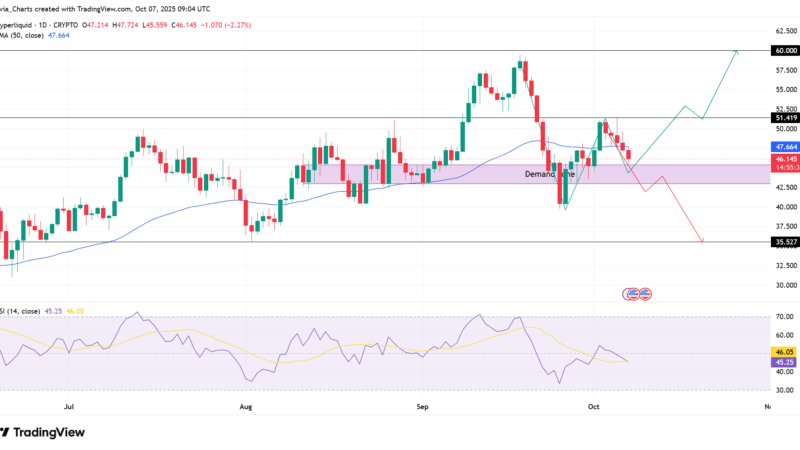

First, let’s start breaking down the technicals. The RSI climbed from an oversold 30 to a neutral 47.33, confirming that buyers are regaining control after a rough week. On the 4-hour chart, XPL displayed a reversal setup. This was validated by surging spot buys at the $0.83–$0.87 support zone. This is where $5.9 million in fresh bids entered the market.

These technical cues point to a potential breakout toward $1.20. However, it’s important to notice that funding rates are still mild.

FAQs

Today’s price spike comes from bullish technical rebounds and heavy exchange incentives, such as staking rewards and airdrops that tightened XPL’s supply.

Profit-taking after promotional campaigns and a sharp drop in network TVL could trigger a correction if demand fades.

If current momentum persists, XPL may target resistance at $1.20. Sustaining TVL above $5B and strong user activity are key to holding gains.