Best Crypto Prop Firms in 2025: A Complete Guide for Traders

The demand for crypto prop firms has exploded in recent years. As cryptocurrencies continue to reshape financial markets, traders around the world are seeking ways to participate without risking significant amounts of personal capital. Prop firms (short for “proprietary trading firms”) provide a solution by giving traders access to funded accounts in exchange for passing evaluation challenges and following specific trading rules.

But with dozens of firms launching globally, how do you know which one is right for you? In this article, we’ll examine the best crypto prop firms in 2025, highlighting their profit splits, rules, reputation, and unique features.

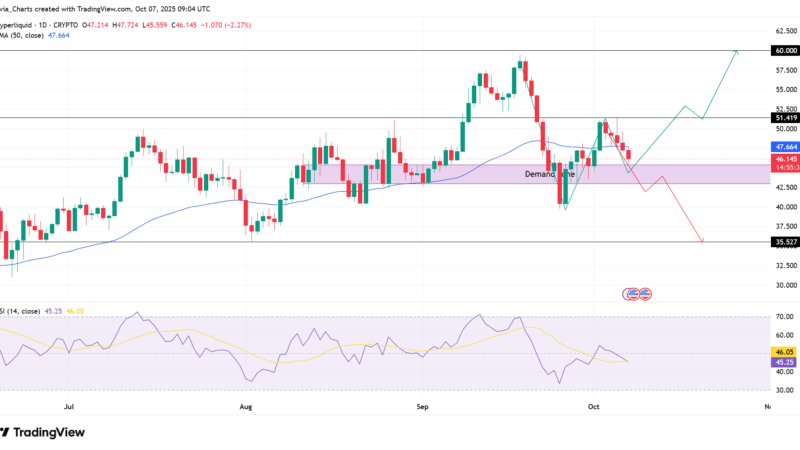

1. HyroTrader

HyroTrader has rapidly positioned itself as a leading name in the crypto prop trading space, offering traders access to capital with a structure that balances flexibility and transparency. Founded in Prague and now expanding globally, HyroTrader differentiates itself by providing real exchange execution through partnerships with platforms like ByBit. This means traders experience genuine market conditions rather than internal simulations, which adds credibility and trust to its funding model.

The firm offers profit splits ranging from 70% to 90%, with leverage up to 1:100, and supports fast payouts that appeal to active traders worldwide. HyroTrader’s focus on sustainable, consistent trading makes it an attractive choice for disciplined participants.

Key features of HyroTrader

- Profit split from 70% to 90% based on performance

- Leverage up to 1:100 on supported crypto instruments

- Real execution via direct exchange connection (e.g., ByBit)

- Fast payouts, with some traders reporting same-day withdrawals

- Global reach with offices in Prague and Dubai

2. FTMO

FTMO is one of the most respected names in the proprietary trading industry, originally established as a forex prop firm before expanding into crypto. Known for its rigorous standards and global reputation, FTMO offers traders the opportunity to work with leverage up to 1:100 and earn profit splits of up to 90%. The firm’s two-phase evaluation process is strict, requiring participants to demonstrate both profitability and disciplined risk management before accessing funded accounts. While this higher barrier to entry can be challenging for newer traders, those who succeed gain access to one of the most transparent and well-regarded funding models in the industry. With a large and active community, FTMO continues to attract serious traders worldwide, though its evaluation fees remain higher than some newer competitors.

Key features of FTMO

- Profit split of up to 90%

- Leverage up to 1:100 (crypto pairs have limitations)

- Two-phase evaluation process with strict rules

- Excellent global reputation and strong community support

- Higher evaluation fees compared to rivals

3. FundedNext

FundedNext has built a strong presence in the prop trading space by combining multiple funding models with an inclusive global reach. While it started as a forex-oriented firm, it has expanded to support crypto traders, offering profit splits of 80% to 90% with leverage up to 1:100. Traders can choose between a traditional two-phase evaluation process or an instant funding option, giving flexibility depending on their preference and skill level. This flexibility makes it attractive to both experienced and aspiring traders. FundedNext’s main strengths are its variety of programs and accessibility, though it may not scale accounts as quickly as some competitors. Overall, it provides a balanced option for traders looking to grow within a well-structured funding environment.

Key features of FundedNext

- Profit split between 80%–90%

- Leverage up to 1:100

- Choice of two-phase evaluation or instant funding

- Global accessibility for traders worldwide

- Slower scaling compared to some rivals

4. BrightFunded

BrightFunded is a newer entrant to the crypto prop trading sector, positioning itself as a firm focused on digital asset traders. With profit splits ranging from 75% to 85% and leverage of up to 1:100, BrightFunded provides competitive terms for those seeking to grow their crypto trading careers. Its evaluation process is simpler than some older firms, often requiring only a single phase challenge to qualify for a funded account. This streamlined structure appeals to traders who prefer fewer hurdles to access capital. While the firm has less of a long term track record compared to industry leaders, it has quickly gained traction thanks to its crypto specific focus and faster scaling opportunities.

Key features of BrightFunded

- Profit split between 75%–85%

- Leverage up to 1:100

- Single-phase evaluation model

- Crypto-focused funding programs

- Limited historical track record compared to larger firms

5. Apex Trader Funding

Apex Trader Funding has long been recognized in the futures trading community, and it has expanded its offerings to include crypto related instruments. The firm is known for its trader friendly environment, including high potential profit splits that can exceed 90%. Apex offers flexible account structures and less restrictive evaluation rules compared to some traditional prop firms, which makes it appealing to traders who want more freedom in their strategies. With its strong reputation and large community, Apex provides credibility alongside opportunity. However, the variety of account types can be complex for newcomers, and its crypto options are still evolving.

Key features of Apex Trader Funding

- Profit split exceeding 90% in some programs

- Flexible leverage on crypto-linked assets

- Evaluation rules are less strict than those of many rivals

- Strong reputation in futures and prop trading

- Complex account structures may be challenging for beginners

6. E8 Funding

E8 Funding is another growing name in the prop firm industry that has extended its services to crypto traders. With a profit split of up to 80% and leverage up to 1:100, it offers terms that remain competitive within the sector. The firm uses a two-phase evaluation model, designed to ensure traders can handle both profit targets and risk controls. E8 Funding is noted for its transparency, providing clear rules and support for its traders. Its crypto offering, however, is still more limited compared to forex pairs, which may be a drawback for those looking to trade a wide range of digital assets.

Key features of E8 Funding

- Profit split of up to 80%

- Leverage up to 1:100

- Two-phase evaluation challenge

- Transparent rules and trader support

- Limited number of crypto trading pairs

7. The Trading Pit

The Trading Pit has earned attention for its focus on transparency and regulated partnerships, making it an appealing option for traders who prioritize credibility. The firm offers profit splits ranging from 70% to 80% and leverage up to 1:100, with a multi-step evaluation process that tests a trader’s ability to handle multiple stages of growth. While its crypto offering is still relatively limited, The Trading Pit’s strong infrastructure and commitment to trader education make it a serious contender in the space. Its main appeal lies in trust and stability, though crypto-focused traders may find its selection narrower than some rivals.

Key features of The Trading Pit

- Profit split between 70%–80%

- Leverage up to 1:100

- Multi-step evaluation process

- Transparent operations and regulated partnerships

- Smaller crypto offering compared to others

8. MyFundedFX

MyFundedFX has become popular among traders looking for affordable entry points into the prop trading industry. With profit splits of up to 85% and leverage up to 1:100, the firm provides competitive conditions for both forex and crypto trading. MyFundedFX offers both one-step and two-step evaluation options, giving flexibility depending on the trader’s style and preference. Its lower evaluation fees and broad accessibility make it especially appealing for beginners or those testing the waters in prop trading. While it lacks the history of some larger firms, its affordability and inclusion of crypto options make it a solid choice for aspiring traders worldwide.

Key features of MyFundedFX

- Profit split of up to 85%

- Leverage up to 1:100

- Choice of one-step or two-step evaluation

- Affordable entry fees for traders

- Less established compared to industry leaders

9. Fondeo

Fondeo is a smaller but growing crypto prop firm that has gained traction due to its easy entry and crypto-focused model. Offering profit splits between 75% and 90% and leverage up to 1:100, Fondeo provides conditions that are competitive with larger firms. It uses a simplified one step evaluation process, allowing traders to qualify for funded accounts more quickly. While its community is still relatively small compared to bigger names, its focus on crypto traders gives it a niche advantage. Fondeo is best suited for those who want direct exposure to digital assets in a prop trading environment.

Key features of Fondeo

- Profit split between 75%–90%

- Leverage up to 1:100

- One-step evaluation challenge

- Crypto-focused funding model

- Smaller trader community compared to larger firms

10. The Funded Trader

The Funded Trader has gained popularity for its gamified approach to prop trading, appealing to younger and more engaged communities. While it is primarily forex-focused, it has introduced crypto trading options to meet growing demand. Traders can access profit splits ranging from 80% to 90% with leverage up to 1:100, alongside evaluation challenges that vary depending on account type. The platform’s strengths include its active community and engaging programs, but crypto traders may find its offering narrower compared to dedicated digital asset firms. Still, it provides a creative and reputable alternative for those interested in both forex and crypto.

Key features of The Funded Trader

- Profit split between 80%–90%

- Leverage up to 1:100

- Flexible evaluation challenges

- Gamified platform with strong community appeal

- Limited depth in crypto offerings

What Is a Crypto Prop Firm?

A crypto prop firm provides traders with access to capital to trade cryptocurrencies, derivatives, or futures. Instead of risking their own funds, traders operate with the firm’s money. Profits are shared between the trader and the firm, while losses are absorbed by the firm (within set rules).

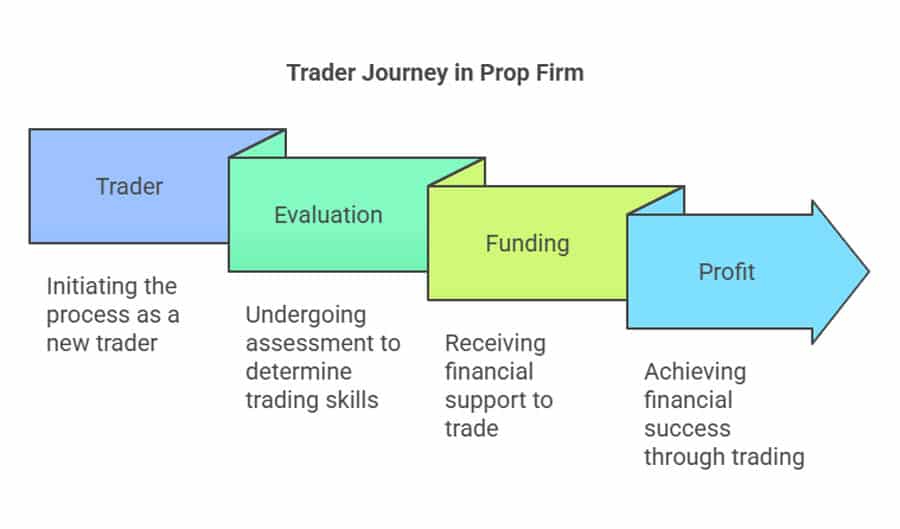

How do Crypto Prop Firms Work?

Crypto prop firms follow a structured process designed to evaluate traders and provide them with access to funded accounts. While each firm has its own specific rules and models, the core journey is generally similar across the industry. Traders start with an evaluation stage to demonstrate their skill, then progress to funded accounts where they share profits with the firm. Over time, consistent performers may even qualify for larger capital allocations. Below is a detailed look at each stage in the process.

Evaluation phase:

The first step is proving yourself through an evaluation challenge. Most firms require traders to hit specific profit targets without exceeding maximum drawdown limits. This stage is designed to test risk management, consistency, and strategy discipline. Challenges can be one step or two steps, depending on the firm. While the process may feel restrictive, it ensures only skilled traders advance. Passing the evaluation demonstrates that you can manage risk effectively, which builds confidence for both you and the firm providing the capital.

Funded account:

Once the evaluation is passed, traders gain access to a funded account either a live trading account with real capital or a simulated environment tied directly to market conditions. The funded stage is where the opportunity becomes real. Traders can now operate with larger positions and pursue meaningful profits without exposing personal savings to significant risk. This arrangement allows traders to focus on performance while the firm provides the financial backing. However, traders must continue following the firm’s rules to maintain their funded status.

Profit sharing:

All crypto prop firms operate on a profit-sharing model, where both the trader and the firm benefit from successful trades. Typically, traders retain between 70% and 90% of the profits, while the firm takes the remainder to sustain operations and cover risk. The exact split often depends on the firm’s policies and the trader’s performance over time. A fair profit-sharing structure aligns the incentives of both parties: the trader is rewarded for skill and discipline, while the firm profits only when the trader succeeds. This shared interest model is the foundation of the prop trading relationship.

Scaling opportunities:

Many prop firms also provide scaling opportunities for consistent and profitable traders. This means account sizes can increase gradually as a trader proves their reliability, allowing them to manage larger capital allocations and earn higher payouts. For example, a trader who consistently meets profit targets without violating risk rules might see their funded account grow from $50,000 to $200,000 or more over time. Scaling programs create a career pathway for traders, turning short term opportunities into long term professional growth. They also reinforce discipline, since only consistent performance unlocks higher capital access.

Pros and Cons of Crypto Prop Firms

Like any trading model, crypto prop firms come with clear advantages and potential drawbacks. For many traders, these firms offer a unique pathway to access capital and participate in high-volume trading without risking personal savings. However, they also impose rules and challenges that may not suit everyone. Understanding both sides of the equation is essential before committing to a firm, as this helps set realistic expectations and reduces the risk of disappointment. Below, we break down the main benefits and limitations of joining a crypto prop firm.

Pros of Crypto Prop Firms

Access to capital:

The biggest advantage of prop firms is access to trading capital. Instead of risking your own savings, you can trade with the firm’s funds once you pass the evaluation. This significantly lowers the barrier to entry for aspiring traders, enabling them to operate with larger account sizes than they could fund independently. For skilled traders, this means an opportunity to turn small strategies into meaningful profits without personal financial exposure.

Profit-sharing model:

Prop firms reward successful traders with generous profit splits, typically between 70% and 90%. This structure allows traders to keep the majority of their earnings while the firm retains a smaller portion to sustain operations. Unlike traditional brokers, the firm’s success is tied directly to the trader’s success, which creates a strong alignment of incentives. For disciplined traders, this model can be more lucrative than self-funded trading, especially when combined with scaling opportunities.

Risk management structure:

Evaluation rules may feel restrictive, but they enforce essential trading discipline. By requiring traders to respect drawdown limits and avoid reckless strategies, prop firms help foster sustainable trading practices. This benefits both parties the firm limits its risk, while traders learn to manage capital with professional-level discipline. For newer traders, these structured rules can act as a training ground to build stronger habits.

Global opportunities:

Many crypto prop firms operate on a global scale, giving traders from nearly any country the chance to participate. This accessibility allows individuals worldwide to compete on equal terms, regardless of their financial background. Some firms even offer multilingual support and region-specific resources, making it easier for international traders to succeed in the funded environment.

Cons of Crypto Prop Firms

Evaluation challenges:

Passing the evaluation phase can be difficult, particularly for newer traders. Strict rules on drawdown, profit targets, and trading style often lead to disqualification, even for traders with solid skills. While these challenges ensure discipline, they can also discourage those who struggle under pressure. In some cases, repeated attempts mean paying multiple evaluation fees, which can add up over time.

Ongoing restrictions:

Even after securing a funded account, traders must follow the firm’s trading rules closely. Restrictions may include limits on maximum position sizes, banned strategies (such as hedging or Martingale), and mandatory stop loss usage. For traders who prefer complete flexibility, these limitations can feel constraining. Breaking a rule, even unintentionally, often results in immediate disqualification from the funded program.

Profit sharing with the firm:

Although traders keep a majority of profits, they must still share a portion with the firm. For some, this feels like giving up hard-earned gains that could have been kept if they traded independently. While the trade-off is access to more capital, traders should weigh whether the reduced percentage is worth it in the long run, especially as they gain experience and consider self-funding.

Firm reliability risks:

Not all prop firms are equally reliable. Since the crypto prop industry is relatively new, some firms lack long-term credibility or financial stability. Traders risk joining firms that shut down unexpectedly or delay payouts. Reputation, transparency, and verified proof of payouts should always be part of the evaluation process when selecting a firm. Without careful due diligence, traders could find themselves tied to a firm that fails to deliver on its promises.

How to Choose the Best Crypto Prop Firm

Selecting the right crypto prop firm can make a significant difference in your trading journey. While many firms advertise high payouts and quick access to capital, it’s important to evaluate them carefully to avoid hidden pitfalls. The best firms offer clear rules, sustainable profit-sharing structures, and fast, reliable payouts. Traders should also consider their personal trading style, whether they prefer high leverage, wider asset variety, or more lenient evaluation rules. Additionally, firm reputation is critical: community feedback, independent reviews, and transparency about payouts all provide valuable signals. By weighing these factors, traders can identify firms that not only offer opportunities but also align with their goals and risk tolerance.

Profit split:

One of the most important considerations when evaluating a prop firm is the profit split structure. This determines how much of your trading profits you actually keep. While most crypto prop firms offer traders between 70% and 90%, the specific percentage often depends on performance, consistency, and account type. A higher profit split means more retained earnings for the trader, but it’s equally important to confirm that the firm actually honors these payouts consistently. Some firms advertise high splits but have hidden conditions, so always check the fine print and verify through trader reviews.

Leverage:

Leverage directly impacts how much buying power a trader has and, therefore, how large their positions can be relative to account size. Many crypto prop firms provide leverage ranging from 1:10 up to 1:100. Higher leverage can amplify profits but also magnifies risk, making strong risk management essential. If you’re a trader who prefers scalping or day trading strategies , higher leverage may be attractive. However, conservative traders may value stability over aggressive exposure. Always ensure the leverage offered aligns with your strategy and risk tolerance.

Evaluation rules:

Before gaining access to funded accounts, most firms require traders to pass an evaluation process. These rules vary by firm but typically involve hitting profit targets without exceeding daily or overall drawdown limits. Stricter evaluation rules are designed to encourage disciplined trading and filter out high-risk behavior, but they can also make it harder for new traders to qualify. Some firms offer single-phase evaluations, while others use two-step challenges or even instant funding options. Understanding these rules helps set realistic expectations and prevents accidental violations that could disqualify you.

Payout speed:

Fast and reliable withdrawals are crucial when choosing a prop firm. While many firms promise quick payouts, actual trader experiences can differ significantly. Some platforms process requests within 24 hours, while others may take several days or longer. Delayed payouts can be frustrating and undermine trust in the firm, especially in crypto, where volatility moves quickly. Always check independent reviews to confirm whether a firm’s payout timeline matches its promises, and prioritize firms that consistently deliver prompt withdrawals.

Reputation:

A prop firm’s reputation should carry significant weight in your decision-making. In the relatively new and fast-growing crypto prop trading sector, transparency is not always guaranteed. Look for firms with positive community feedback, verifiable proof of payouts, and partnerships that add legitimacy. Independent reviews, social media discussions, and trader forums are excellent sources of unfiltered opinions. A well-regarded reputation not only signals reliability but also reduces the risk of encountering sudden closures or disputes over payouts.

Global accessibility:

Finally, traders should ensure that the firm they are considering actually accepts participants from their country or region. Some prop firms operate globally, while others have restrictions based on regulations or operational limitations. For example, U.S. traders may face limitations with certain firms due to compliance requirements. Global accessibility is also about customer support. Look for firms that offer multilingual resources and responsive service for international traders. The wider the reach, the better the chances that the firm can accommodate your needs regardless of where you trade from.

The post Best Crypto Prop Firms in 2025: A Complete Guide for Traders appeared first on CryptoNinjas.