U.S. Government’s $29.6B Crypto Stash Drops $12B as Bitcoin Pulls Back from Peak

Key Takeaways:

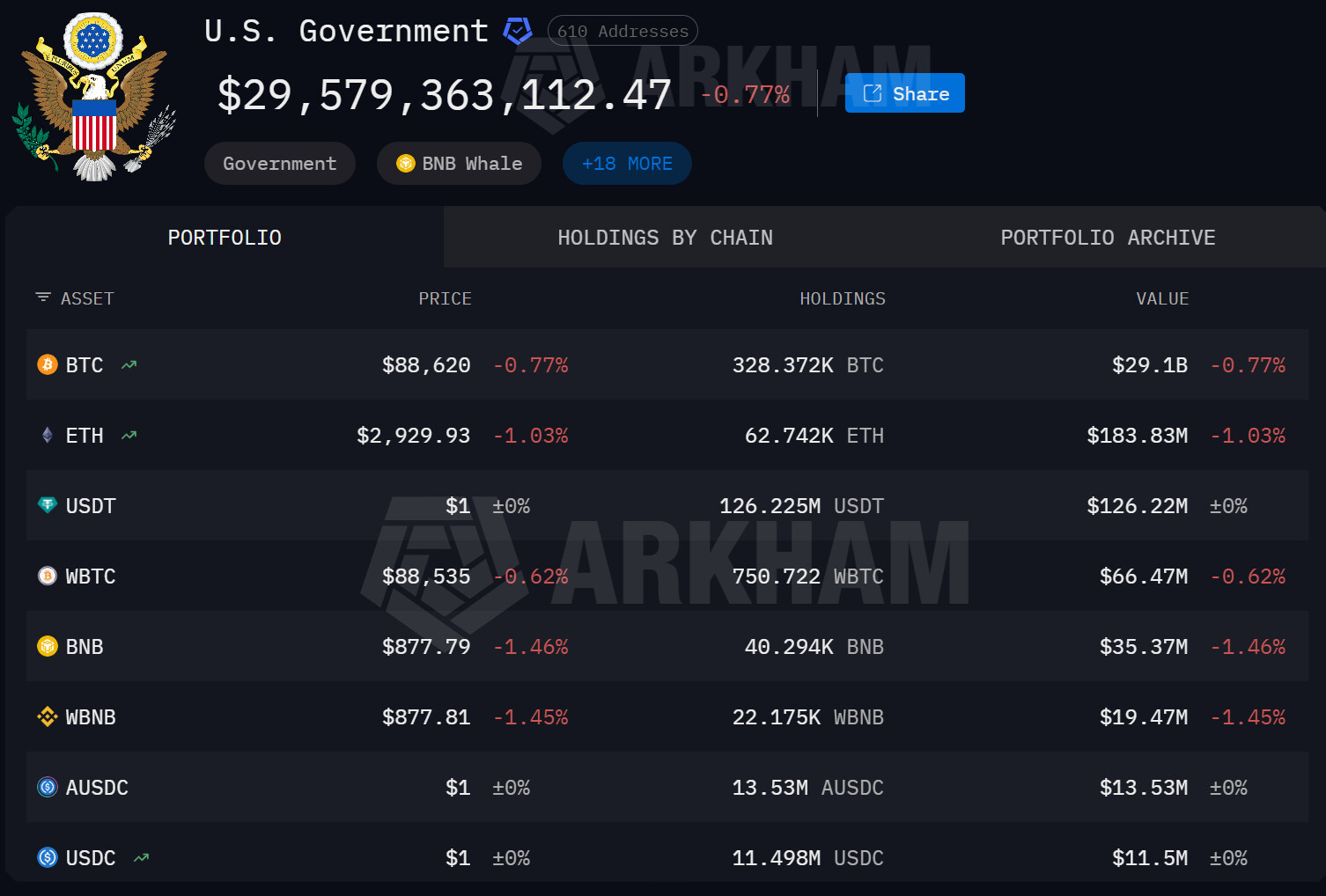

- U.S. government crypto holdings have fallen about $12 billion from Bitcoin’s peak, now near $29.6 billion

- Bitcoin dominates the portfolio, with over 328,000 BTC seized from criminal cases

- Wallet movements are closely tracked because future sales could affect market supply

The U.S. government remains one of the world’s largest known Bitcoin holders, even after a sharp decline in portfolio value. New on-chain data shows how market swings, not active trading, are driving the valuation of its crypto reserves.

Read More: Holding $17.8B, US Government Now One of the Largest Crypto Whales

U.S. Government Crypto Holdings at a Glance

According to blockchain analytics platform Arkham Intel, wallets linked to U.S. government agencies currently hold crypto assets worth roughly $29.6 billion. That figure is down about $12 billion from Bitcoin’s recent peak, reflecting the broader market pullback rather than any major disposals.

These holdings were not built from the accumulation strategy with clear purpose. Instead, they come from years of seizures tied to criminal investigations. The Department of Justice (DOJ), The Department of Justice (IRS), Internal Revenue Service, and other agencies often seize digital assets relating to activities of darknet market, ransomware, frauds and large-size hack attacks.

Captured assets have been transferred to Government-controlled wallets during legal processing. The on-chain public visibility of these wallets shows that they are being closely monitored by analysts and traders.

Breakdown of Seized Assets

The vast majority of the portfolio is Bitcoin. Estimates by the government indicate that it possesses:

- 328,370 BTC

- 62,740 ETH

- 125.7 million USDT

Bitcoin constitutes both of the portfolio value at present and almost all the portfolio volatility. Balances of Ethereum and stablecoins are smaller and this-indicates that cases of individual seizure are seen and a diversification strategy is not developed.

How These Assets Enter Government Wallets

Cryptocurrency comes under the Federal Government as a result of law enforcement. Policy has conventionally been in support of liquidation after forfeiture is approved by courts. Assets are auctioned and converted in U.S. dollars and victim compensation or transferred to Treasury or DOJ funds.

The strategy has established significant supply events in the past, particularly when there is a big Bitcoin auction. An individual sale generates sell side pressures though not in real-time.

Market Attention and Policy Speculation

The drawn down has raised the debate on whether the government should proceed with its liquidation of the seized Bitcoin or to treat it differently. Other observers in the market speculate that the current and subsequent administrations might put a halt to sales, and stock Bitcoin as a reserve to be used in the long term.

As of yet, a policy change has been refuted officially. Nevertheless, even the size of the holdings makes the subject difficult to overlook. Even a move to sell, keep or transfer a part of BTC can affect market sentiments.

Read More: El Salvador Adds $101M in Bitcoin as Government Buys 1,098 BTC During Market Dip

The post U.S. Government’s $29.6B Crypto Stash Drops $12B as Bitcoin Pulls Back from Peak appeared first on CryptoNinjas.