The Real Reason Silver Prices Are Surging in 2026

The post The Real Reason Silver Prices Are Surging in 2026 appeared first on Coinpedia Fintech News

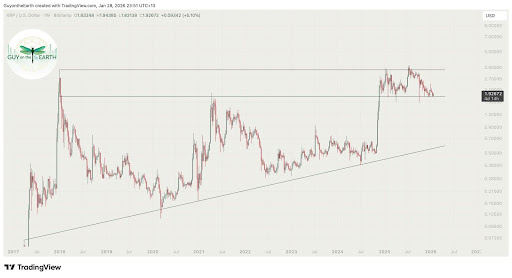

Silver prices have surged dramatically, surprising even long-time market watchers. After years of moving quietly, silver has entered a powerful rally, driven not by speculation alone but by deep structural problems in supply and rising real-world demand. The big question now is whether this move still has room to run — or if a sharp correction is coming.

A Multi-Year Supply Shortage Is Finally Catching Up

The silver market has been running a supply deficit for several years. Global consumption has consistently exceeded mine production, creating a large gap that was quietly filled by inventories. Over time, those buffers thinned.

Once prices began to rise, the market quickly realized that available physical silver was far more limited than paper trading suggested. This shortage laid the foundation for the recent surge.

China’s Export Controls Tighten Global Supply

Experts also say that China plays an important role in refining silver, not just mining it. Recently, Chinese authorities tightened export rules, slowing the flow of refined silver to global markets. As a result, silver prices inside China began trading at a significant premium to international prices.

This matters because when one of the world’s largest suppliers restricts exports, buyers elsewhere are forced to compete harder for a shrinking pool of metal.

Industrial Demand Is Rising Fast

Silver is not just an investment metal. It is essential in solar panels, electronics, data centers, power grids, and electric vehicles. Solar power alone is expected to consume an increasing share of global silver supply over the next decade.

Unlike gold, silver has limited substitutes in high-performance electrical applications. As global electrification and AI infrastructure expand, silver demand continues to rise — even as supply struggles to keep up.

Paper Markets vs. Physical Reality

Most silver trading happens in paper markets, where claims on silver far exceed the amount of metal that actually exists. This system works until buyers demand physical delivery.

When physical demand increased, borrowing costs for silver spiked and futures markets showed signs of stress. These signals suggest that real metal, not paper contracts, is now driving prices.

ETFs and Refinery Issues Added Fuel

Large inflows into silver exchange-traded funds removed millions of ounces from circulation. At the same time, refinery disruptions reduced the ability to process raw silver into usable form. Together, these factors further tightened supply.

Will Silver Keep Rising — Or Crash?

Silver’s recent pullback looks more like a paper-market correction than a collapse in physical demand. Premiums for real silver remain elevated across major regions, indicating continued scarcity.

That said, silver is volatile. Sharp moves higher often come with sudden corrections. Long term, however, as long as supply remains tight and industrial demand keeps growing, silver’s repricing story may not be finished.

The market is no longer asking how high silver can go, but how scarce it really is.