Hyperliquid Treasury Eyes Yield by Using HYPE as Options Collateral

Public companies are not just assessing crypto potential; they are buying in. Since the approval of spot ETFs in 2024 and throughout 2025, multiple firms in the US have been actively purchasing and adding top cryptos to their balance sheets.

Strategy, formerly MicroStrategy, is well known for its Bitcoin holding plans. They now hold over $50Bn of the digital gold. Though they might be under pressure now that their Bitcoin cost basis is higher than spot rates, they are not capitulating and are inspiring other firms.

Unlike Bitcoin, holding HYPE or ETH and staking them translates to consistent yearly or monthly revenue. It is a strategy that Hyperion DeFi, a public firm trading on the Nasdaq (HYPD), is tapping into to boost revenue. At press time, HYPE is one of the top performers, up nearly +3% in the last 24 hours.

DISCOVER: 9+ Best Memecoin to Buy in 2026

Hyperion DeFi has a HYPE Plan To Boost Revenue

Yesterday, Hyperion DeFi announced the launch of a first-of-its-kind institutional “Volatility Income Vault.” Presently, Hyperion holds more than 1.86M HYPE.

The plan is simple: They will leverage their substantial holdings of HYPE, the native token of Hyperliquid, as collateral for on-chain options trading. In doing so, the company is attempting to transform a static treasury into a multi-layered revenue engine.

This represents a major milestone in the evolution of Hyperion DeFi. Since pivoting and rebranding from Eyenovia, a med-tech-focused company, they have been aggressively repositioning themselves as a public firm aiming to build a HYPE treasury. Their plan mirrors that of Strategy, but, as mentioned earlier, the primary objective is to earn a yield by being active participants in the HYPE staking ecosystem.

In pursuit of this goal, rather than just HODLing or staking, Hyperion DeFi, in partnership with the Rysk protocol, is introducing a more sophisticated active treasury management model. This strategy centers on using HYPE liquid staking tokens (LSTs) and stablecoins as collateral within a dedicated vault on the HyperEVM.

Instead of merely earning the base staking yield on Hyperliquid, presently at around +4%, Hyperion will sell options contracts, specifically covered calls and cash-secured puts. Options are contracts that let traders buy or sell an asset at a set price later.

Hyperion will collect premiums from other market participants who speculate on HYPE USD prices. By stacking these premiums on top of existing staking rewards, Hyperion aims to increase its revenue and boost monthly cash flow.

DISCOVER: Top 20 Crypto to Buy in 2026

Is This A Genius Move? Hyperliquid HYPE is Deflationary

The success of this strategy will depend on the health of the Hyperliquid ecosystem. As of early February 2026, Hyperliquid has emerged as a top-tier blockchain. Meanwhile, its perpetual exchange is pulling in billions in trading volume, rivaling Binance and Coinbase.

A compelling aspect of Hyperliquid is its autonomous HYPE buyback mechanism. The protocol uses roughly +97% of its trading fees to buy back and sequester HYPE from the open market. In the last 24 hours, over $3M of HYPE were bought. For HYPE treasury holders like Hyperion, this is beneficial, as it relies on a “marginal buyer” in Hyperliquid that structurally supports prices over time.

The buyback on $HYPE exceeded $3,000,000 in 24 hours, which had not happened since November 21, 2025. pic.twitter.com/Kc3ZqMGqGf

— Hyperliquid News (@HyperliquidNews) January 14, 2026

Additionally, Hyperliquid is actively building and innovating. The recent HIP-4 “Outcomes” proposal seeks to expand the utility of Hyperliquid to include a prediction market and other products like non-linear derivatives. If it finds traction, taking a slice of volume from Polymarket, the HYPE token may easily fly back to 2025 highs, outperforming Bitcoin and Ethereum.

HIP-4 is coming. Outcome trading on HyperCore.

This is huge. Let me explain what it unlocks.What are outcomes?

Fully collateralized contracts that settle within a fixed range. No leverage. No liquidations. You know your max gain and max loss upfront.

Think of it as:… pic.twitter.com/TFae7hb2Ch

— Yaugourt.hl (@Yaugourt) February 2, 2026

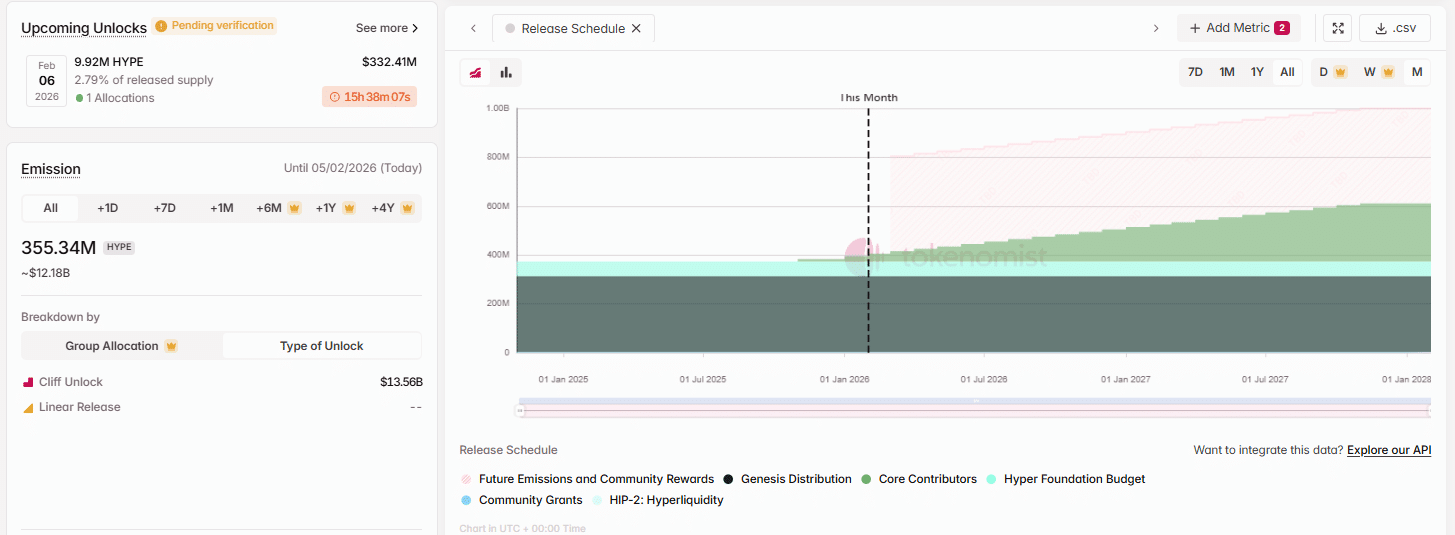

Furthermore, the launch of the Hyperion vault comes less than 24 hours before a massive unlock on February 6, when Hyperliquid will release 9.92M HYPE.

(Source: Tokenomist)

Historically, such events trigger price volatility as the market anticipates possible selling pressure. By launching the Volatility Income Vault just 48 hours prior, Hyperion is positioned to “harvest” this volatility through elevated option premiums.

DISCOVER:

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

The post Hyperliquid Treasury Eyes Yield by Using HYPE as Options Collateral appeared first on 99Bitcoins.