Mega Whales Turned Bearish: Is $1.00 the Real Risk Level for XRP price?

The post Mega Whales Turned Bearish: Is $1.00 the Real Risk Level for XRP price? appeared first on Coinpedia Fintech News

XRP price is hovering around $1.43, barely holding above the $1.41 support, and the market tone isn’t exactly comforting. Just days ago on the weekly chart, XRP briefly slid to $1.10 which was its lowest level in several months, it barely stopped just above the psychologically loaded $1.00 mark.

That bounce looked encouraging on the surface. Underneath, not so much. Because while price recovered, confidence didn’t.

Longer-term holders still remain shaky, and the structure around the XRP price chart suggests the rebound may have been more mechanical than conviction-driven. This isn’t panic yet, but it’s fragile on the inside.

Weekly Rebound Hides Deeper Structural Weakness Underneath

One thing investors and traders must know to be clear. That a dip to $1.10 and a spike back isn’t meaningless, at least for now. Because it means that buyers did step in, and the $1.00-$1.10 zone still commands respect from bulls. But here’s the problem, in the short-term it looks like a spike but on the long-term chart the recovery didn’t flinch XRP price meaningfully towards the broader trend.

From a technical standpoint, XRP/USD is still skating dangerously close to failure. If $1.41 gives way, price action opens a clean path back toward $1.10. And if that level fails to hold on a retest, the downside narrative intensifies fast.

So yes, support exists. But it’s being tested by hesitation, not confidence. ANd, if it returns back the $1.00 consolidation could start.

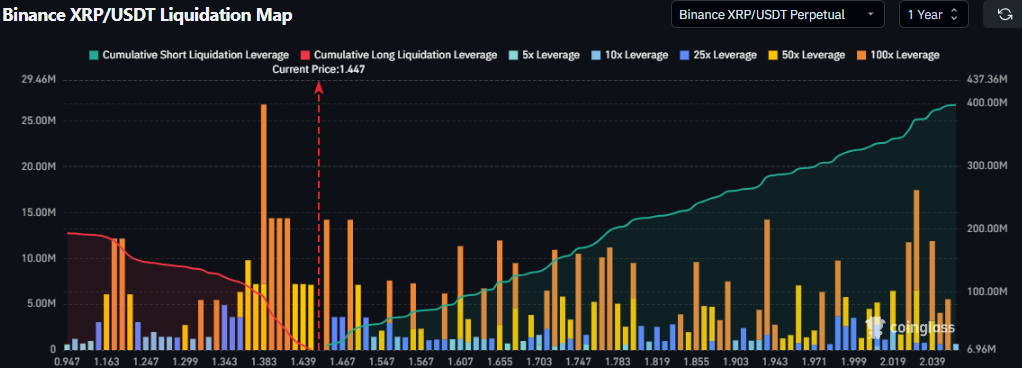

Derivatives Data Leans Heavily Toward More Downside

Now for the uncomfortable part. Derivatives positioning also doesn’t agree with the idea of a stable base forming.

Liquidation data shows roughly $390 million stacked on the short side compared with just over $190 million in long exposure. That imbalance matters. It suggests traders are leaning into weakness, not preparing for a sustained rebound.

In other words, the futures market isn’t buying the bounce. It’s betting against it.

And if XRP price drifts lower again, that heavy short positioning could amplify volatility rather than cushion it. This is why any XRP price prediction right now carries asymmetric risk.

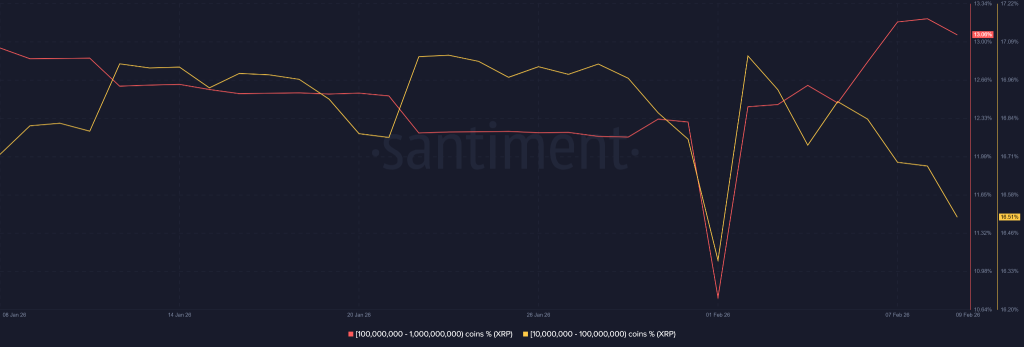

Supply Distribution Shows Whales Quietly Heading for Exits

Meanwhile, on-chain behavior isn’t offering much comfort either. Per Santiment data, the metric Supply distribution by balance tells a clear story. Addresses holding between 10 million and 100 million XRP have been steadily selling since early February, which is responsible for the crash in XRP. More concerning, now wallets in the 100 million to 1 billion XRP range have turned bearish in the last 24 hours with metric showing a downside u-curve.

That shift matters. Larger holders don’t usually rush. When they start leaning toward distribution, it often precedes deeper price tests.

If selling pressure continues and XRP revisits $1.00, the risk isn’t just a clean breakdown. Cascading liquidations could follow, reinforcing bearish momentum across both spot and derivatives markets.

For now, XRP price remains above support. But the longer it lingers without demand stepping in, the thinner that safety net becomes.