Bitcoin Spiked $3K Daily Following The Fed’s Rate Decision

Today, Bitcoin and most of the cryptocurrency market recovered some ground lost during the week, following a favorable reaction to the U.S. Federal Reserve’s announcements to keep the interest rates unchanged.

The year-end policy is focused on promoting jobs and achieving price stability in the medium term. The Fed’s official P.R. highlighted the positive evolution of the economy, something that the financial – and cryptocurrency – markets received with optimism:

“With progress on vaccinations and strong policy support, indicators of economic activity and employment have continued to strengthen … Overall financial conditions remain accommodative, in part reflecting policy measures to support the economy and the flow of credit to U.S. households and businesses.”

The Fed also announced its plans to fight inflation, ending its bond-buying program, and focusing on job generation.

Bitcoin Spikes But It’s Not Yet Enough to Celebrate

The news generated mixed reactions among analysts, mainly depending on the time frame used for their forecasts. In very short-term terms, it is a breath of fresh air for the markets as investors can borrow in times of crisis to continue to grow.

However, those thinking in the longer term cautiously pointed to the Fed’s prospects of rising interest rates at least three times in the coming year as part of a strategy to combat inflation – which is getting rid of its old label of “transitory.”

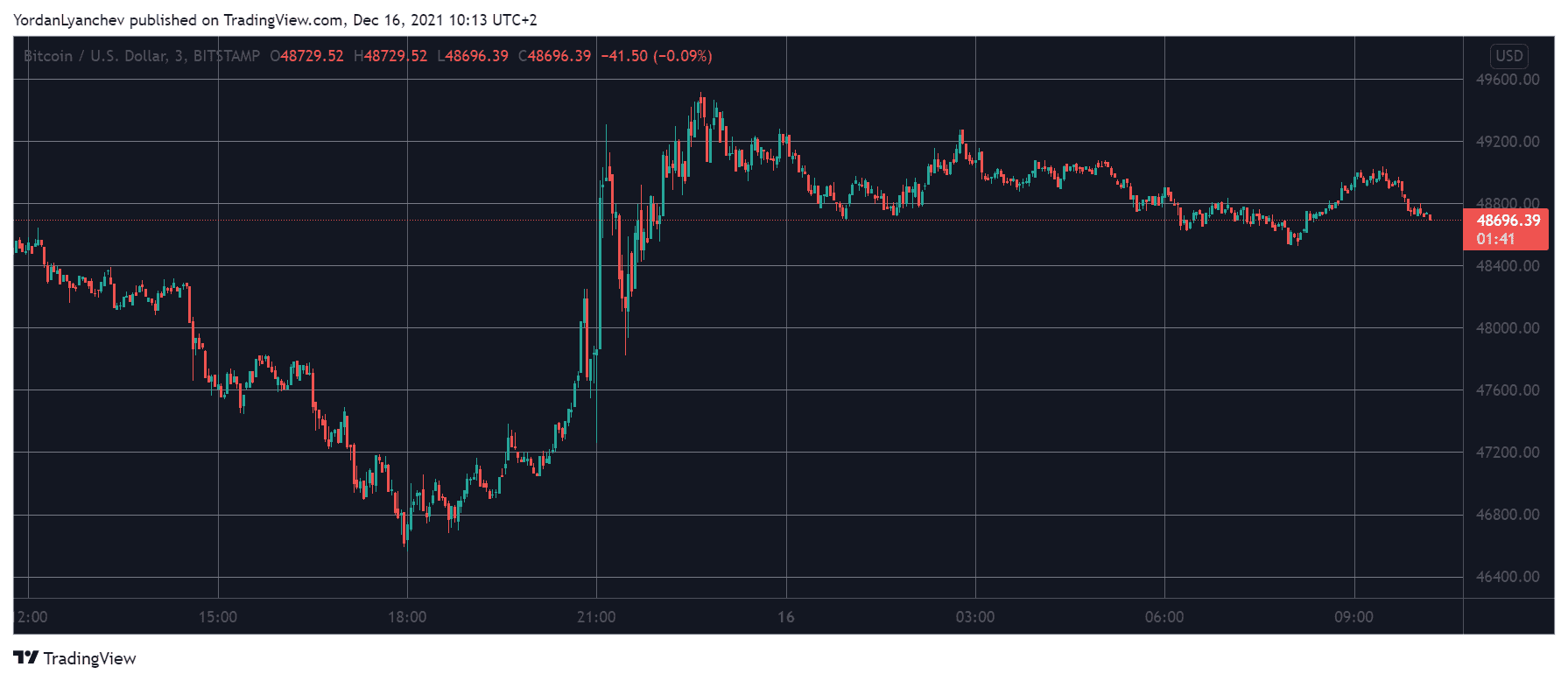

Bitcoin responded enthusiastically. The December 15 candlestick closed at nearly $49,000, for 1.5% growth in 24 hours; however, that’s 5% up from the daily low, around $46,530. In other words, the Fed’s announcement did play a role in driving Bitcoin’s price up.

At the time of writing, Bitcoin is slightly under $49,000; however, prices are still below the 200 EMA located near $50K, which indicates that it is still too early to talk about a medium-term bullish recovery. Since the December 4 crash, Bitcoin has failed to break through the $50K barrier with strength and has remained relatively horizontal, moving between circa $46,500 and $50,000.

The Altcoin Market Follows Bitcoin

Most of the altcoins in the top 100 by market capitalization followed Bitcoin’s upside move, closing the day with green candles.

Avalanche (AVAX) leads with an 18% gain, according to Coinmarketcap. However, the unusual rise seems to have been more influenced by the launch of the USDC stablecoin on its blockchain.

Solana, on the other hand, has also shown double-digit growth in what would be the biggest daily price boost since the beginning of the month.

Ethereum, meanwhile, reflected a modest 5% growth, consolidating above the psychological resistance of $4,000.

In general, the markets are still not all that enthusiastic. The charts of the most important assets still give bearish signals, and the Crypto Fear & Greed Index shows a state of nervousness among digital currency hodlers.

It seems like there’s still a long road before the dream numbers portrayed by yesterday’s Coinmarketcap glitch become real.