TA: Short-Term Bearish? Why Bitcoin Price Could Struggle Above $57.5k

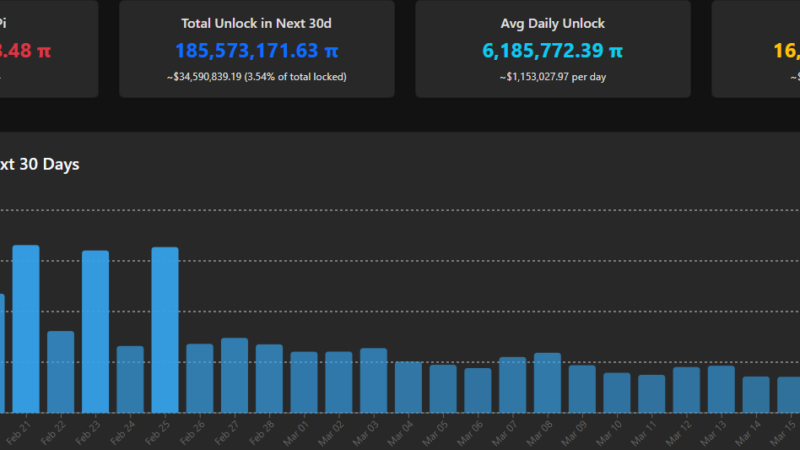

Bitcoin price extended its decline and tested the $55,500 support against the US Dollar. BTC is now recovering, but it is likely to face a strong resistance near the $57,500 level.

- Bitcoin failed to hold the $57,000 zone and extended its decline towards the $55,500 level.

- The price is now trading well below the $57,500 support and the 100 hourly simple moving average.

- There was a break below a key contracting triangle with support near $57,450 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could correct higher, but the bulls are likely to face a strong selling interest near $57,500.

Bitcoin Price Dips Further

Bitcoin struggled to restart its upward move above the $58,000 zone, resulting in a bearish move. BTC broke the $57,500 and $56,200 support levels to move further into a bearish zone.

There was also a break below a key contracting triangle with support near $57,450 on the hourly chart of the BTC/USD pair. The pair spiked below the $56,000 level and tested the next key support near the $55,500 zone.

A low is formed near $55,492 and the price is consolidating losses. It is now trading above $56,000, and testing the 23.6% Fib retracement level of the recent drop from the $59,475 swing high to $55,492 low. On the upside, the first key resistance is near the $57,000 level.

Source: BTCUSD on TradingView.com

The main resistance is now forming near the $57,500 level (the recent breakdown zone). The 50% Fib retracement level of the recent drop from the $59,475 swing high to $55,492 low is also near the $57,500 level to act as a massive hurdle. A clear break above the $57,500 level could open the doors for a steady increase.

More Losses in BTC?

If bitcoin fails to climb above $57,000 and $57,500, there could be more downsides. The first major support on the downside is near the $56,000 level.

The main support is now forming near the $55,500 level. A downside break below the recent low and $55,500 could accelerate losses. The next target for the bears might be $53,200 or even $52,500 in the near term.

Technical indicators:

Hourly MACD – The MACD is slowly losing momentum in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is still well below the 50 level.

Major Support Levels – $56,000, followed by $55,500.

Major Resistance Levels – $57,000, $57,500 and $58,000.