HSBC reportedly blacklists MicroStrategy’s stock for investing in Bitcoin

Buying MicroStrategy stock (MSTR) is reportedly no longer possible for HSBC customers on the bank’s online trading platform — HSBC InvestDirect, or HIDC.

According to a supposed message from the bank to its customers, HSBC has directed users that already own MicroStrategy stock not to buy additional shares.

Twitter user Camiam claimed to have received such a message from the banking giant on March 29:

Hey @michael_saylor , you may want to ask your legal team if what @HSBC_CA is doing here is legal. It sure does not sound like it is! They wont allow us to buy @MicroStrategy . They maybe naked short… pic.twitter.com/GWSpt5t9eH

— Camiam⚡️☣️ (@Camadamus) April 8, 2021

The MSTR blacklisting appears to be part of the bank’s amended user policy prohibiting users from interacting with cryptocurrencies with an excerpt from the message reading:

“HIDC will not participate in facilitating (buy and/or exchange) product relating to virtual currencies, or products related to or referencing to the performance of virtual currency.”

According to the alleged HSBC communique, MicroStrategy is a virtual currency product hence the reason for the blacklisting.

MicroStrategy, a business intelligence and software firm, has pioneered Bitcoin (BTC) adoption among publicly-listed companies in the United States.

Since first adding Bitcoin to its balance sheet back in August 2020, the Fortune 500 company now holds over 90,000 BTC currently valued at about $5.26 billion.

The blacklisting MSTR is only the latest in HSBC’s recent anti-crypto moves. Earlier in the year, the world’s sixth-largest bank also reportedly blocked customers from moving profits from crypto exchanges to their bank accounts.

Despite banning users from buying MicroStrategy stock, reports of similar prohibitions are yet to emerge for other companies with Bitcoin investment interests.

Indeed, companies with significant Bitcoin investments like Tesla, Hut 8 Mining, and Square to mention a few are still listed on the HIDC trading catalog.

HSBC becomes the latest bank to react negatively to MicroStrategy’s Bitcoin involvement. Back in December 2020, Citibank downgraded MSTR over the company’s “disproportionate” focus on the largest cryptocurrency by market capitalization.

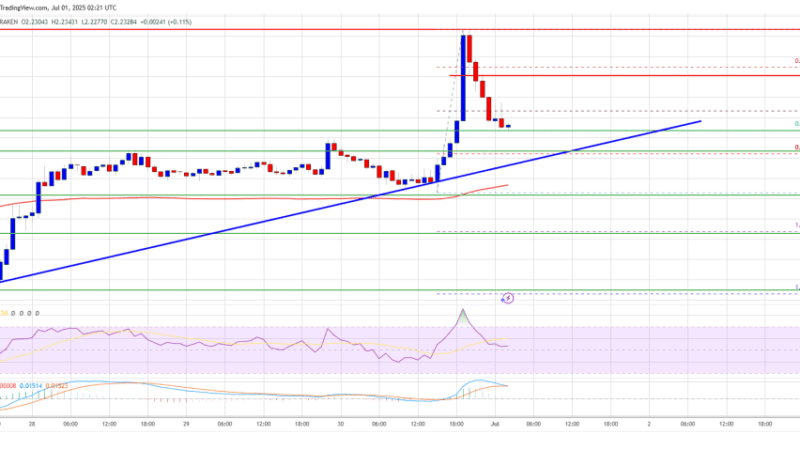

MicroStrategy’s Bitcoin investment initially seem to trigger a positive run for the company’s stock price reaching a 21-year high above $1,200 back in early February. MSTR has since struggled and is now almost 50% down from its 2021 peak.

Neither HSBC nor MicroStrategy immediately replied to Cointelegraph’s request for comments.