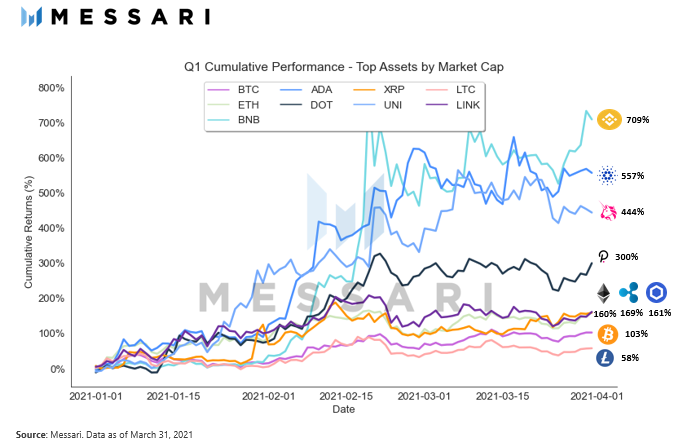

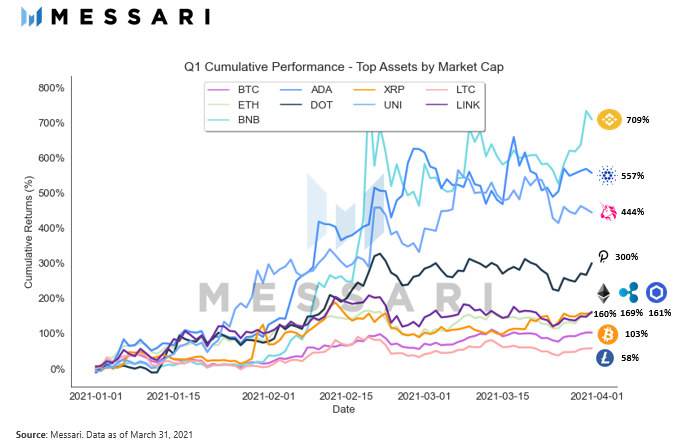

Up 700% in Q1, BNB’s next rally could be one for the “history books”

Crypto research firm Messari released this Q1 Performance Recap, the undisputed winner on the top assets was Binance In parallel, the token leveraged Binance high trading volume “and earnings fueled by white-hot crypto markets”, according to Talamas. One of BSC’s most popular protocols PancakeSwap also was of the top winners these past months. The researcher claimed: Binance Smart Chain has quickly become the most used smart contract platform next to Ethereum and has benefitted from Ethereum’s rising transaction fees, and accelerated volumes and earnings fueled by white-hot crypto markets. These developments created the perfect environment for BNB to reach new all-time highs. PancakeSwap’s native token CAKE made 3,031% gains, ranking it in the top position of the best performing DeFi assets. At the time of writing, Binance Although BNB dropped from its ATH at $448, trader “Kaleo” was expecting a vertical breakout due to a pattern spotted in its price. The token has a period of a massive rally, shakeout, and a new push to ATH. In the short term, BNB could experience a period of accumulation as it prepares for the next rally, Kaleo said: All in on $BNB and $FTT (…) One more flight. One more leg up for BNB and FTT. Trader “Bitcoin Printer” is bullish on Binance said: IF RSI breaks out and invalidates the Uniswap v3 deployment. Set for early May, the new features and cheaper transactions could reverse BSC and PancakeSwap’s edge. Now, PancakeSwap has the top position in daily trading volume with $967 million followed by Uniswap v2 with $799. Analyst Checkmate said the following on BNB’s future: Straight up, the single biggest upset this bull could deliver would be a BNB flip of ETH. Even if it was just for a day, it would be one for the CT history books.

BNB from the traders perspective