Ethereum on-chain metrics may spell trouble with funding rates at unsustainable levels

Earn up to 12% APY on Bitcoin, Ethereum, USD, EUR, GBP, Stablecoins & more.

Start Earning Interest

On-chain data suggests that Ethereum may be bound for a correction even after entering price discovery mode.

Etheruem appears to have resumed its uptrend after suffering a minor setback on Apr. 7 that caused over $230 million in liquidations. Despite the massive losses generated across the board, the second-largest cryptocurrency by market capitalization was able to rebound and make a new all-time high of $2,212 recently.

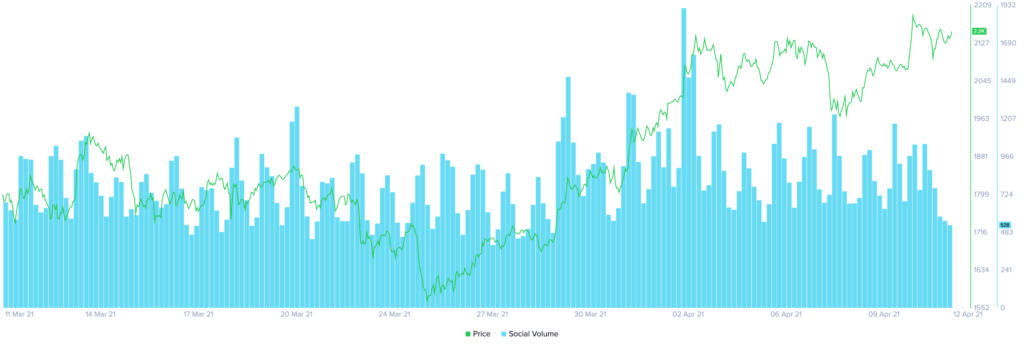

Dino Ibisbegovic, head of content and SEO at Santiment, noticed that the new milestone was not accompanied by a spike in Ethereum-related mentions on social media. While Ether moved into price discovery mode, the lackluster social engagement activity may “bode well” for another upswing. Ibisbegovic said:

“The fact that we’re not seeing a major uptick in ETH-related chatter seems to suggest a growing complacency about Ethereum’s ATH rally, which may help provide room for further price appreciation in the midterm.”

Moreover, known cryptocurrency exchange wallets show no signs of profit-taking throughout the recent bullish impulse. The number of ETH tokens flowing in and out of trading platforms has remained stable over the past week.

Such market behavior suggests that market participants are confident about Ethereum’s upside potential.

Ethereum funding rate spells trouble

While social volume and exchange activity point to further gains, Ethereum’s funding rates spell trouble.

Ether’s BitMEX perpetual contract funding rate shot up to 0.66% and it is hovering at 0.42% at the time of writing. Market speculators seem to be growing optimistic, having long traders pay short traders’ funding at unsustainable levels.

A funding rate of 0.1% or higher every eight hours is considered alarming as it has led to steep corrections in the past. Now that it recently surpassed the highest level ever recorded since the beginning of the year, similar price action could unravel.

The elevated funding rates are a point of concern despite Ethereum’s rising prices. Ibisbegovic recommends investors pay close attention to the number of tokens flowing into known exchange wallets as it may signal a “new wave of holder sell-offs that can prove difficult for the bulls to absorb.”

Get an edge on the cryptoasset market

Access more crypto insights and context in every article as a paid member of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context

Santiment

Santiment