Filling a Market Gap: Heart of TenX Journey to Mimo DeFi

Crypto mass adoption means that it’s time to think about the wider market who will be interested in many of the lower-risk, lower-reward types of DeFi services. Easy-to-adopt, as well as customized solutions, are necessary so as not to alienate potential users.

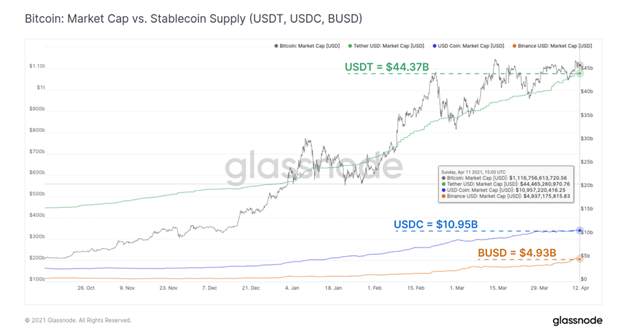

In the world of stablecoins and especially fiat-pegged stablecoins in particular, the US dollar has been the undisputed king. Despite the threat of the SEC lawsuit still looming, Tether (USDT) has continued its lead, and together with USD Glassnode.

Alongside the growth of BTC’s market cap, the Glassnode charts demonstrate correlative demand for stablecoins, indicative of their growing roles as both a reference trading currency and as DeFi collateral.

USD-Euro FX fees: Unnecessary Cost and Inconvenience

The explosion in the growth of stablecoins is a clear sign that its place within the crypto ecosystem is only growing in significance. The proliferation of USD-pegged stablecoins has, however, not extended over to the second most traded currency, the Euro.

It is a common gripe among European crypto traders who have to hold USD (even amidst depreciation) in order to operate in the DeFi (decentralized finance) world and then pay the exchange rates going back and forth.

According to Claude Eguienta, CEO of Mimo DeFi, with the expansion of crypto, it was time to think about the wider market.

“Many people who are not typical crypto users are entering the market,” observes Eguienta. “DeFi has a lot of lower-risk, lower-reward types of financial services that are suitable for Mr. Everyone. When you tell Mr. Everyone that he has to take another step further by using a currency that he doesn’t use in his everyday life, it is alienating.”

Changing from Euro to a USD-pegged stablecoin to make use of DeFi services like trading or staking, and then back to Euro is an unnecessary cost and an added inconvenience. “If we want a more decentralized world to happen, we’ve got to make it easy for everyone. It’s not just about making nice and sexy apps; sometimes it’s the underlying assets that matter more,” adds Eguienta.

Euro Stablecoin Platform to Solve Challenges that European Crypto Users Face

Mimo DeFi is a decentralized lending platform that allows users to mint the native stable token PAR (Parallel), algorithmically pegged to the Euro. Users lock BTC, ETH and USDC (with more crypto options to be added) as collateral in a virtual vault while minting PAR which can be staked in the liquidity pools to earn high-yield returns.

The platform is developed by the same TenX team that famously launched their crypto wallet platform in 2017. The TenX Visa Card has been successfully used by many as a crypto payment solution in countries all over the world.

With a large European user base, as well as a management team composed of many Europeans, TenX came to understand the specific challenges faced by European crypto users. Nevertheless, Eguienta insists that the Mimo product is more a “by-product of reaching to the wider market”, not just to “serve Europeans”.

Additional feedback from their users also made the TenX team realize that ‘spending away” digital assets was not desirable in the vibrant DeFi environment as users did not want to lose opportunities for ongoing exposure. Hence, a lending-borrowing platform was conceived so that one crypto journey did not have to end even as another one began.

Decentralized Stablecoins vs. Centralized Stablecoins

With the number of DeFi projects on the market right now, all touting decentralization, what makes one stablecoin more decentralized than another? In the end, it all boils down to control, to governance, to transparency.

More centralized stablecoins have to fulfill more compliance requirements towards regulators because simply put, they have ultimate control over the bank accounts where all the currencies backing the stablecoin are stored. We have seen how Tether has been facing a lot of legal ramifications from this but has managed to dodge a regulatory bullet with their recent accounting audit by Moore Cayman.

More decentralized stablecoins, like MakerDAO’s DAI and Mimo’s PAR, while pegged to a fixed currency or commodity, maintain a decentralized governance model where the users own governance tokens which give them voting rights as to how the platform is run.

“The users of any platform must own the platform,” declares Eguienta. “For example in ETH, if you’re running a node, validating transactions, you’re being paid in ETH. For Mimo, if you’re providing liquidity, using the platform to borrow, well you should control it. And the platform rewards you with that.”

A practice in the industry where venture capitalists are given bulk deals early on in the fundraising and have unfair access to governance tokens is seen as unacceptable by Eguienta. “You cannot on the one hand promote decentralization and yet give 50% of the control to venture capitalists who are not working for you,” insists Eguienta.

On the Mimo platform, everyone is given an equal opportunity to get governance tokens. The same model applies to everyone – borrow PAR, provide liquidity in the pools and be rewarded with governance tokens.

In essence, this gives the people who use the platform and who provide liquidity longer, the power to control the platform. While centralization currently provides better levels of efficiency, over time, the more sustainable model will likely be a decentralized one.