THETA Price Analysis: Primed for a Surge to Fresh ATHs As Rally Extends

THETA gained pace in the last 3 weeks to reach all-time highs of $15.84 followed by a breather. Price action now suggests follow-up gains need a stronger buying sentiment.

*Bulls attempt to emerge as THETA/USD stays in consolidations

*THETA on the verge of re-writing all-time highs beyond $15.84

*Theta receives 3rd U.S. Patent 10,979,467 for decentralized streaming

A brief pullback on Mar. 24 at the all-time high of $15.84 drove THETA’s price to a low of $10.12, however, the bears were met with strong buying interest. THETA/USD has been in consolidation after a breather from the ATHs of $15.84. The RSI’s easing from the overbought zone suggests that there could be more room on the upside. The bulls regained traction in the prior day and edged higher, minimizing the negative impact from Wednesday’s close in red. At the time of writing, bulls attempt to emerge as price stays in consolidation past the $14 and the $11 range. The latest rally above the $12 pivot zone may attract more momentum players into the bidding war with THETA on the verge of re-writing all-time highs beyond the $15.84 level.

Receives Third U.S. Patent

On April 13, Theta Labs received its third US patent 10,979,467 for “Methods and Systems for Peer-to-Peer Discovery in a Decentralized Data Streaming and Delivery Network.” This groundbreaking innovation expands on Theta’s previous US Patent 10,771,524 by introducing View Nodes that use the superior Peer Discovery system to optimize decentralized video delivery.

Peer Discovery’s patented technology uses advanced algorithms to improve the reliability and connectivity of Theta’s peer-to-peer edge network, resulting in dramatically improved video delivery quality. Theta Labs is rapidly becoming fully decentralized, with nearly 60% of THETA tokens earning a stake to maintain the governance and security of its chain.

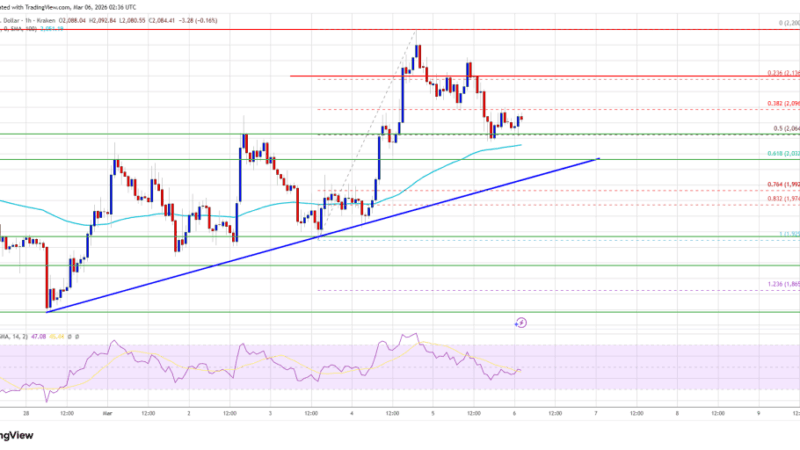

THETA/USD Daily Chart: Bullish

THETA regained momentum on Friday and moved higher, minimizing the negative impact from Wednesday’s red close, signaling that bulls are running out of steam ahead of key barriers at $16.00 (psychological/daily cloud top). THETA/USD has broken resistance at $14.00. It is followed by $15.00, an important resistance line ahead of ATH at $15.84.

The rebound from $11.07 (Wednesday low) shows signs of fatigue as the price continues to consolidate, but the growing bullish momentum on the formation of the Relative Strength Index (RSI) and Moving Average (MA 50) continues to support and partially compensate for the negative signal. This suggests that the bulls may remain in a long consolidation ahead of a new attack in the $15 zone, a breakout of which would expose targets at 15.84 ATH.

THETA/USD 4-Hour Chart: Ranging

The recent impulse of THETA growth has brought the price back above the moving average (MA 50). It pushed the price up from $12 early in the day to $14.77 but has yet to prove long-term gains by passing the test of all-time highs at $ 15.84. The next milestone of growth is observed in the area from $15 to $16, wherein in March the price turned to correction. Moving out of the $14-11 range, price could retest the $15.84 resistance and ATHs.

And during this week, this demand was actively manifested in investor interest in THETA, ideally, consolidation should remain above $14 (broken horizontal barrier) with deeper falls to stay above the rising moving average (MA 50) so as not to hurt the bulls. This could open the way to $16, a key resistance area on the 4-hour chart. If the THETA/USD pair is trading below the $14 level, sellers can test the $12 and $11 levels.

Key Levels

Resistance Levels: $18, $17, $16

Support Levels: $12, $11, $10

Image Credit: Tradingview

Note: coinpedia.org is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event