1 million crypto traders see nearly $10 billion in liquidations

Traders saw nearly $10 billion in liquidations on Sunday morning as the crypto market saw a deep pullback, data from markets tool Bybt shows. Over 1 million individual accounts were liquidated.

aftermath of today pic.twitter.com/ujSlotcglr

— red (@redxbt) April 18, 2021

Wooosh

‘Liquidations’ occur when traders borrow excess capital from brokerages/exchanges (i.e., ‘margin’ or trading futures) to place bigger bets on the assets they trade. They pay a fixed fee for doing so, while exchanges close out these positions at a predetermined price—when the trader’s collateral is equal to the loss on that position. Such a trade is then said to be liquidated.

And amidst all the euphoria from last week, such as bank executives stating Bitcoin would eclipse gold’s valuation and the asset setting new all-time highs, traders likely borrowed in excess of what their books would allow and contributed to what became an overheated, overleveraged market.

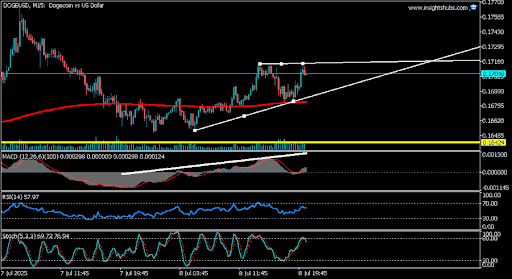

Saturday night was the pin of that balloon. Markets tumbled by nearly 10% on average—some altcoins even seeing losses of 25%—while traders ended up losing $9.85 billion.

Of that, $8.68 billion worth of liquidations happened on ‘long’ trades, or from traders betting on a price upside. Binance saw $4.6 billion worth of longs getting destroyed, Huobi with $1.59 billion, and Bybit with $1 billion.

Crypto takes a hit

Bitcoin (BTC) alone saw $5.6 billion worth of liquidations, followed by Ethereum (ETH) at $1.1 billion and XRP at $462 million.

A gnarly 1 million traders were liquidated. The largest single liquidation order happened on Binance on the Bitcoin/USDt pair with a value of $68.73 million.

Meanwhile, some market veterans commented on the price action. “All you over-leveraged longs got punished. 20-40% drawdowns are increasingly common and happen every few weeks now,” said Bobby Ong, co-founder of market analytics tool Coingecko.

He added, “Be careful when using leverage. This is becoming the usual sharp V-shape recovery.”

That was a good weekend reset. All you over-leveraged longs got punished. 20-40% drawdowns are increasingly common and happens every few weeks now. Be careful when using leverage. This is becoming the usual sharp V-shape recovery

— Bobby Ong (@bobbyong) April 18, 2021

At least newcomers would now know: crypto doesn’t always go up.

Get an edge on the cryptoasset market

Access more crypto insights and context in every article as a paid member of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context