Cardano’s Founder Laughs at DeFi Because it Has no Real Markets

In distinguishing real-world use versus speculative investing, IOG CEO Charles Hoskinson said he derides DeFi in its current state. The comments come as Cardano announced securing a contract with Ethiopia’s Ministry of Education for a blockchain-based ID system.

This accomplishment is part of Cardano’s pan-African strategy that intends to improve lives by providing new systems. By tapping into real-world use for everyday laypeople, Cardano hopes to differentiate itself from the competition. But is this a strategy that will prevail?

“We look to our industry and we think about things like DeFi. I laugh at DeFi at the moment. Not because I think the projects are bad, or the products are bad, or the teams are not motivated. But because they don’t have real markets.”

Cardano Lands The Bird

After months of teasing, and even before the Africa Special event, the bird has finally landed. Yesterday, Hoskinson took to social media announcing a partnership deal with the Ethiopian government.

It will see the implementation of a blockchain-based national student and teacher ID system to record and digitally verify grades and remotely monitor school performance. The idea behind it is to boost nationwide education and employment.

African Operations Director at IOG, John O’Connor, believes the partnership could be the beginning of Africa’s revival as a global economic powerhouse. A time not seen since the Mali and Songhai Empires around the 14th and 15th centuries.

“Ethiopia’s blockchain-based education transformation is a key milestone on IOHK’s mission to provide economic identities and employment, social and financial services for the digitally excluded”

The West Has no Need For Cryptocurrency

Developed nations have a legacy infrastructure in place, making blockchain technology an unnecessary luxury in the west. For most western people, cryptocurrency is primarily being used as a speculative investment.

Hoskinson reiterated this point by describing the frivolity of cryptocurrency through a western lens.

“No-one in America wakes up at the moment, or Germany, or France, and England, and says, “Oh boy, I just can’t wait to get a car loan on a decentralized peer-to-peer lending network.””

He added that most people don’t know what peer-to-peer lending, or DeFi, is, let alone how to access it. The reason why comes down to the existence of legacy infrastructure. But in regions with no infrastructure, the demand for blockchain-based services is much greater out of necessity.

“The vast majority of people use things out of necessity or convenience. When we look to people who have no access to credit, the reality is their first loan is likely going to come from a peer-to-peer marketplace, and likely be denominated in a cryptocurrency-based asset, not a local currency.”

Hoskinson believes DeFi demand will come from people who need it the most. Not those who use it speculatively to become relatively more wealthy. In turn, it’s the overwhelming demand that will drive value, not the technology itself.

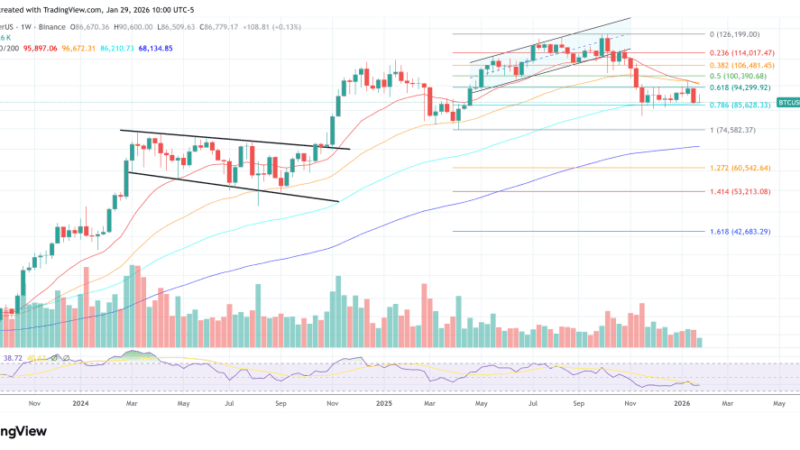

Source: ADAUSD on TradingView.com