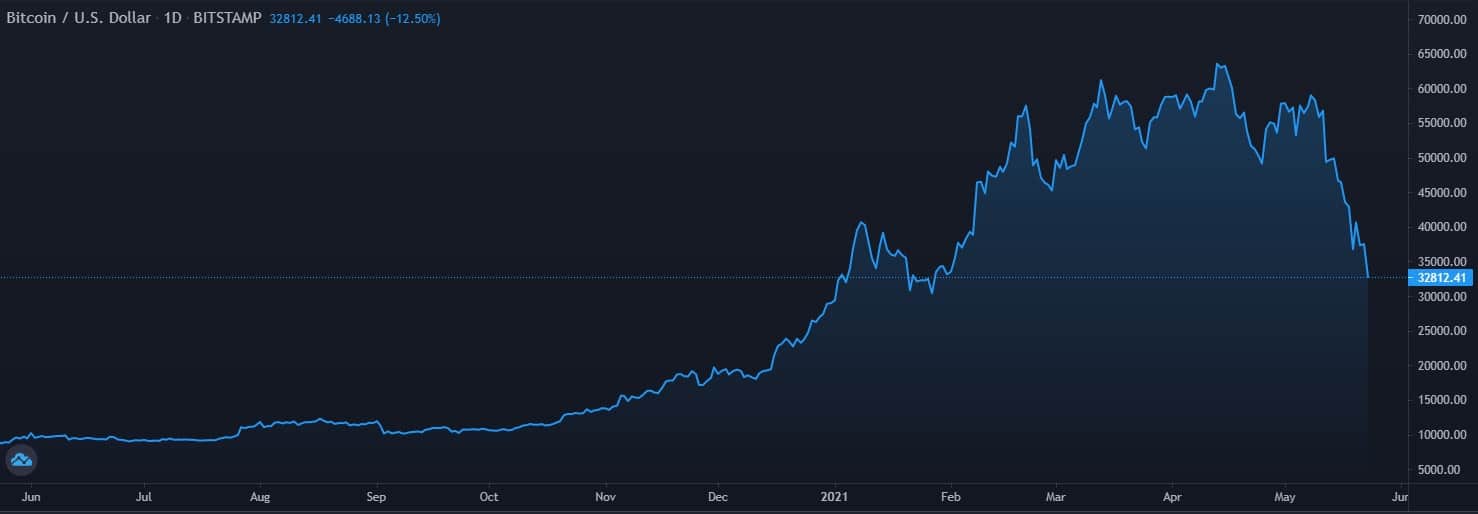

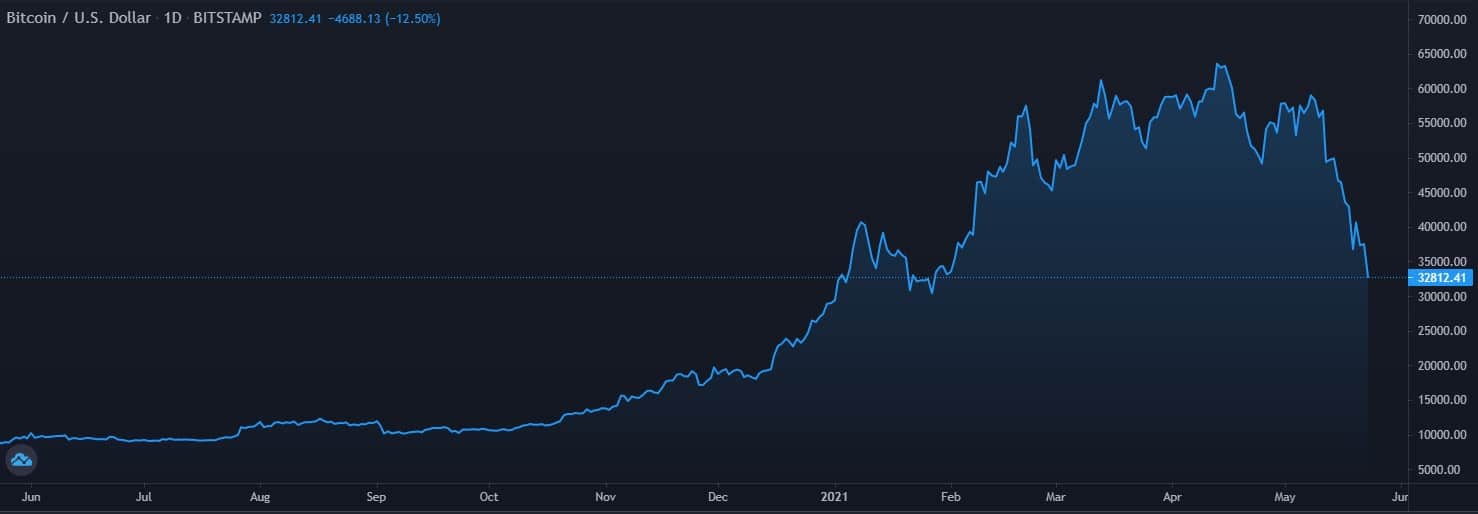

$1.2 Billion Liquidated As Bitcoin Sees 15% Price Collapse In 24 Hours

Bitcoin chopped downwards today towards $31K, looking to retest local lows made earlier in the week just around the $30K mark, according to Bitstamp.

According to data from Bybt, over the past 12 hours the crypto markets saw liquidations of over $1.2 Billion in trader positions. As of writing these lines, BTC price is decreasing 15% over the past 24 hours, whereas major altcoins were hit even harder, with ETH down 21% to a current daily low of $1730, XRP down 24% to $0.65 – daily low, and LTC down 28% to a daily low of $120, in the same timeframe.

So far today, the total cryptocurrency market capitalization dropped from $1.6 Trillion to $1.23T – a staggering loss of over $400 Billion in total value.

- Traders across CT flip bearish as sentiment takes a plunge. The cryptocurrency fear & greed index reaches new lows as people panic sell, aiding the market’s overall downwards trajectory. #cryptocurrency becomes one of the top trending tags on Twitter in several countries.

- BTC stands notably stronger as alts take a severe hammering. Small-cap altcoins took a worse beating: several are down over 90% today, which makes the large-cap alts’ 30% daily loss seem benign.

- News about China’s potential Bitcoin ban and its implications has gripped the Internet, as speculation about miners selling off their BTC stash flies rampant.

- These turbulent times have caused even ‘safe’ assets to be doubted in the cryptocurrency ecosystem: USDT, a Terra-backed stablecoin, broke its peg, temporarily diving down to $0.95.

- As Bitcoin dives to retest the $30K mark, there has been a noticeable increase in net long positions on futures exchanges, primarily BitMEX and Binance.