Bitcoin miners are shutting down Chinese operations after Vice Premier’s comments

Chinese Bitcoin miners are scrambling to shift or shut operations after the latest round of ‘crypto FUD’ initiated by the government, a report on news outlet Reuters said today.

Ending operations

Crypto exchange Huobi suspended all mining operations this morning (alongside ceasing trading services for Chinese users), BTC.TOP, a crypto mining pool, announced the suspension of its China business citing regulatory risks, and crypto-miner HashCow said it is not buying Bitcoin mining rigs anymore.

"Huobi suspends providing mining machine sales and custody services to domestic users. " pic.twitter.com/OHzipfrFdN

—

Joey Wong王祖兒

(@JoeyWong_t3ch) May 23, 2021

Mining, for the uninitiated, uses up a massive computing system that solves millions of complex calculations each second to validate transactions on the Bitcoin network (a process known as ‘proof of work’).

This requires massive amounts of energy for the maintenance, cooling, running of the machines. But some say as the source of this is via coal and fossil fuel-powered energy producers, it leaves behind a big carbon footprint for seemingly little benefit to the world.

And that, in turn, is against what China is trying to achieve as a country. “Crypto mining consumes a lot of energy, which runs counter to China’s carbon neutrality goals,” explained Chen Jiahe, a chief investment officer of Beijing-based family office Novem Arcae Technologies.

He added the recent crackdown is part of the country’s drive to end speculative trading in cryptocurrencies.

The annual energy consumption of China’s cryptocurrency miners is expected to peak in 2024 at about 297 terawatt-hours, the report stated. This, however, greater than all the power consumption by Italy in 2016, making such usage a big concern among environmentalists and industrialists alike.

Bitcoin, mining, and ruthlessness in China

Research suggests over 75% of Bitcoin’s hashrate—a measure of the computational power per second used when mining—originates from Chinese entities like F2Pool, Huobi, and others.

They’ve been around there for the better part of the last decade, with inner China’s favorable climatic conditions, cheaper electricity and manpower rates, and technical prowess proving advantageous for mining entities to grow and thrive.

However, Chinese officials are not as supportive of the quick growth. In statements last week, Vice Premier Liu He and the State Council said they would soon crack down on the trading and mining of cryptocurrencies in the country.

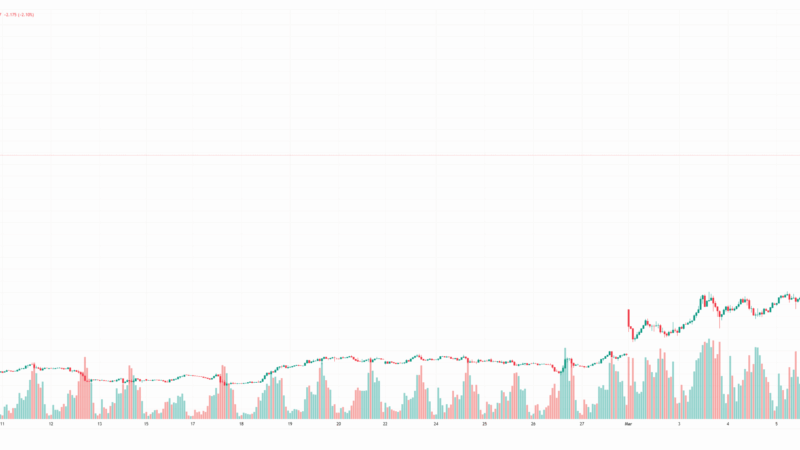

“[We will] crack down on Bitcoin mining and trading behavior, and resolutely prevent the transmission of individual risks to the social field,” the officials said last Thursday, with a drastic market sell-off ensuing in the hours later.

Meanwhile, industry insiders say mining as a whole is unlikely to end, as operators can simply shift to friendlier locations or use alternative energy sources.

But for Chinese miners, it’s yet another loss for the country: “Eventually, China will lose crypto computing power to foreign markets as well,” said BTC.TOP founder Jiang in a statement last week, a reference to how China lost its position as a crypto trading powerhouse back in 2017.

The post Bitcoin miners are shutting down Chinese operations after Vice Premier’s comments appeared first on CryptoSlate.