Disrupting Narratives: Is Bitcoin Bound For Longer Cycles With Diminishing Returns?

After one of Bitcoin’s worst drops in its history, many people wonder if the crypto market has reached a top. The market was hit by FUD after FUD, and it negatively impacted some holders. Many retail investors panic sold their coins. January 2018 flashbacks kicked in and suddenly there was talk of the start of a new bear market.

For months, the crypto space around Bitcoin has been dominated by bullish narratives of institutional adoption, BTC as a store of value stealing gold’s shine. “Up only” became something more than a meme, it was a conviction right until the moment when the prices broke below every critical support.

Despite its apparent sudden execution, BTC’s price crash was predicted by many experts able to read the signs and indicators that go beyond the narratives. Anonymous analyst “John Nash” has been studying this phenomenon for some time and came up with an interesting theory.

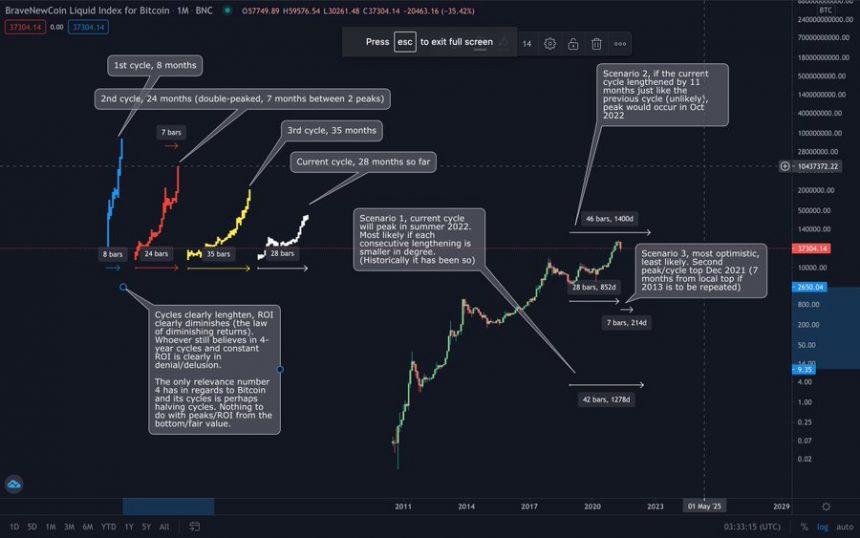

“Nash” reviewed BTC’s previous cycle to counter “moonboism”, a made-up condition suffered by those investors with an everlasting “Up Only” sentiment. As the chart below shows, every BTC since 2021 shared a characteristic: they tend to be longer than its predecessor and offer less return on investment (ROI).

Bitcoin’s first cycle began in 2011 with an 8-month duration. During this period, BTC’s price went from below $1 to around $10. The second cycle started somewhere in 2013 and lasted for about 7 months with 2 different peaks at the end of that year and in 2014.

Bitcoin’s third cycle has been the longest, so far, with a 35-month duration. The current cycle has extended for 28 months, the analyst said:

Cycles clearly lengthen, ROI clear diminishes (the law of diminish returns). Whoever still believes in 4-year cycle and constant ROI is clearly in denial/delusion.

Beware Of Bitcoin’s Price Narratives

From the chart presented by the analyst, he presents 3 possible scenarios. A peak of the current cycle by summer 2022, an extension of the cycle until October 2022, if it follows the same length as the previous cycle.

Finally, the least likely scenario and the most optimistic is a peak of the cycle by December 2021. It is possible to assume, based on the previous argument, that the shorter the cycle, the more explosive the ROI. So, if this scenario plays out BTC could see massive gains.

In a separate post, the analyst warns investors about narratives, this can be powerful to drive new users, but equally dangerous if blindly follow. Based on Metcalfe’s law, used to describe the curve of adoption of new technology, “Nash” made the following conclusion:

During the past decade Bitcoin has been following adoption curve/Metcalfe’s law more or less steadily, however, with one peculiar property. Since Bitcoin’s network growth is directly expressed in monetary value it is prone to speculative episodes i.e. bubbles.

Using a logarithmic growth curve (LGC) is possible to determine BTC’s true bottom and top, the moment when the curve will start to flatten and fewer users will enter the network. This will be accompanied by more maturity (time) and less volatility for BTC’s price.

The analyst rejects models that predict a BTC price appreciating to infinity, he believes that no Bitcoin cycle outperforms its previous overextension.

In other words, it is less likely for BTC to reach an all-time high price if the grown expressed in percentage is higher than in 2017. At the time, BTC went from $1,000 to $20,000 increasing by 1,900%. Then, for the cryptocurrency to rise from $10,000 to $100,000 in this cycle would represent a 900% increase. A plausible price according to this theory.

BTC trades at $36,112 with losses in all time frames. The monthly chart has been the most affected with a 37.3% loss, at the time of writing.