Exodus: Chinese Bitcoin Miners Set Their Sights on Texas

Beijing is still issuing orders to shut down Bitcoin mining operations and many of them are now seeking friendlier climes overseas to base their operations.

On Monday, CryptoPotato reported that Yunnan, the fourth-largest Bitcoin mining producer, had been targeted in the regime’s latest crackdown.

In what crypto industry observers are calling the “great mining migration”, many of these companies are looking towards North American, and specifically Texas to base their mining facilities according to a report by CNBC.

Everything is Bigger in Texas

Texas often has some of the world’s lowest energy prices, and its share of renewables is growing over time. Currently, Texas is the nation’s leader in wind-powered electricity generation, producing almost 30% of the U.S. total according to the state comptroller.

The lone star state has a deregulated power grid that lets customers choose between power providers. Additionally, its political leaders and bankers are very pro-crypto which makes it a dream destination for Bitcoin mina miners seeking a new home.

Brandon Arvanaghi, previously a security engineer at crypto exchange Gemini, commented:

“You are going to see a dramatic shift over the next few months. We have governors like Greg Abbott in Texas who are promoting mining. It is going to become a real industry in the United States, which is going to be incredible.”

Vice president of Hong Kong-headquartered mining pool Poolin, Alejandro De La Torre, is already planning an exit.

“We do not want to face every single year, some sort of new ban coming in China. So we’re trying to diversify our global mining hashrate, and that’s why we are moving to the United States and to Canada.”

Arvanaghi continued to explain why Texas could be the destination of choice, stating “Texas not only has the cheapest electricity in the U.S. but some of the cheapest in the globe,” before adding “It’s also very easy to start up a mining company … if you have $30 million, $40 million, you can be a premier miner in the United States.”

Bitcoin Hashrate Exodus

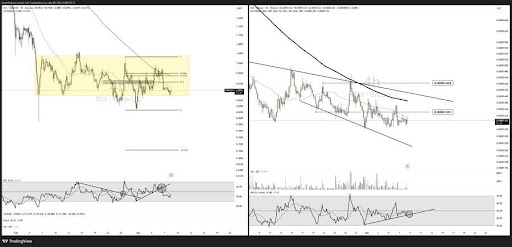

Castle Island Ventures partner Nic Carter said that given the drop in hashrate, “it appears likely that installations are being turned off throughout the country”. The analyst thinks that probably 50% to 60% of Bitcoin’s entire hashrate will ultimately leave China.

Current estimates suggest that its market dominance is between 55% and 65% and it is already falling. The actual hashrate for the Bitcoin network is currently 114.5 EH/s, down 33% from its peak of 171.4 EH/s on May 13 according to Bitinfocharts.