Ethereum Sees Record Daily Volume Withdrawn From Centralized Exchanges

Exchange supply in the crypto market has been down across the board, and Ethereum has been no exception. The digital asset has grown in popularity due to the rise of decentralized finance (DeFi). Due to its token being the primary mode of payment on the protocols and Ethereum being the largest smart contracts platform in the market. This has led to increased fate in the asset by investors. Many of whom see the price of ETH hitting as high as $10,000 before the year runs out.

Related Reading | Cathie Wood Reiterates $500K Bitcoin Call, Reveals Ethereum Rebalancing

As sentiments have skewed more into the positive for the asset, hold sentiments around ETH have risen. This is evidenced in the current exchange balance levels. 2021 has seen a declining trend in exchange reserves of the digital asset, and recently, outflows from exchanges have gone up again. This time marking record outflows in the span of a day.

Ethereum Outflows In A Day Totals $1.2 Billion

A recent report from IntoTheBlock showed that Ethereum saw outflows from centralized exchanges totaling $1.2 billion in a single day. IntoTheBlock is a data analytics platform that provides insights into the crypto market. The number represents the highest amount of ETH to leave exchanges in a 24-hour time frame. Beating the previous record that was $1 billion leaving exchanges in a day.

Related Reading | TA: Ethereum Consolidates, What Could Spark A Fresh Rally

The net amount of $ETH leaving exchanges just hit a new record

Over $1.2B worth of $ETH left centralized exchanges yesterday

Last time $1B+ left CEXs, #Ethereum increased by 60% within 30 days pic.twitter.com/wfRuX11Rtk

— IntoTheBlock (@intotheblock) September 16, 2021

It has been reported that both Bitcoin and Ethereum exchange reserves have continued to plummet despite recent price highs. With numbers this low, it shows that investors are taking their assets off exchanges for personal safekeeping. Indicating that users are not selling off their holdings to take profits.

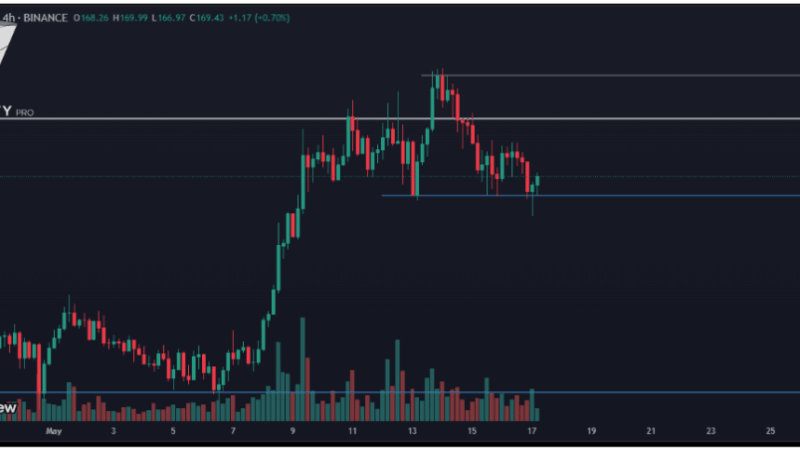

ETH exchange outflows total $1.2 billion in one day | Source: IntoTheBlock

Exchange reserves for bitcoin are now only 6.5% of its entire supply and Ethereum reserves on exchanges are about 15.7% of its total supply. Trends indicate that this number will likely dwindle over the next several months.

What This Means For ETH Price

This record amount leaving centralized exchanges holds some interesting implications for the digital asset. The last time that much Ethereum left exchanges, the price of ETH witnessed a massive surge that saw the price of the asset grow over 60% of its value. If history repeats itself again, then the price of ETH is headed for a new all-time, likely reaching up to $4,500 this time around.

Exchange reserves plummeting can lead to a supply squeeze that would send the price shooting higher. Once the reserves deplete enough to the point where demand on the exchanges is exceeding the supply of coins available, then another bull run is imminent in the future of the asset.

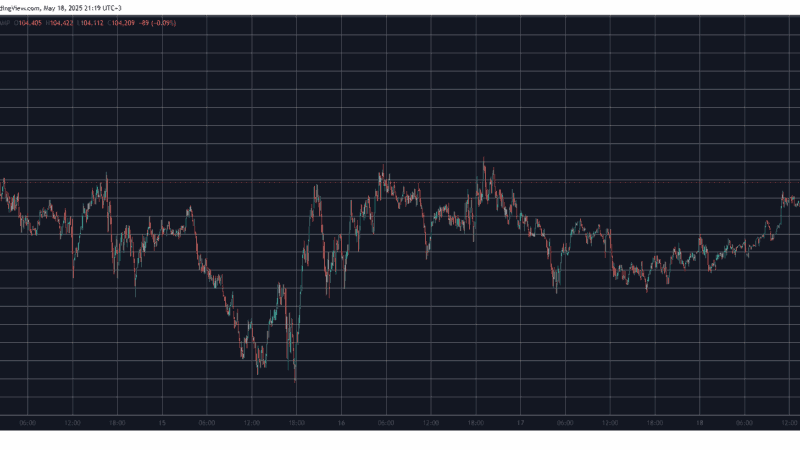

ETH still trading above $3,400 | Source: ETHUSD on TradingView.com

Currently, Ethereum is still trading above $3,400 at a price of $3,457. It is still trending lower than its 24-hour highs, but movements show a return into the green before the trading day officially opens.

Featured image from Decrypt, chart from TradingView.com