What Lies Behind The Price Ditch Of Solana (SOL), Cardano (ADA), and Algorand (ALGO)?

The post What Lies Behind The Price Ditch Of Solana (SOL), Cardano (ADA), and Algorand (ALGO)? appeared first on Coinpedia – Fintech & Cryptocurreny News Media| Crypto Guide

The crypto street has seen all the praiseworthy aspects and shortcomings throughout the year. Especially, few projects in the space have been able to ascertain significant growth. Notably, Solana, Cardano, and Algorand are up by more than 500% just within a year. Maximum profits were observed in the first two or three quarters of the year. Specifically, the second half of the year was truly tough for all three projects, yet it is still opaque why these are still undervalued.

Cardano (ADA):

Cardano (ADA) price that has made more than 1000% profits in just two bull cycles fought so hard to regain the momentum yet failed to achieve since mid-October. Especially in Q4, someone really can’t comprehend what exactly is wrong with ADA.

All related metrics to the ecosystem such as on–chain transactions, number of active addresses seen at ATH, whilst NFTs, smart–contract scripts experienced phenomenal growth. On the other hand, the network has recently accomplished 20 million transactions and a record of 1 million wallets staked. Yet it failed woefully to gain the momentum, the community has lost patience.

However, the ADA price is under bearish reign over the past few months and the crucial support would be around $1.17. If it is a deep correction, then altcoin would stand out to reclaim the previous high of $2.4 in the immediate bull cycle.

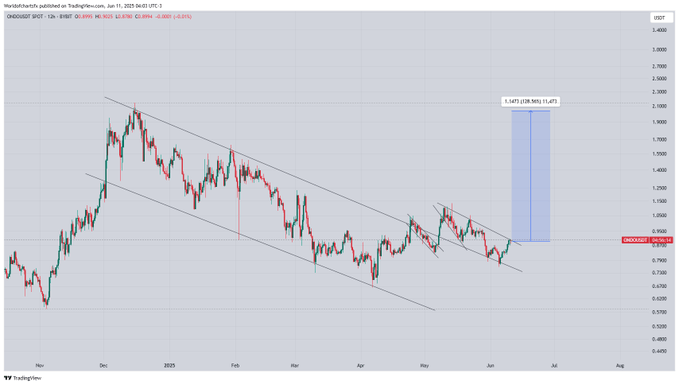

Algorand (ALGO):

It is really pessimistic to see how Algorand is still considered to be an undervalued asset. The protocol has achieved groundbreaking results in terms of fundamentals, yet it hasn’t impacted price action. The Algorand ecosystem has seen more developer activity about a 4,300% surge year-to-date. Moreover, it has done extremely well in terms of improvising its governance and innovations with groundbreaking collaborations.

One of the proponents of the space believes that Algorand deserves to have an equivalent trading volume that of Cardano. While responding to his view about how ADA would be profitable in the future, in contrast he emphasized how Algo would be equally worthy to invest in. Yet what left traders perplexed is how the ecosystem failed to achieve expected profits despite all the strengths.

At present the Algorand price is trading at $1.47, as bearish dominance is underway the crucial bottom to retest would be $1.14. Once it confirms breakout, the asset would easily rally well above $2 in its immediate bull run.

Solana (SOL):

Solana’s price has made a rugged move this year from $2 to $260 in the year’s end. Howbeit, the bad part is the platform’s failure to properly handle network outages. Yesterday was for the second time users reported a bug while carrying out a transaction.

Due to network congestion on Friday, the high-throughput blockchain witnessed roughly 50% of the drop in its transaction per second. Owing to the network glitch, the SOL price woefully dropped to $168.62 with more than a 12% loss round the clock. Due to the same reason, the network has lost 25% of its profits in the September bull rally.

SOL price exhibits signs of recovery post the quick resolution in the glitch. The price is trading at $169, in the next bull cycle, it would surge well above $225.

Collectively, Cardano, Algorand, and Solana are epic projects yet they are not up to their place where they deserved to be. However, the next bull cycle would answer all these mind-blogging perplexities amongst traders and proponents.

tweet and tell me how is not common sense to have

tweet and tell me how is not common sense to have