Death Cross is Near For Bitcoin Price Action! One More Correction Prior to the 2022 Q1 Bull Season!

The post Death Cross is Near For Bitcoin Price Action! One More Correction Prior to the 2022 Q1 Bull Season! appeared first on Coinpedia – Fintech & Cryptocurreny News Media| Crypto Guide

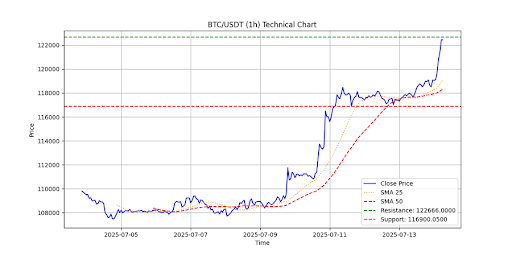

Bitcoin price may be at stake as it has been trading at crucial levels, pointers kindle panic over plausible death cross. Though the primary asset running green in the charts, the asset needs to pass the challenge of bearish crossover between 20 day and 200-day exponential moving average. Interim, the crossover would further shed the risks of negative sentiments amongst retailers, therefore extending the correction.

Death-Cross Threatens Bitcoin Bulls!

The recent spike in Bitcoin price pushed 200 days MA close to 20 days MA, which has created a FUDs of May sort of market crash. When the bearish crossover appeared on May 30th, the flagship asset collapsed by over 25% falling from $36.6k to $28.8k in just 14 days. In addition, whilst during the market crash led by the pandemic in March 2020 has actually halved the price from $8k to $4k.

However, the 1-day chart from the trading view had raised the risk of potential death cross ahead of rising in 200 days MA. As the asset has been under prolonged correction for over two months, the next couple of days seems to be playing a decisive role in terms of death cross. Although the primary coin has managed to rebound, it has ended up generating consecutive higher lows in the past month.

If something like the May death cross reappears in the next couple of days, it would continue to correct up to $42k before commencing to 2022 Q1. Besides, Santiment analytics confirmed the bearish retail sentiments over the flagship asset. Though it has experienced significant accumulation at its lower ranges, the possibility of death cross would play a key role in the price action.

Collectively, if Bitcoin escapes from the death cross, we might experience a saga of price rally like the one we had in early 2021. Whenever retail sentiments corrected their bottom, usually the asset had rallied very hard in the past. The sooner it breaks the downward parallel channel, the earlier we commence the new year with a grand price rally.