Survey shows 44% of student loan borrowers plan to invest in crypto or NFTs

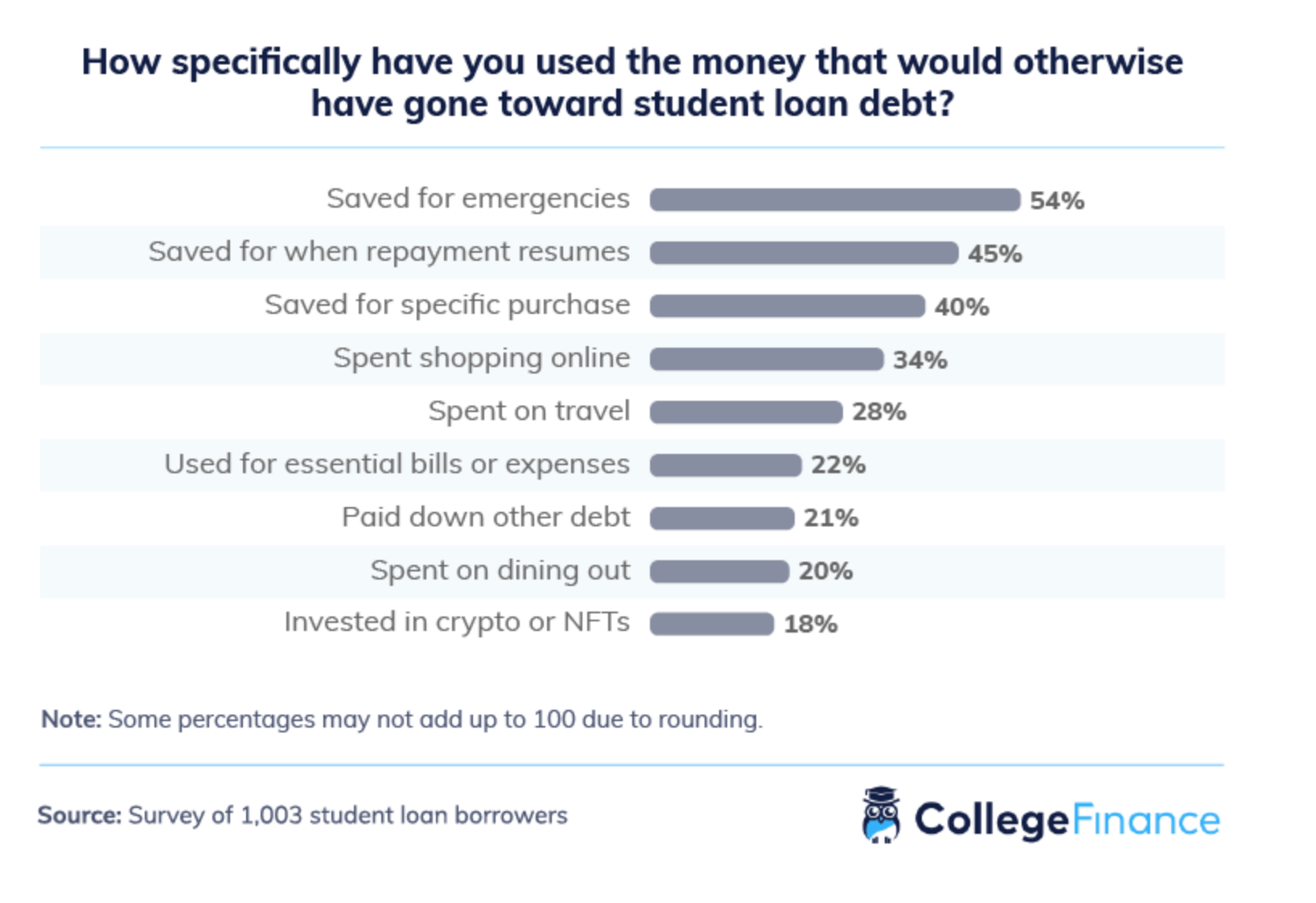

Since the onset of the student loan freeze in the US in March 2020, 18% of borrowers have been using the extra money to invest in crypto or NFTs, a recent study showed.

College Finance, a company that provides information about student financing options, polled over 1.000 borrowers to investigate how are they preparing for the student loan payments resumption, and what they’ve been doing with the pocketed money that didn’t need to go toward debt.

Meanwhile, the Biden-Harris administration extended the student loan payment pause and interest waiver until May next year–helping 41 million borrowers save $5 billion per month.

Extra money

With the onset of the pandemic in the US, federal student loan interest rates have been set to 0% and payments have been paused.

Surveyed borrowers were on average putting $385 toward their student loan debt on a monthly basis but since the pause, this money was repurposed by the majority–with only 12% reported continuing with payments.

Since the pause began, 18% of borrowers have been using the extra money they’ve pocketed to invest in crypto or NFTs.

Gen Zers (20%) were more likely to use the pocketed extra funds to invest in crypto and NFTs than millennials and Gen Xers (18% apiece).

Preparing for pesky payments

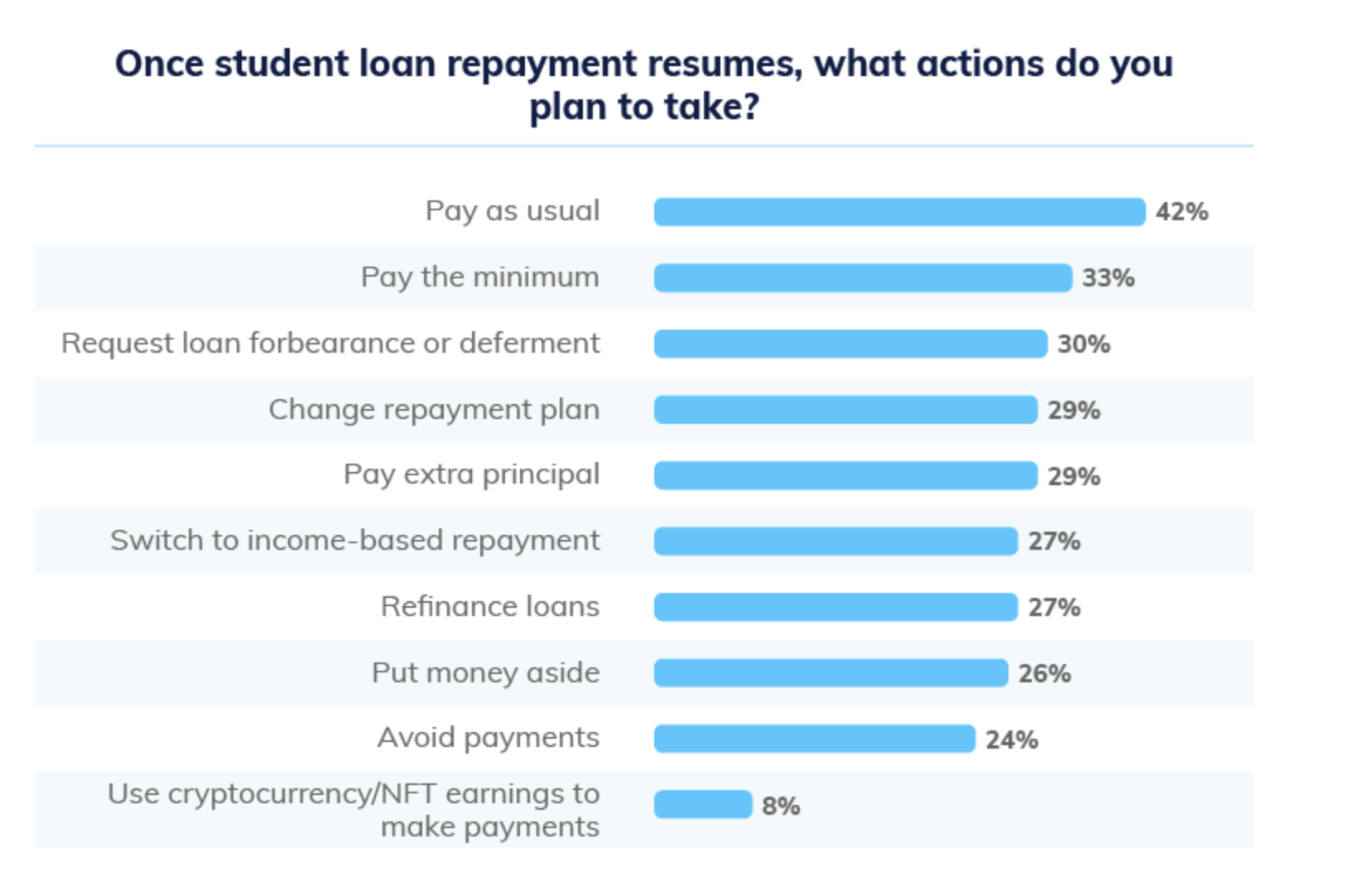

When payments resume, 30% of polled borrowers said they plan to request loan forbearance or deferment, and nearly one in four plan to avoid payments altogether, according to College Finance.

Meanwhile, the survey results also revealed that nearly one in ten borrowers plan to lean on crypto and NFT earnings to make their payments when the pause is up.

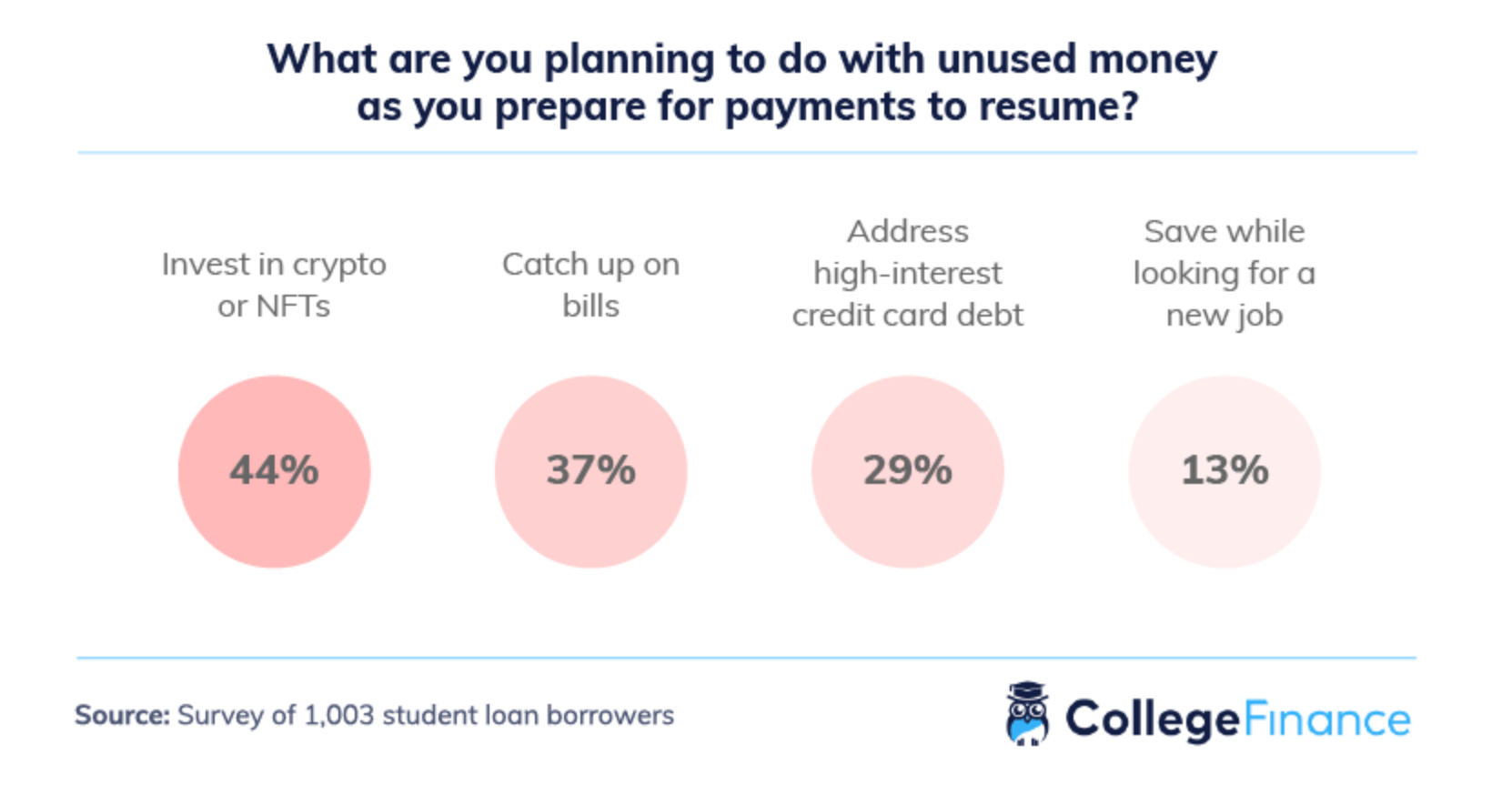

However, a more significant number of polled borrowers (44%) stated they are planning to invest in crypto or NFTs, as they prepare for payments to resume–with Gen Zers again surfacing as the group most likely to do so.

The post Survey shows 44% of student loan borrowers plan to invest in crypto or NFTs appeared first on CryptoSlate.