Bitcoin Fireworks Underway! BTC To Outstrip Stock Market In the Next Supercycle!

The post Bitcoin Fireworks Underway! BTC To Outstrip Stock Market In the Next Supercycle! appeared first on Coinpedia – Fintech & Cryptocurreny News Media| Crypto Guide

The broader crypto space has continued to sail downstream by losing its grounds of $2 trillion psychological mark. Especially market representatives Bitcoin and Ethereum are back to their historical bottoms of $41,667 and $3,200 respectively. Bears appear to be reluctant to clear the route for bulls anytime soon.

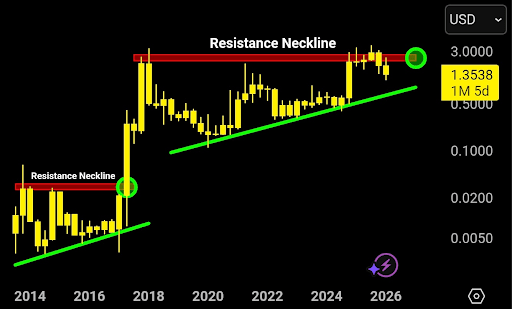

Bitcoin Fireworks Underway to Outperform Stock Market!

US Fed has decided to initiate their first interest hikes in winter. However, proponents and analysts have been arguing that the ongoing correction is essential as the market was almost bullish since mid-2020. Further, once tapering of interest rate hikes begins to spring, inflation is said to severely impact the market.

Thereby, institutional investors and retailers will have a chance to use Bitcoin to increase their purchasing power. As the crypto space is heavily volatile it raises the same way it corrects. In the initial months of interest rate hikes, the crypto market especially Bitcoin is expected to outpower the stock market with positive volatility.

When Bitcoin Price Will Rise Again?

The Crypto fraternity claims that this is the right opportunity for anybody to get exposure to the crypto space as it is back trading to its crucial levels. An on-chain metric platform Santiment has observed a massive accumulation of BTC when the price was trading below $43k. Further, Cryptoquant has revealed that the leverage ratio is continued to claim new highs amid of rising in the open interest rates.

Moreover, funding rates are still positive which indicates that currently, longs are paying for shorts. When shorts start to build up the Bitcoin price would see a gradual rise toward newer heights. Along with the macro outlook, even in the short term, we may get to see some nice spikes.

Collectively, the current intensity of Bitcoin liquidations suggests that bears may pull down the price below $38k eventually. Once we are done with the correction, probably by the next week we can see some really good moves. Furthermore, the macro outlook remains optimistic for the crypto market as the asset has proved its potential to act as a hedge against inflation.