The Pros and Cons of a CBDC, According to the Federal Reserve

The central bank of the United States – the Federal Reserve – released a discussion paper that examines the advantages and disadvantages of rolling out a potential US CBDC. This is the first conversation that the Fed has organized with the broad public to determine whether and how the digital version of the dollar could benefit the domestic financial system.

Pluses and Minuses

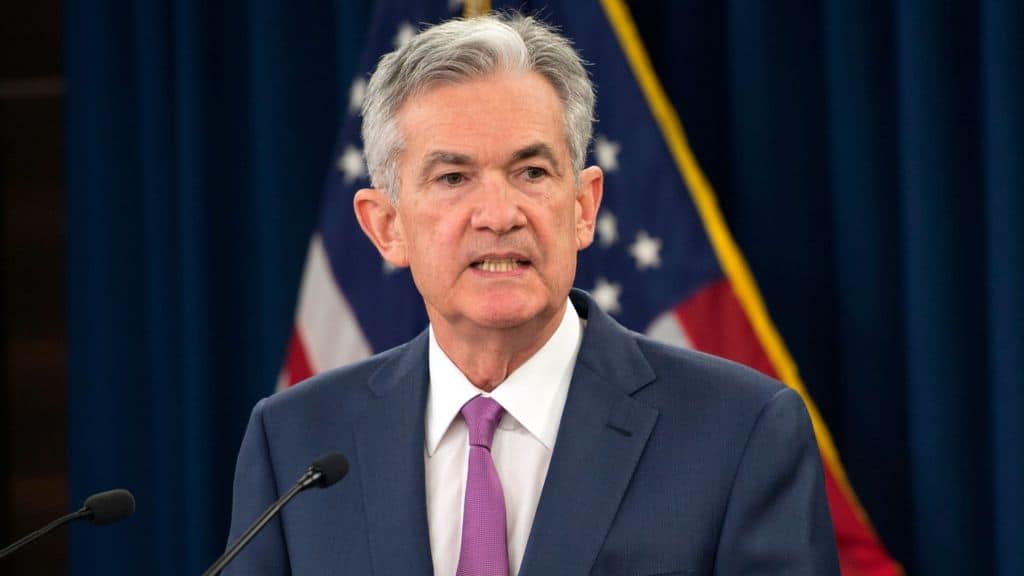

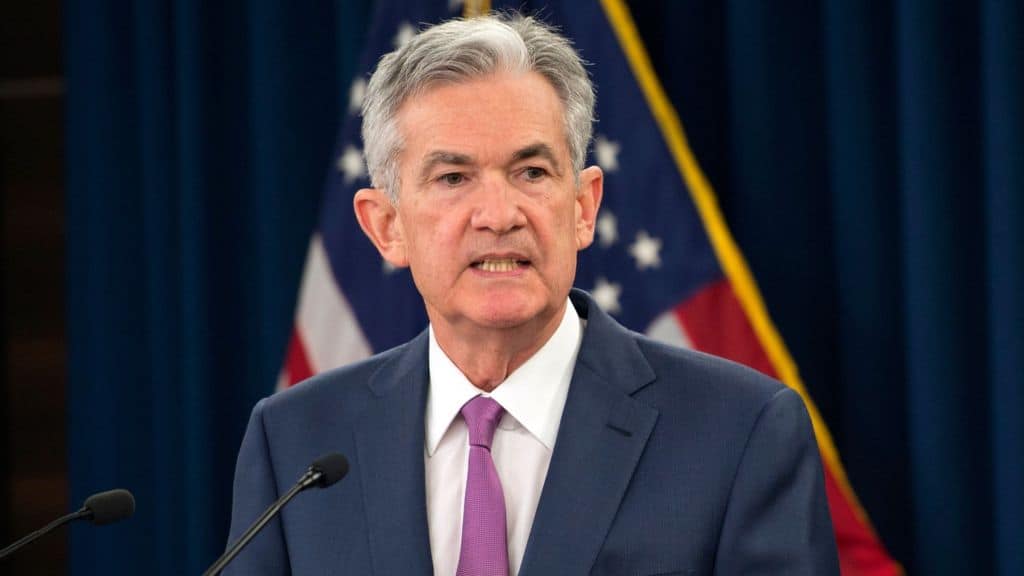

While numerous countries, with China leading the pack, are racing to issue their own central bank digital countries and implement them in their monetary network, the USA is in no rush. More than a year ago, Jerome Powell – Chairman of the Federal Reserve – assured that the world’s leading economy will first “carefully and thoughtfully” examine the matter before jumping into decisions.

In a recent report, the Fed outlined the most significant pros and cons of such a financial product.

“We look forward to engaging with the public, elected representatives, and a broad range of stakeholders as we examine the positives and negatives of a central bank digital currency in the United States,” Powell said.

The institution noted that consumers and businesses have long held and transferred money in digital forms, including bank accounts or online transactions. As such, a potential central bank digital currency could continue the trend and provide a “safe, digital payment option for households and businesses.” Additionally, CBDC transactions could result in faster settlement opportunities between nations.

However, the digital version of the US dollar could work against people’s privacy as the government would control the monetary product. It may also not be beneficial for America’s financial stability and not advance the existing means of payment.

Last year, Powell argued that a CBDC’s main benefit could be to replace cryptocurrencies, including stablecoins. Nonetheless, earlier this month, he changed his viewpoint and stated that central bank digital currencies and stablecoins could co-exist.

The Chinese CBDC Won’t Work in the US

In April 2021, the Chair of the Federal Reserve opined that the USA should not copy-paste the Chinese model of a central bank digital currency. According to him, the two economic superpowers are very different and require distinctive approaches:

“The currency that is being used in China is not the one that would work here. It’s one that really allows the government to see every payment for which it is used in real time.”